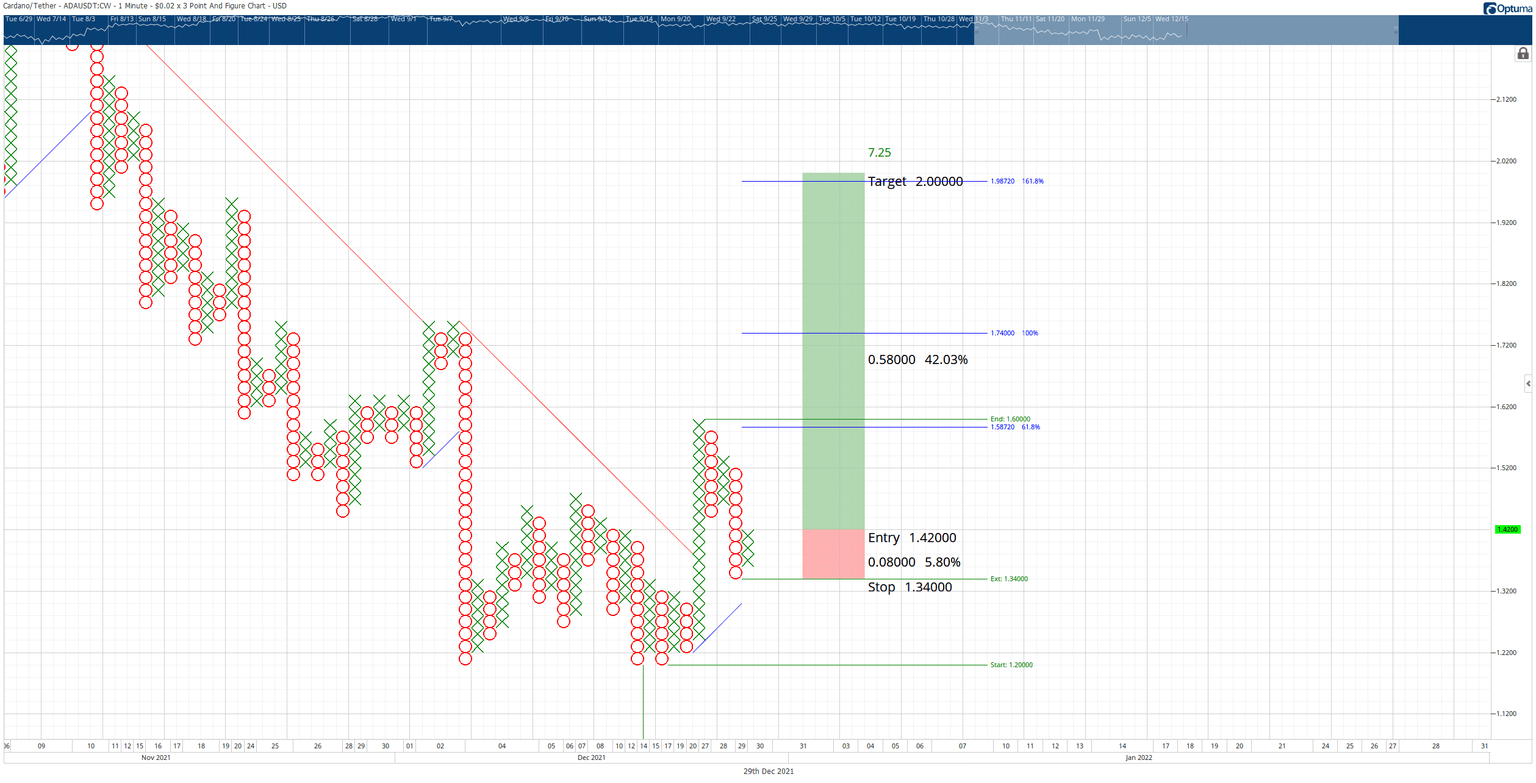

Cardano presents buy opportunity before ADA hits $2 for a 40% upswing

- Cardano price action develops a bullish continuation pattern on its Point and Figure chart.

- Downside risks remain, but lows are likely in as buyers return.

- Entry opportunity could yield a 40% gain.

Cardano price has suffered some intense selling pressure along with the rest of the market. However, the losses that Cardano has experienced have not been as extreme as many others.

Cardano price develops bullish entry setup

Cardano price has recently converted into a bull market on its $0.02/3-box reversal Point and Figure chart. The daily candlestick chart, however, continues to show weakness. That weakness has caused many weak hands to abandon Cardano and new short positions to open at the bottom. As a result, a spectacular bear trap is likely developing.

There is a hypothetical long entry opportunity for Cardano price. The long idea is a buy stop order at $1.42, a stop loss at $1.34, and a profit target at $2.00. This hypothetical trade setup provides a 7.25:1 reward for the risk. In addition, a trailing stop of two to three boxes would help protect any profit made after the entry is triggered.

The long entry assumes that a corrective wave has been fulfilled when price dropped to $1.34, fulfilling Wave 2 of an Elliot Impulse Wave. The 161.8% Fibonacci expansion of Wave 1 is at $1.98 – just shy of the $2.00 level. The projected profit target utilizing the Vertical Profit Target Method in Point and Figure is $2.00. Traders should look for Cardano price to face some selling pressure in that range.

ADA/USDT $0.02/3-box Reversal Point and Figure Chart

The hypothetical long idea is invalidated if Cardano price moves below $1.30. In that scenario, Cardano will likely return to bear market conditions with new setups targeting price levels below the $1.00 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.