Bitcoin whales accumulate at fast pace, exchange supply at lowest point since 2021

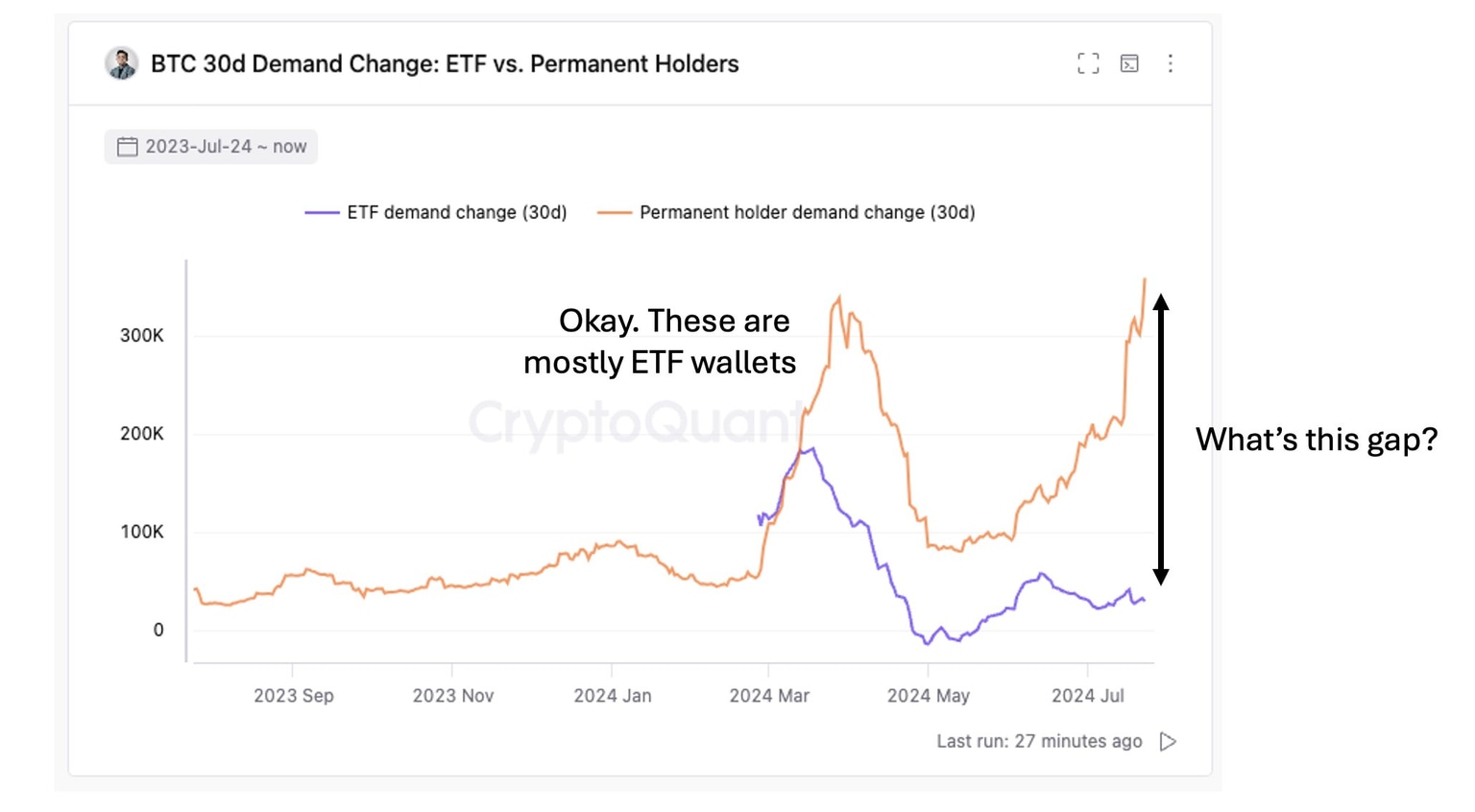

- Bitcoin is in the accumulation phase per CryptoQuant data, 358,000 BTC has moved to permanent holder addresses in the past month.

- Bitcoin Spot ETFs have recorded 53,000 BTC inflow, signaling institutional demand for the largest cryptocurrency.

- Supply on exchanges has hit lowest level since November 2021, as seen in on-chain data trackers.

- BTC sustains recent gains and hovers around $67,000 amidst marketwide optimism.

Bitcoin (BTC) whales are scooping up the asset at a fast pace, according to data from crypto intelligence tracker CryptoQuant. On-chain data shows that Bitcoin supply on exchanges is at its lowest level since November 2021, a sign that the selling pressure on BTC remains low, even as Mt.Gox creditors receive their Bitcoin and transfer it to centralized exchanges.

Institutional demand for Bitcoin remains strong with 53,000 BTC inflow in July. BTC looks poised for further gains this month.

Three factors driving Bitcoin gains

Whale accumulation, institutional demand and supply on exchanges are the key drivers of Bitcoin’s recent gains. Data from CryptoQuant shows that Bitcoin is leaving exchanges to hit custodial wallets, not institutional or miner wallets. “Custodial” wallets are key here, since they represent Bitcoin that is pulled out of circulation typically for accumulation or holding for a relatively long period of time.

