Bitcoin whales holding up to 100,000 BTC hunt cycle bottom, here’s what to expect

- Bitcoin whales are groups of investors holding between 1,000 and 100,000 BTC that influence the asset’s price through large volume transactions.

- Recent Bitcoin whale activity has been characterized by net selling, implying that a potential cycle bottom is close.

- Bitcoin price uptrend is capped at $17,259, more than 1.37 million BTC tokens were acquired below this price level, profit-taking could kick in.

Bitcoin network’s large wallet investors influence the asset’s price through their transaction activity. Analysts at Santiment found evidence of whale activity influencing the asset’s price. Bitcoin price uptrend is capped at $17,259.

Also read: Bitcoin whale activity signals possibility of a historic bull run in BTC if this occurs

Bitcoin whales hunt BTC price bottom in bear market

Bitcoin whales, large wallet investors holding 1,000 and 100,000 BTC influence the asset’s price through their transaction activity. Analysts at crypto intelligence tracker evaluated whale transactions and identified a correlation between the two.

Groups of investors who hold significant amounts of Bitcoin can have a major impact on price and transactions influence the asset’s price trends. A group of BTC holders who own between 1,000 and 100,000 BTC tokens have been net sellers and the asset’s price has followed suit. Analysts predict with confidence that Bitcoin could trade sideways or touch lower prices within the next six to twelve months.

Bitcoin whale activity of investors holding between 1,000 and 100,000 tokens

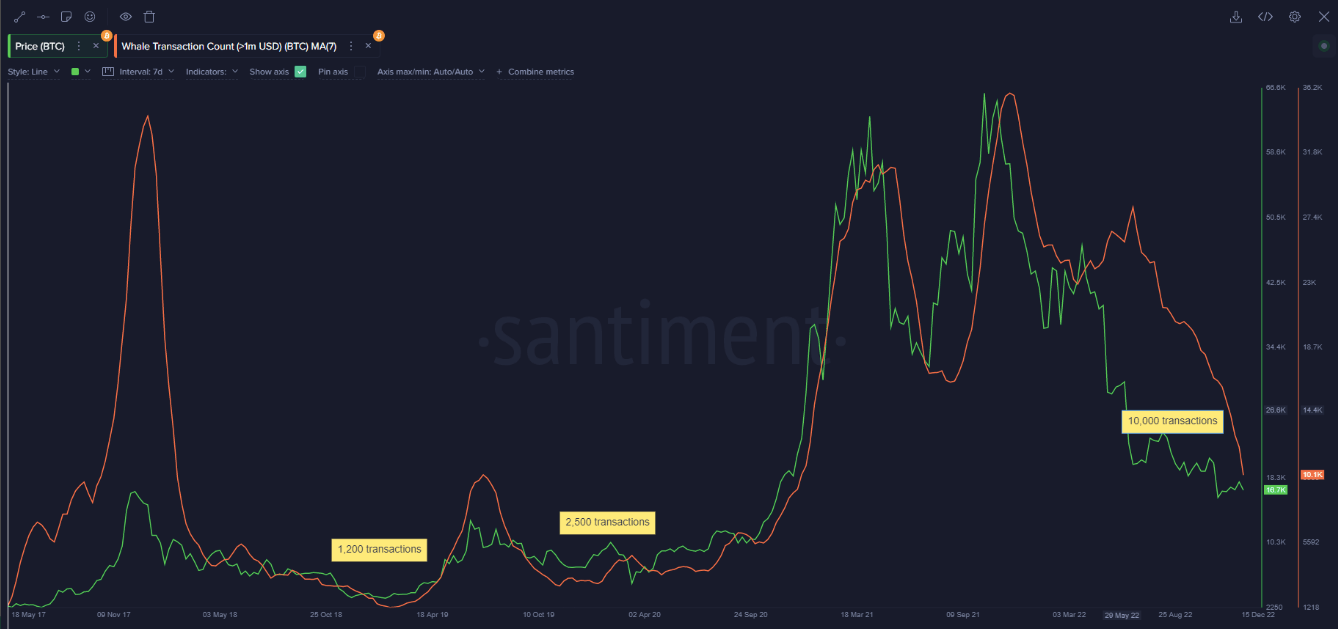

Monitoring the number of transactions made by BTC whales is a useful way to gauge the level of activity in the market. Bitcoin bottoms are associated with low levels of whale activity. During previous bottoms, the 7-day average transaction count was between 1,200 and 2,500 transactions.

Currently, there are still 10,000 transactions a day and experts believe the average needs to drop lower to spot a Bitcoin price bottom in the ongoing cycle.

Bitcoin whale transactions

Large wallet investors are interested in two volume gaps at the $14,600 and $12,200 area. It is key to note whether whales are accumulating the asset in these areas. Large transactions in these price ranges could influence BTC price.

Bitcoin price uptrend is capped at $17,259

At least 2.44 million wallet addresses scooped up 1.37 million BTC while the asset exchanged hands between $16,651 and $17,123. Once Bitcoin price crosses this range, experts believe mass profit-taking will begin. The largest asset by market capitalization’s gains, therefore, may be capped at $17,259.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.