Can Ethereum price hold as Vitalik Buterin sells 30,000 ETH?

- Vitalik Buterin moved 30,000 ETH out of his main wallet to the one used for sales, gifts and donations to charities.

- The wallet now holds $62 million worth of Ethereum.

- Analysts predict a downside target of $450 for ETH price as a worst-case scenario.

Vitalik Buterin pulled 30,000 ETH from his public wallet today, fueling a bearish sentiment among investors. Proponents have considered the likelihood of the sale of 30,000 ETH moved by Buterin and expect a negative impact on the Ether price.

Buterin moves 30,000 ETH out of public wallet

The co-founder of Ethereum has sparked fears among investors as he moved 30,000 ETH tokens from one of his multisig wallets. Buterin has previously used the destination wallet for sales, gifts, and donations to charities.

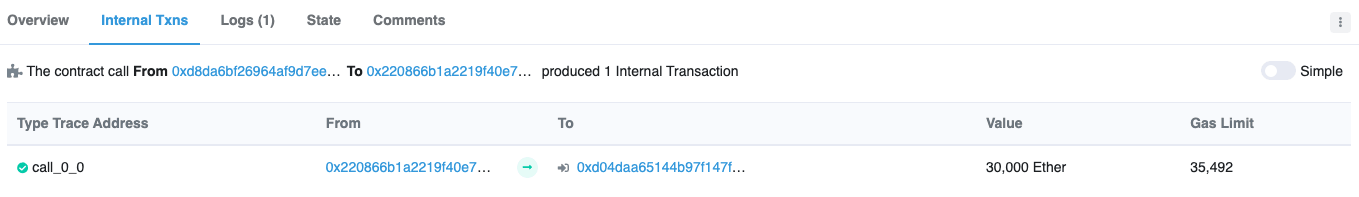

Buterin’s multisig wallet “Vb 3” recorded a transfer of 30,000 ETH to 0xD04daa65144b97F147fbc9a9B45E741dF0A28fd7.

Buterin’s 30,000 ETH transfer

The public wallet address now holds 290,000 ETH, The transfer is being seen as a bearish move or a signal that Vitalik Buterin is cashing out his Ethereum. While a mere move of a cryptocurrency from one wallet to another is not considered an indicator, Buterin’s transfer is out of his Ethereum holdings.

Proponents believe it is possible he may want to sell a portion of the 30,000 ETH.

Ethereum is trading around $2,086. At this rate, the transferred ETH accounts for roughly $62.58 million. If these tokens were to hit an exchange, a spike in selling pressure on the altcoin could increase substantially, pushing prices lower.

John Roque, an analyst at 22V Research, believes Ethereum remains in a bearish posture even though the token has retraced by more than 50% from its all-time high. Roque told Bloomberg,

Ethereum is oversold daily and oversold weekly and cannot rally.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.