BNB Price Forecast: Binance bulls target $750 as Trump drives crypto trading volumes to a record high

- Binance coin price hit $715 on Thursday, rising 9% gains since the start of the week.Cryptocurrency trading volumes on centralized exchanges reached a record high of $3.72 trillion in December, with Binance remaining market leader.

- Rising trading activity on Binance has boosted demand for the BNB native token.

- With market volatility intensifying ahead of Trump’s inauguration, another spike in trading volumes in January could propel BNB price towards $750.

BNB price crossed the $715 on Thursday as traders continued to take strategic speculative positions ahead of the US Presidential inauguration slated for January 20. Recent reports show Binance emerged market leader as Trump’s re-election drove crypto trading volumes to record highs in December 2024.

BNB price retest $715 as traders re-shuffle portfolio ahead of Trump’s inauguration

Binance Coin (BNB) reached $715 on Thursday, marking a significant milestone as traders adjusted their portfolios ahead of the U.S. presidential inauguration on January 20.

This upward movement reflects a broader resurgence in cryptocurrency markets, with BNB appreciating approximately 8.7% over the past three days, climbing from $660 on Tuesday to $717 on Thursday.

The increased demand for BNB is partly attributed to the rising popularity of tokens within the BNB Chain ecosystem.

Notably, the BNB chain team announced an AI Agent Competition on Thursday, aimed at promoting the development of AI memes on the blockchain.

As traders continue to reassess their strategies in light of political developments, BNB remains well-positioned for further upside.

Binance emerges market leader as Trump re-election drives record-high crypto trading volumes.

The re-election of Donald Trump on November 5 famously triggered a record-breaking buying frenzy across the crypto market with the likes of Bitcoin (BTC), BNB and Solana (SOL) all reaching all time highs.

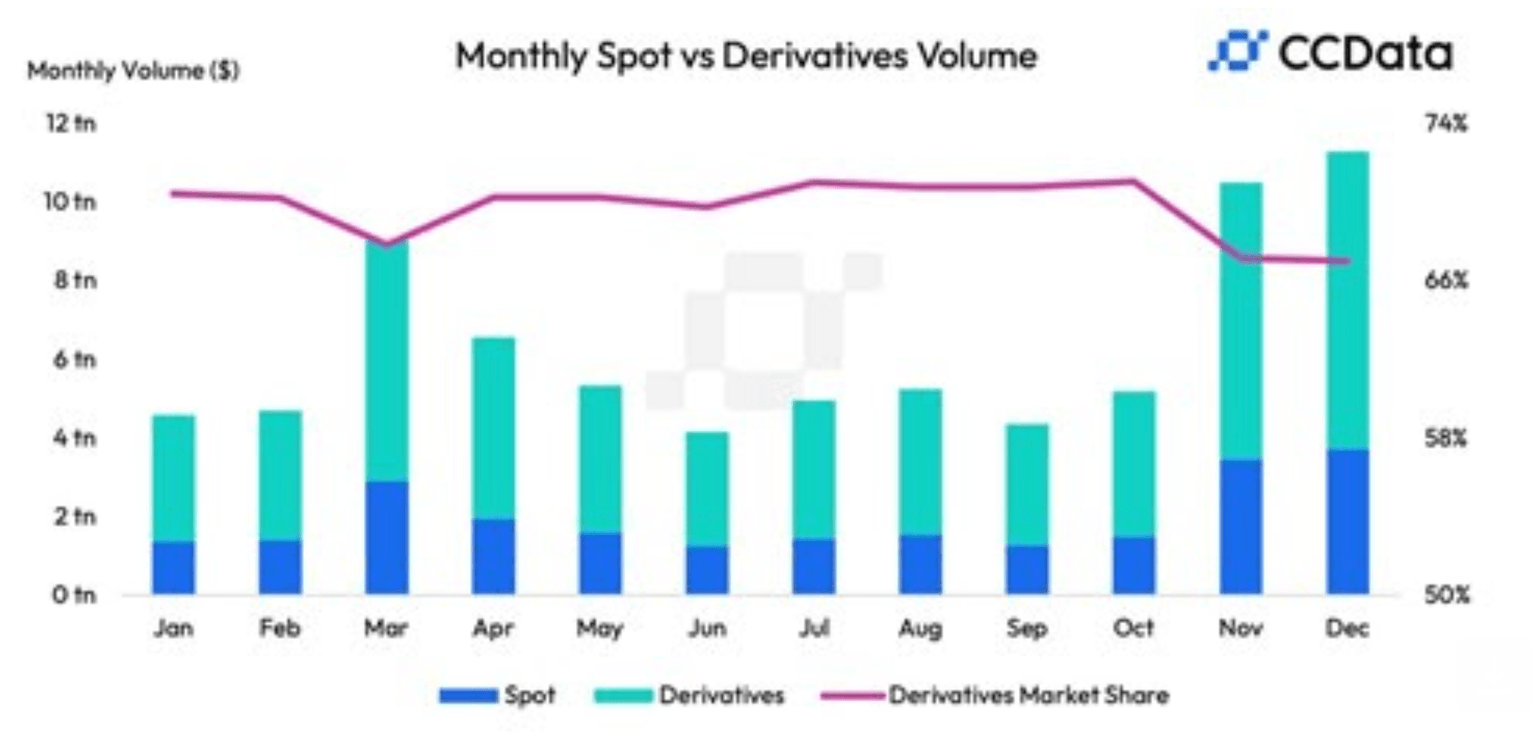

However, during the market frenzy in December 2024, CCData’s Exchange Review report. shows that combined spot and derivatives trading surged 7.58% to a record high of $11.3 trillion.

Spot trading volumes rose 8.1% to $3.72 trillion, while derivatives volumes climbed 7.33% to $7.58 trillion.

According to the report, Binance retained its dominance as the top exchange, processing $946 billion in spot trading volumes, a modest 0.13% increase month-over-month.

Bybit followed with an 18.8% rise to $247 billion, while Coinbase recorded a 9.62% jump to $191 billion.

Binance Coin (BNB), the exchange’s native token, has been a key beneficiary of this surge.

Much of BNB’s utility stems from staking incentives, offering traders discounted fees on the Binance platform.

Hence, as exchange trading volumes spike, so does demand for BNB.

BNB has already rallied 8.7% over the past three days, crossing $715 on Thursday.

With the increase in speculative trading ahead of Trump’s January 20 inauguration could replicate December’s trading frenzy, potentially propelling BNB toward the $750 mark.

BNB Price Forecast: Roadblocks ahead as bulls target $750 rally

BNB price action suggests bullish momentum as traders capitalize on increased market activity ahead of Trump’s inauguration.

The chart highlights a falling wedge, a classic bullish reversal pattern. Prices have broken above the upper wedge boundary, signaling potential upside continuation.

This 8.71% gain in the last three days aligns with increased trading volumes, hinting at sustained buyer interest, with the immediate target at $750.

The Chande Kroll Stop indicator, set at $682.05 and $720.81, reveals a robust support zone. Prices maintaining above the $720.81 threshold affirm bullish control.

The widening gap between these stop levels strengthens the bullish case, especially amid rising demand for BNB’s utility in the Binance ecosystem.

However, bearish risks remain. The BBP (Bullish-Bearish Power) oscillator at 13.45 suggests diminishing momentum.

Failure to maintain above $720.81 could see BNB retrace towards $682, eroding recent gains.

In summary, BNB’s falling wedge breakout and supportive technicals favor further upside.

A spike in trading volumes could propel BNB to $750, while a breakdown below $682 would invalidate the bullish thesis.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.