Cardano Price Prediction: ADA 2023 price trajectory

- Cardano price is at a 20% loss in market value on the month.

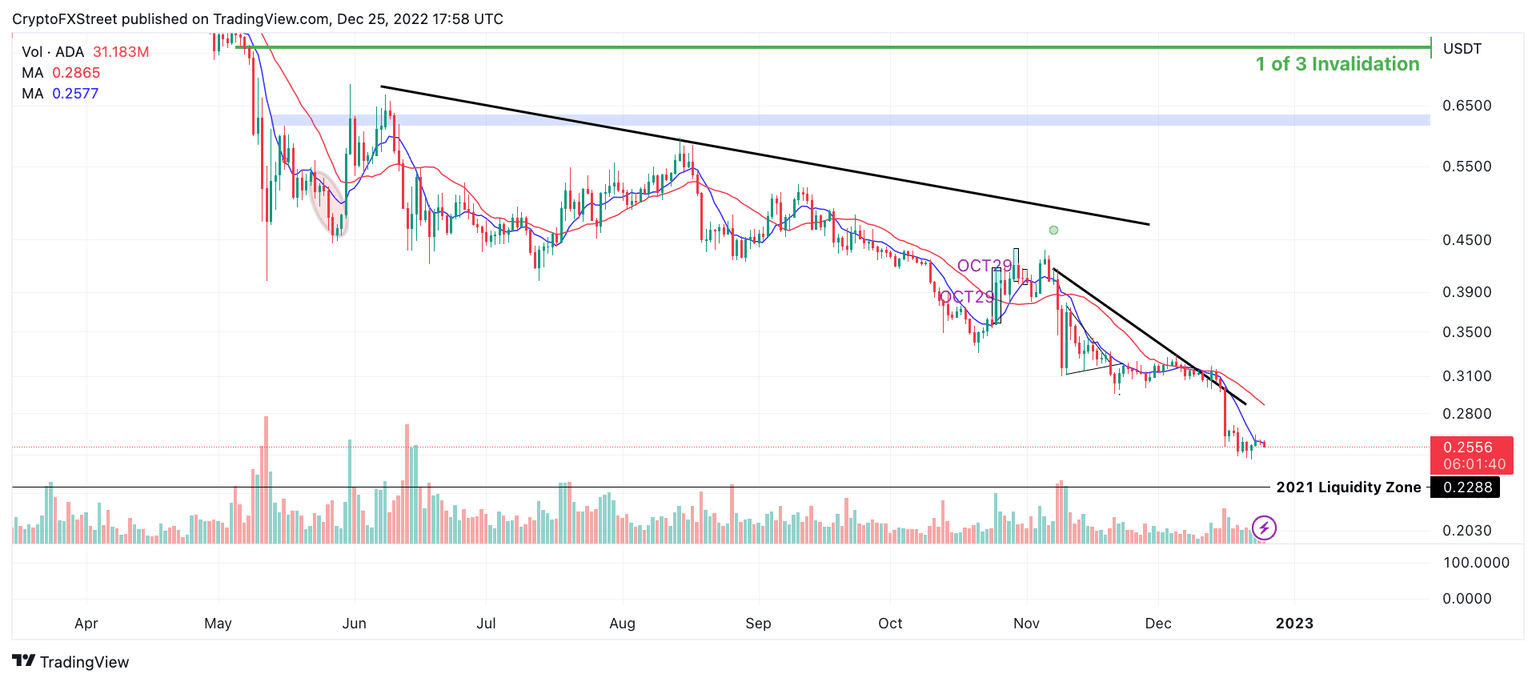

- The technicals show ADA in a strong downtrend above a 2021 liquidity zone.

- Invalidation of the bearish thesis will require a hurdle above the $0.32 resistance barrier.

Cardano is on its way toward 2021 price levels. Buying the dip could lead to an early loss of capital in 2023.

Cardano price points south

Cardano price continues to stair step its way south as the bears have forged a 20% decline since the start of the month. On December 25, ADA shows confounding evidence of full control from the bears. The mid- $0.20 zone is acting as resistance for bulls in the market. The weekly low is within arms reach at $0.246 and could be moments away from being liquidated.

Cardano price currently auctions at $0.256. On December 23, the bulls re-engaged with the 8-day exponential moving average for the forest time after landing in the mid-$0.20 zone. The bears quickly rejected the bulls' attempt to reconquer the indicator and produced an indecision candlestick a day later.

At the time of writing, the market is 6 hours away from closing. If market conditions persist, the bears will produce a bearish engulfing daily candlestick, solidifying the third and final piece of a developing shooting star reversal pattern.

Considering these factors, The classical technical analysis pattern could be the catalyst bears in the market are looking to add to their positions. The next bearish target zone lies 9% above ADA's current market value at $0.228. The target zone is a liquidity level that has remained untagged since it was first established in January of 2021 during Cardano's infamous 10x bullrun.

ADA/USDT 1-Day Chart

The bulls will need to establish serious momentum to void the bearish potential. A breach above the 8-day exponential moving average at $0.265 could catalyze a spike towards the other side of the previous trading range, where the 21-day simple moving average hovers at $0.28. The Cardano price would rise by 10% if the bulls were successful.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.