Cardano price awaits 20% breakout as ADA range tightens

- Cardano price has been rangebound for roughly a week, hinting at an explosive breakout on the horizon.

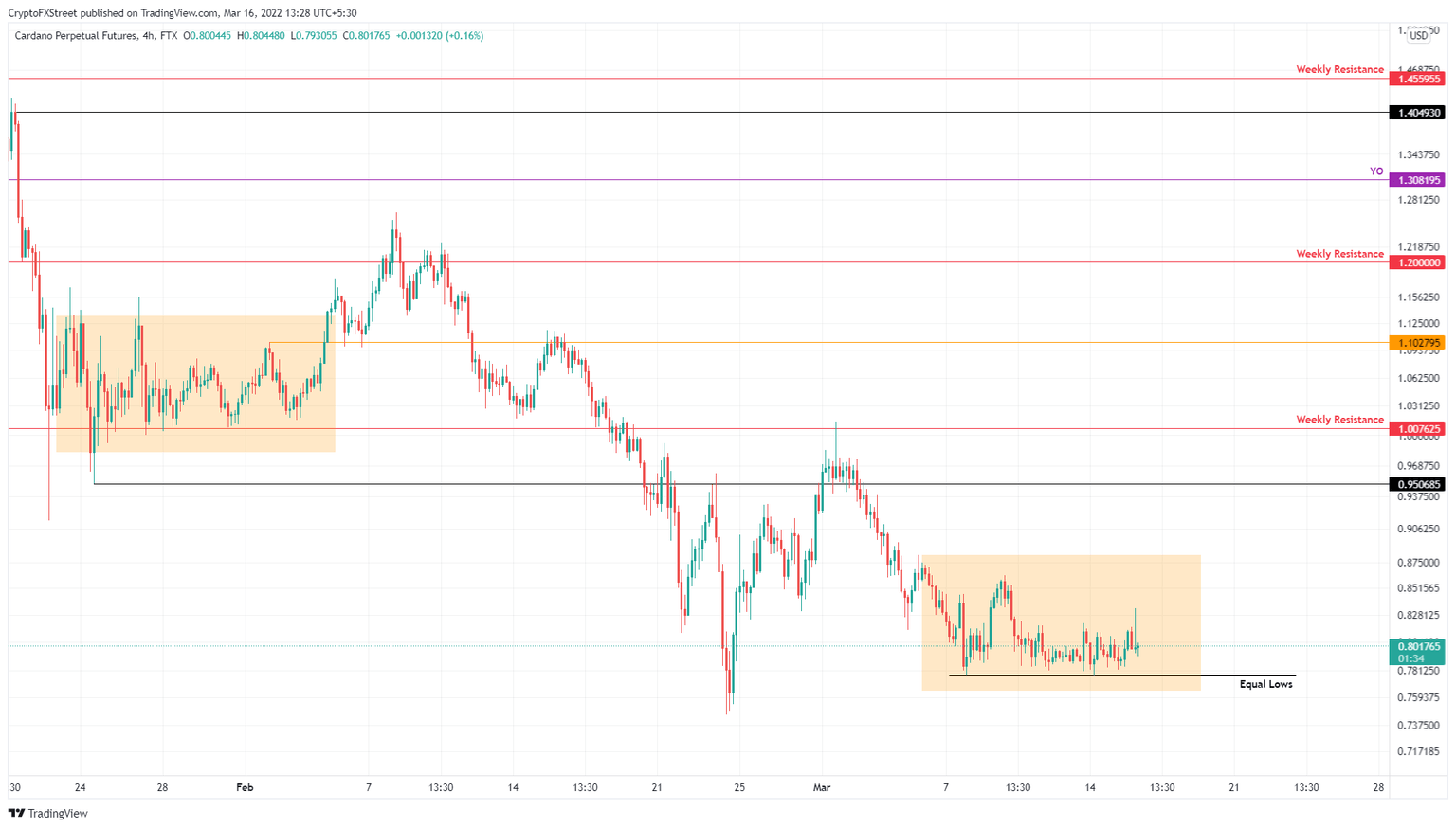

- Investors can expect ADA to sweep the $0.776 equal lows before rallying 20% to $0.950.

- A four-hour candlestick close below $0.676 will invalidate the bullish thesis.

Cardano price has slipped into a sideways movement, evidencing a lack of volatility. This move appears to be a fractal, echoing a similar move last seen in February. That time the resolution of the coiling up was an explosive run-up, so investors can expect a similar outcome to play out this time.

Cardano price plays the patience game

Cardano price set up a swing low at $0.776 on March 8 and has stuck close to this level ever since. The tight consolidation that has unfolded resembles the price action seen in February, indicating it could potentially be a fractal.

Since the sideways movement has seen a considerable reduction in volatility, investors can expect a breakout from this formation to result in an explosive move. Due to the equal lows present at around $0.776, there is a good chance market makers might push ADA to sweep lower to collect liquidity before triggering a move higher.

Interested market participants can enter a long position at $0.776. The upside for Cardano price is limited at the first resistance barrier at $0.950. From the equal lows, this rally would constitute a 22% ascent.

In a highly bullish case, ADA could extend the rally to the $1 psychological barrier, where investors in the trade can also book profits.

ADA/USDT 4-hour chart

While things are looking up for Cardano price, a breakdown of the $0.776 barrier without a quick recovery will reveal a weakness among bulls. If ADA produces a four-hour candlestick close below $0.676, however, it will invalidate the bullish thesis and open Cardano price for further descent.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.