Cardano Price Prediction: ADA likely to revisit $0.68

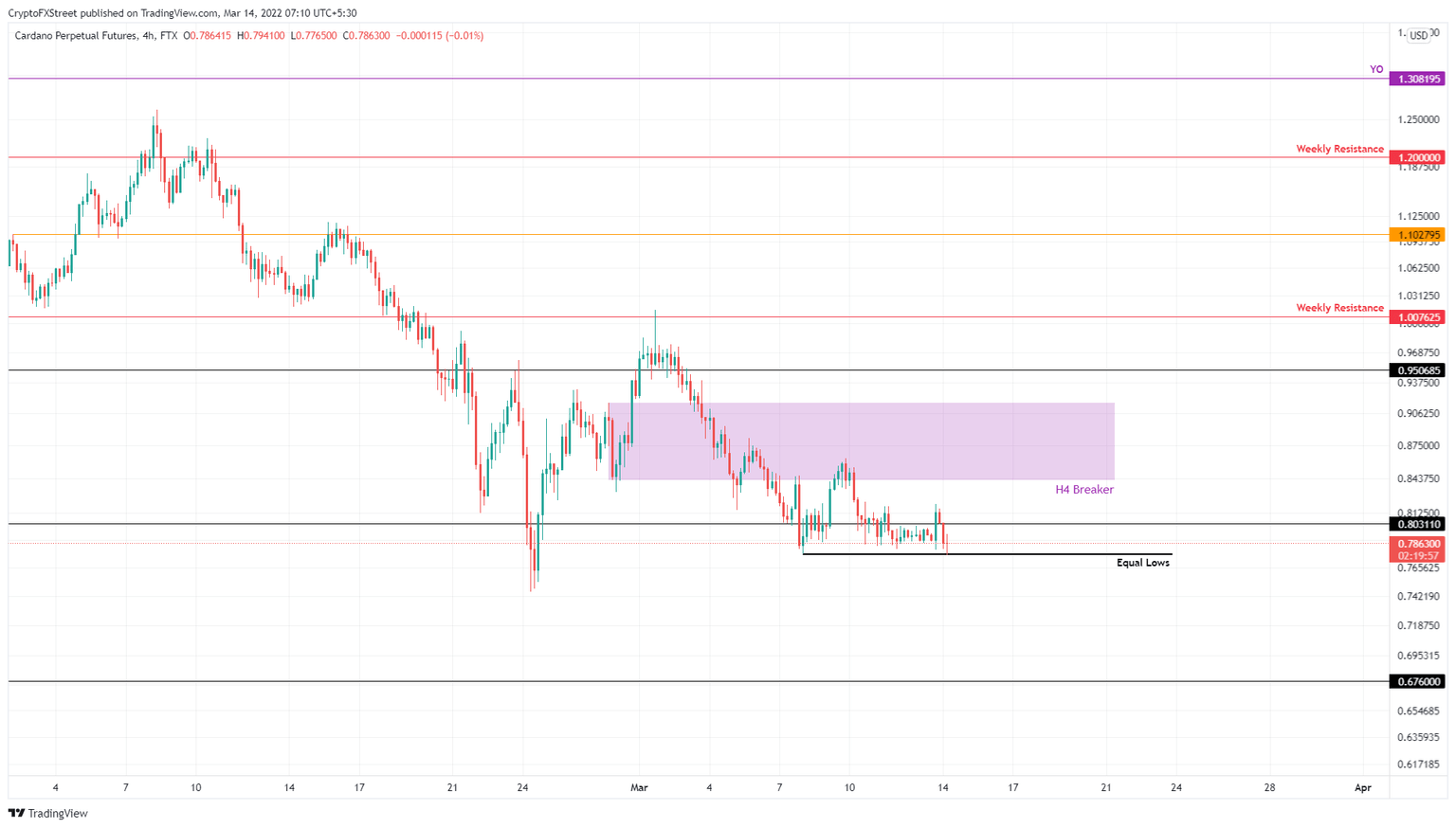

- Cardano price consolidates after facing rejection at the $0.843 to $0.916 breaker.

- A breakdown of the coiling up could lead to a 12% downswing to $0.676.

