Bitcoin's biggest mining pool may be behind the BTC price drop, but buyers stepped in

Bitcoin (BTC) fell to lows of $28,950 on Jan. 22 thanks to miners likely selling huge amounts of their holdings — but big buyers made sure that the dip was minimal.

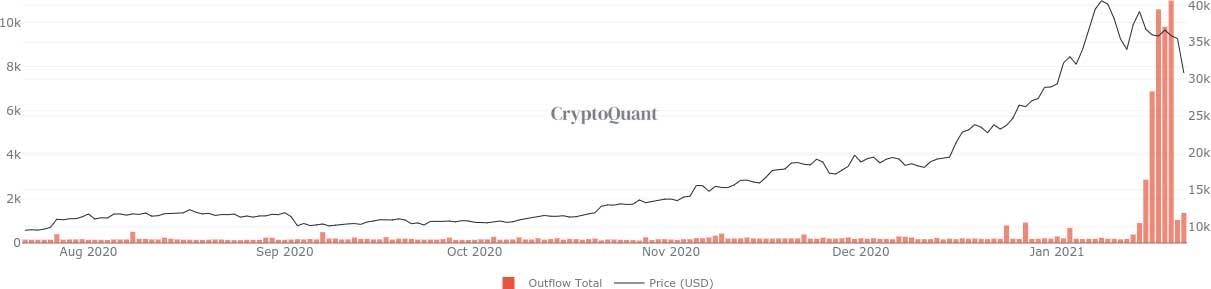

According to data from on-chain monitoring resource CryptoQuant, the past few days saw vast outflows from mining pools, which in turn corresponded to BTC/USD shedding 20% in a week.

F2Pool daily outflows hit 10,000 BTC

Beginning Jan. 15, outflows from F2Pool — currently the largest mining pool comprising roughly 15% of total hash rate — in particular, began to rise. By Jan. 17, daily outflows had reached 10,000 BTC ($313 million), these continuing for three days in a row before returning closer to normal levels.

F2Pool appears to be responsible for the vast majority of outflows, which do not necessarily mean that miners sold BTC on the open market, but simply that they moved mined coins from their original wallet.

F2Pool BTC outflows daily chart. Source: CryptoQuant

Regardless of the pool's motives, the numbers form a welcome counterargument explaining Bitcoin's sudden price drop this week. Previously, theories including the controversy around stablecoin Tether (USDT) as well as a recovering dollar were being touted as the root causes of the downward volatility.

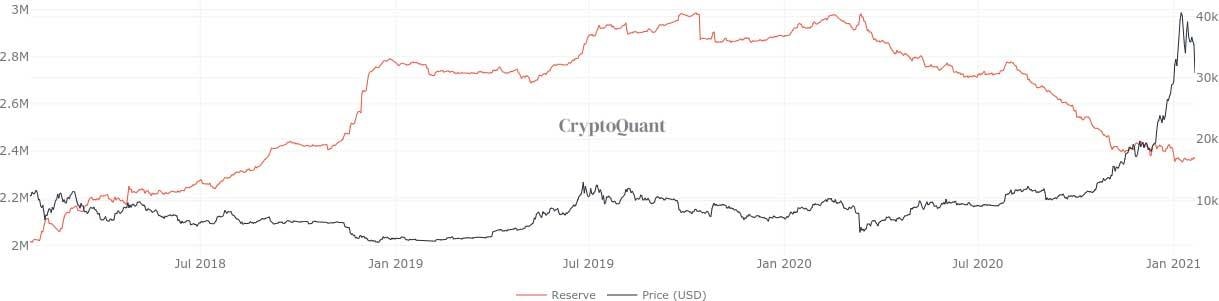

Meanwhile, Bitcoin exchange balances have stayed constant throughout January in contrast to the general downtrend that has been in place since summer 2019, data shows.

Exchange Bitcoin reserves chart. Source: CryptoQuant

Sales come amid huge Grayscale buys

Should the F2Pool coins have formed a large glut of new BTC supply for sale on the market, it is likely that once buyer in particular would have hoovered them up fairly quickly.

As Cointelegraph reported, asset management giant Grayscale has added conspicuous amounts to its assets under management this week, these potentially helping BTC/USD avoid a deeper dive.

Grayscale BTC holdings. Source: Bybt.com

The company's recently published Q4 2020 report, in which it says that institutions provided 93% of its inflows, compounds the idea that it is the main buyer of any spare BTC supply.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.