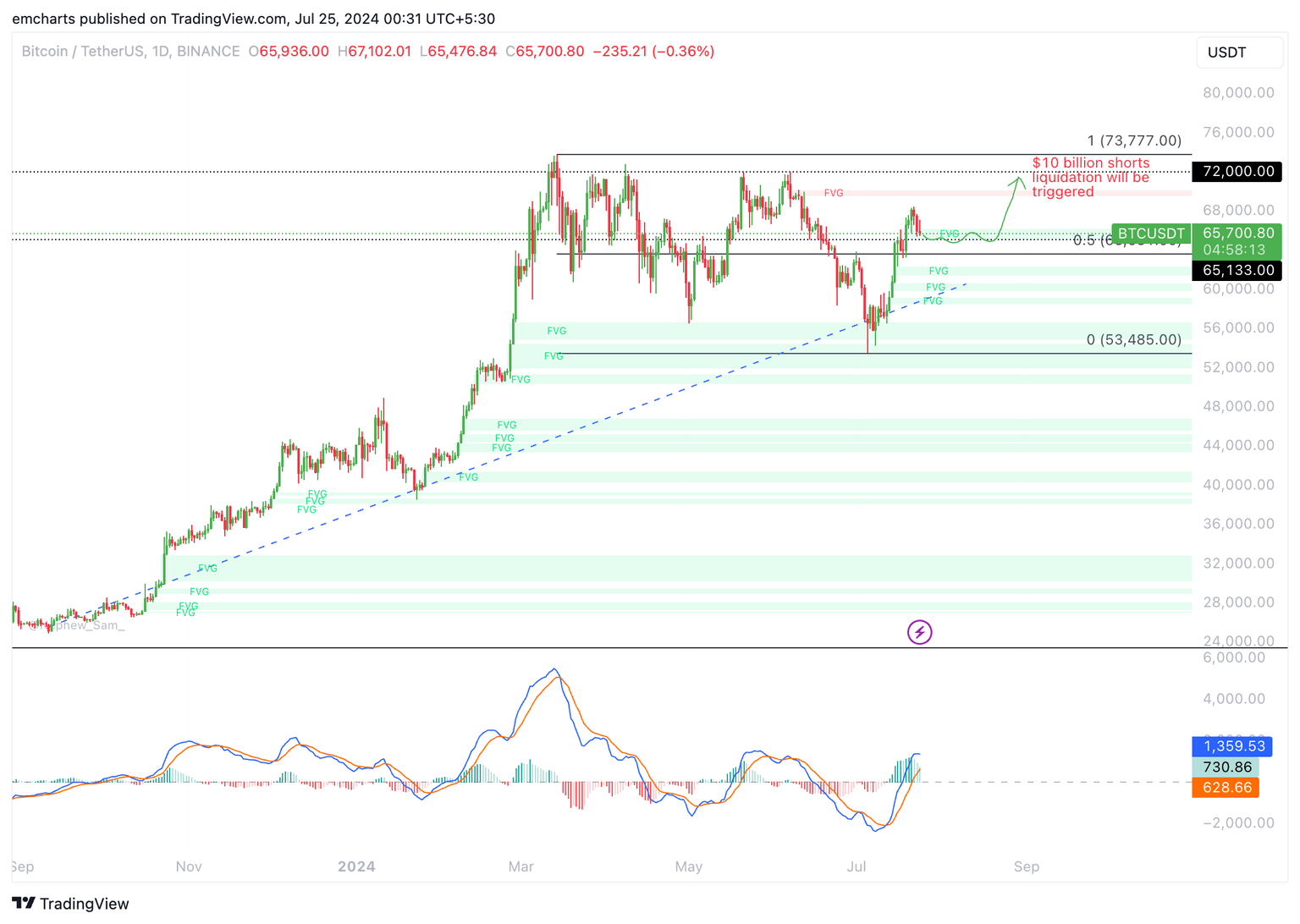

Bitcoin demand change in the past 30 days as seen on CryptoQuant

Rising reserves of custodial wallets, combined with declining supply on exchanges, eases the selling pressure on Bitcoin. As the availability of Bitcoin on exchanges reduces, there is a lower likelihood of a mass sell-off event taking place.

Santiment data shows that supply on exchanges is at its lowest level since November 2021.

Bitcoin supply on exchanges vs. price

Net positive flows to Spot Bitcoin ETFs suggest consistent institutional demand, a factor that has catalyzed gains in BTC over the past few months.

#Bitcoin is in an accumulation phase.

— Ki Young Ju (@ki_young_ju) July 24, 2024

Over the past month, 358K BTC has moved to permanent holder addresses. In July, global spot ETF inflows were 53K BTC.

Though not all remaining BTC is in custody wallets, whales are clearly accumulating. And it's an unprecedented level. pic.twitter.com/Cyl2ZVhIIX

The three factors driving gains in Bitcoin have held BTC price steady close to $67,000, early on Wednesday.

Bitcoin rally to $72,000 could result in liquidation of $10 billion in shorts

Bitcoin is currently in an uptrend. The largest asset by market capitalization could collect liquidity in the Fair Value Gap (FVG) between $65,133 and $66,122. Bitcoin could rally towards the $72,000 target where Coinglass data shows, $10 billion in shorts will be liquidated.

BTC could face resistance at the $70,000 level. The Moving Average Convergence Divergence (MACD) indicator supports Bitcoin’s recent gains and implies positive momentum in Bitcoin’s price trend.

BTC/USDT daily chart

Bitcoin could find support at the psychologically important $65,000 level in the event of a correction in the asset.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B23.55.30%2C%252024%2520Jul%2C%25202024%5D-638574455404659734.png&w=1536&q=95)