- On-chain metrics suggest that the bearish outlook is plausible.

Cardano price shows no signs of slowing down as it teeters on the last meaningful support cluster. Therefore, investors need to keep a close eye on this massively oversold altcoin as the chances of accumulation are high. Regardless, from a short-term perspective, ADA seems likely to drop lower.

Cardano price to re-establish directional bias

Cardano price flipped a demand zone, extending from $0.843 to $0.916 into a breaker as it slid below it on March 6. The newly formed breaker is a hurdle, so the resulting recovery faced rejection and immense selling pressure, leading to a 7% downswing.

The resulting move set a swing low at $0.776, kick-starting a consolidative phase. As ADA began coiling up, it created another equal low, suggesting the presence of sell-stop liquidity below it.

Therefore, investors can expect Cardano price to sweep these lows before establishing a directional bias. The bears are likely to take control, pushing the so-called “Ethereum-killer” down to the immediate support level at $0.676.

This move would constitute a 12% downswing and is where Cardano price will stabilize before re-evaluating its strengths and weaknesses.

ADA/USDT 4-hour chart

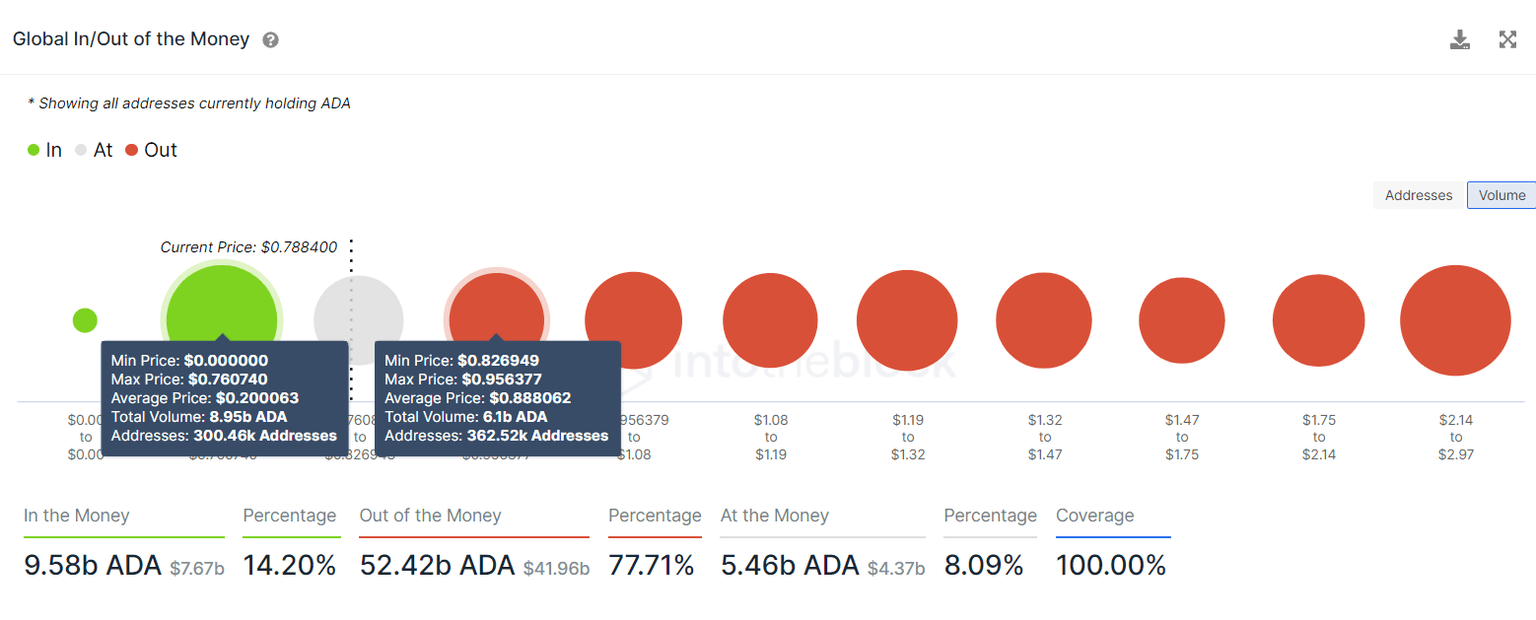

Supporting this move lower is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows the gruesomeness of the downswing that ADA has been through over the past six months.

