Cardano Price Prediction: ADA must break key resistance to target $2.60

- Cardano price continues to consolidate and congest inside the Cloud on the daily chart.

- Whipsaws in price action continue to vex bulls and bears, frustrating both sides of the market.

- The immediate threat remains bearish, but conditions are slowly developing to lean in favor of the buyers.

Cardano price action over the weekend has been an exercise in frustration for buyers and sellers alike. Solid bullish momentum that began last Thursday (September 28th) failed to generate follow-through buying pressure. Additionally, bears have been unable or unwilling to show conviction in a resumption of selling pressure.

Cardano price trend remains bearish; threshold for bulls to take over benefits any spike in buying pressure

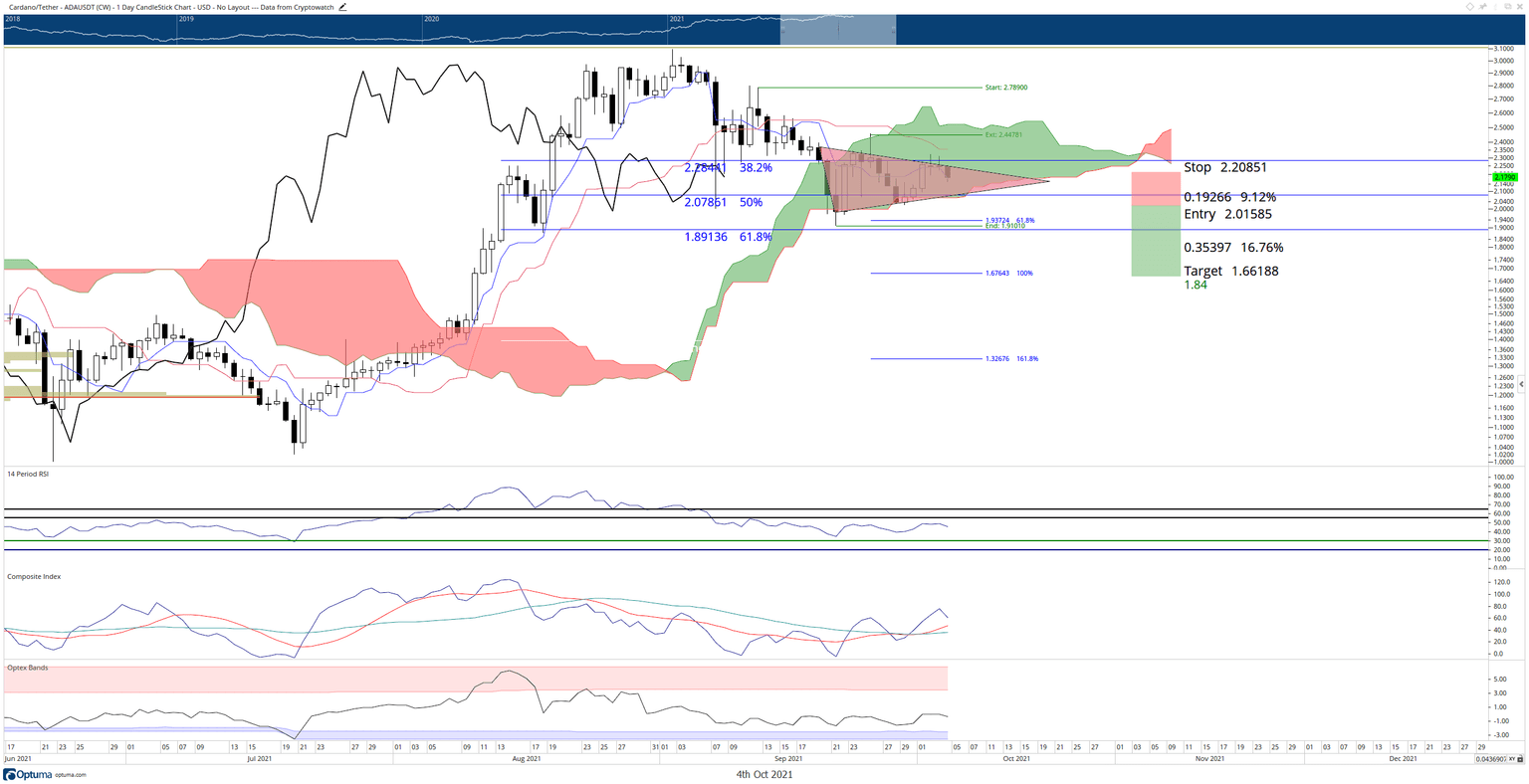

Cardano price is currently in a position to see buyers have a much easier time taking control of this market and propel Cardano into a new bullish expansion phase. The first hurdle that bulls need to leap over is a return and close above the daily Kijun-Sen at $2.36. From there, they need to push above the Cloud and close the Chikou Span above the candlesticks.

This would occur at $2.53. However, a close at $2.53 would mean the Chikou Span is not yet in ‘open space’ (a condition where the Chikou Span would not intercept any candlesticks over the subsequent five to ten periods in the future). Thus, for ‘open space’ to be accurate, buyers will need to close Cardano price above $2.64 or wait until October 11th, when a close above $2.53 would be sufficient to confirm the Chikou Span in ‘open space.’ From there, new-all-time highs would be all but a forgone conclusion.

ADA/USDT Daily Ichimoku Chart

However, given the current Cardano price action within the Ichimoku Kinko Hyo system, the current trend continues to favor bears. The final step for Cardano to enter a clear and sustained bear market is a close below the Cloud – which also coincides with a close below a bearish pennant. A close below $2.01 would ensure a test of $1.90 as support before a deeper thrust lower towards $1.67.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.