Cardano price fractal forecasts a 15% upswing soon

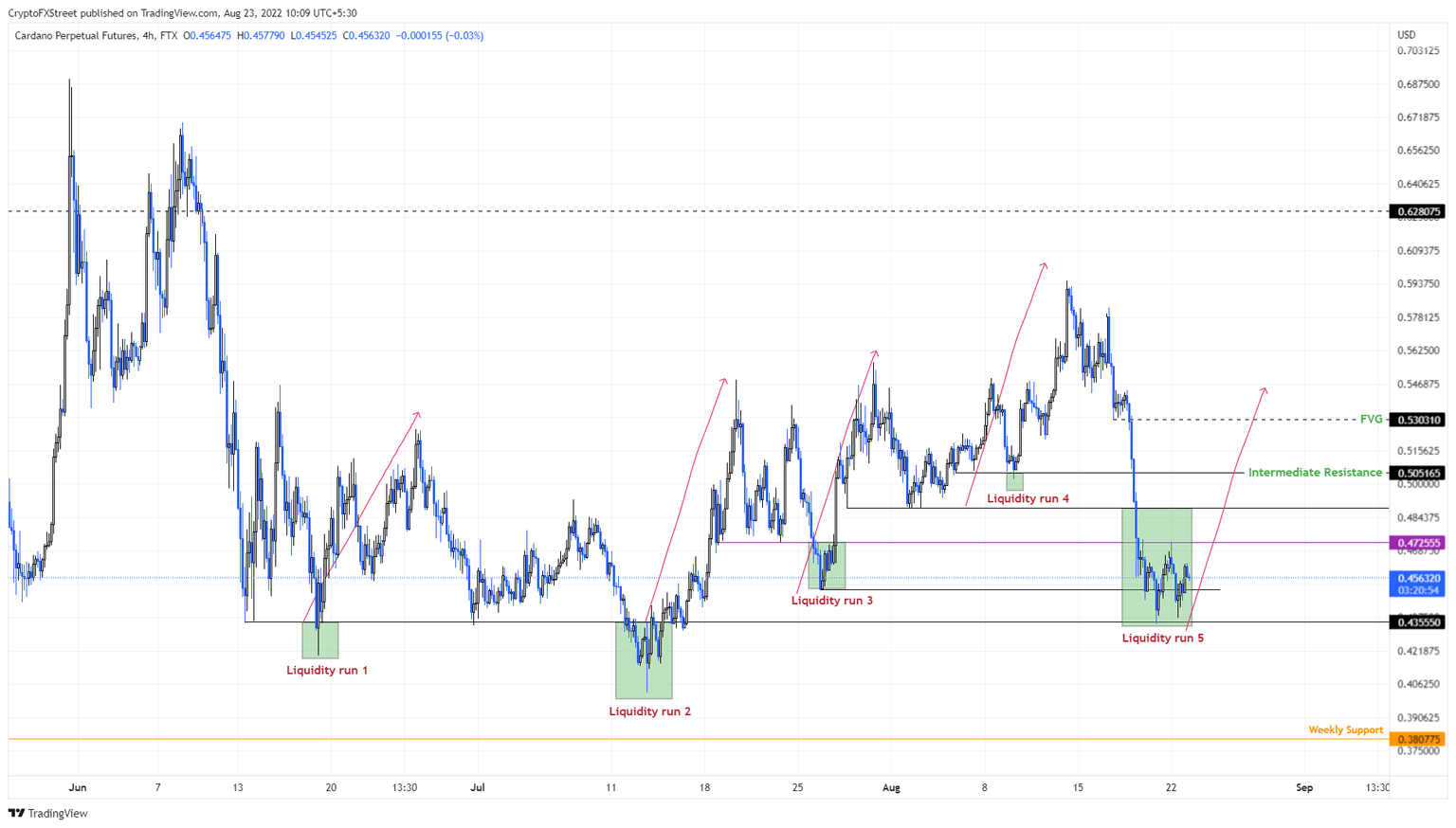

- Cardano price has recently slid below equal lows, formed at $0.488 and $0.450, and collected liquidity.

- If the liquidity fractal persists, this move could trigger a quick 15% upswing for ADA.

- A daily candlestick close below $0.435 without recovery will invalidate the bullish thesis.

Cardano price reveals an interesting setup that has been repeated four times in the last two months or so. The most recent occurrence was on August 23, which forecasts a quick but explosive move for ADA.

Cardano price ready for recovery

Cardano price first formed this fractal as the June 19 swing lows collected the liquidity resting below the previously formed swing low at $0.435. This move was followed by a quick recovery above $0.435, which confirmed the start of a recovery rally.

As a result, Cardano price rallied 24% in the next week. Similar setups were noticed three more times, with the most recent one occurring between August 20 to 23 as ADA crashed by roughly 20%.

This swing low collected liquidity resting below the equal lows formed at $0.488 and the July 27 swing low at $0.450. Moreover, the altcoin has also recovered above the previous low, indicating that the bulls are ready for a rally.

In such a case, investors can expect Cardano price to rally at least 8% to retest the $0.488 hurdle. But clearing this barrier could lead to a revisit of the $0.505 blockade after a 12% ascent. Ideally, the uptrend will exhaust around $0.530, ie., after a 17% ascent from $0.456.

ADA/USDT 4-hour chart

On the other hand, if Cardano price fails to stay above $0.456, it will signal weakness in the aforementioned model. A daily candlestick close below $0.435 without recovery will invalidate the bullish thesis. In such a case, Cardano price might revisit the $0.415 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.