Cardano price is currently hovering around the last meaningful support area, where roughly 300,460 addresses purchased nearly 8.95 billion ADA for an average price of $0.20. Interestingly, this area extends up to $0.76, which is around the level forecasted from a technical perspective. Therefore, ADA is likely to head lower but see palpable bullish pressure as it approaches the $0.76 barrier.

ADA GIOM

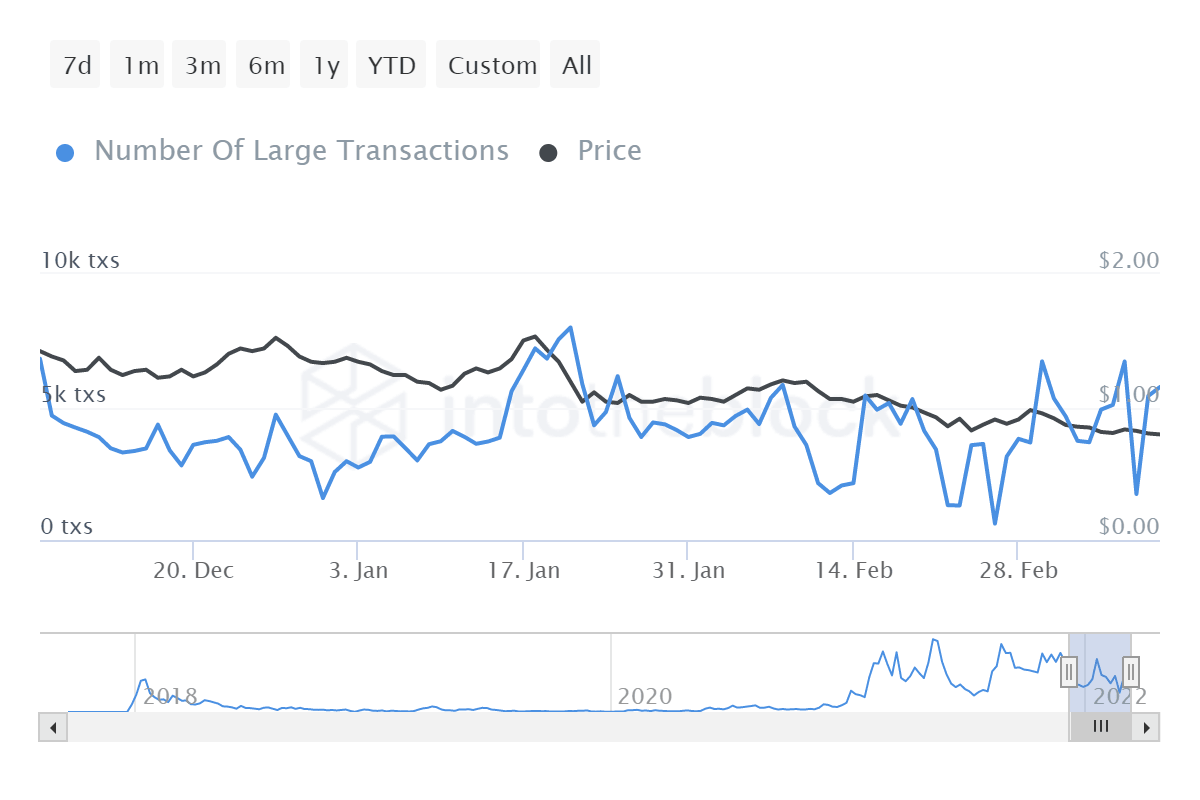

On the other hand, the large transactions worth $100,000 or more indicate that whales are not interested in ADA at the current price levels. These whale transfers have dropped from roughly 7,000 to 5,700 in the past three months, denoting an 18.5% decline.

ADA large transactions

While things are looking a little risky for Cardano price, investors need to note that a recovery above $0.916 will invalidate the breaker and the bearish thesis.

In such a case, Cardano price could make a run at the $1 weekly resistance barrier and attempt to set a higher high around this level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.