Bitcoin Weekly Forecast: Early longers trapped, a move to $46,200 likely

- Bitcoin price shows an interesting move to the downside to purge the sell-side liquidity before heading up to $46,200.

- Investors can expect BTC to stabilize between $40,100 to $40,500 and trigger a run-up to yearly open.

- A daily candlestick close below $34,752 will invalidate the bullish thesis.

Bitcoin price reveals an opportunity to buy as it stoops to crucial support levels. This downswing looks to be a ploy from market makers to purge the sell-side liquidity before triggering an uptrend.

Bitcoin price and what to expect

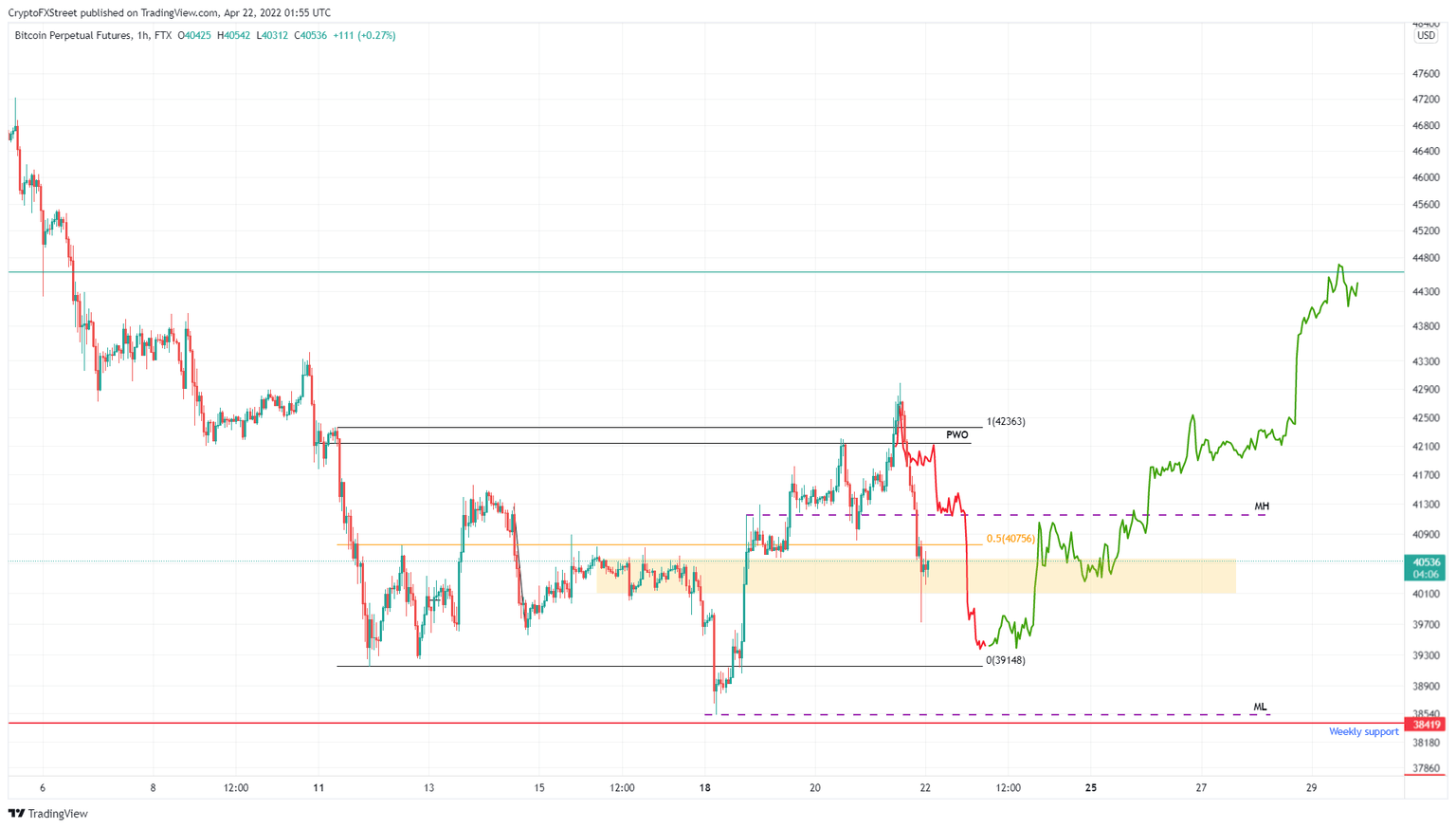

Bitcoin price crashed 7% since the April 21 swing high at $42,988 and is currently hovering around $40,540. This downswing shows strength around the $40,100 to $40,500 support area and investors can expect a bounce here.

The resulting upswing is likely to push BTC to retest Monday’s high at $41,152. If the bullish momentum is enough to produce a four-hour candlestick close above the weekly open at $42,137, there is a good chance the run-up will continue until Bitcoin price retests the $44,591.

BTC/USDT 1-hour chart

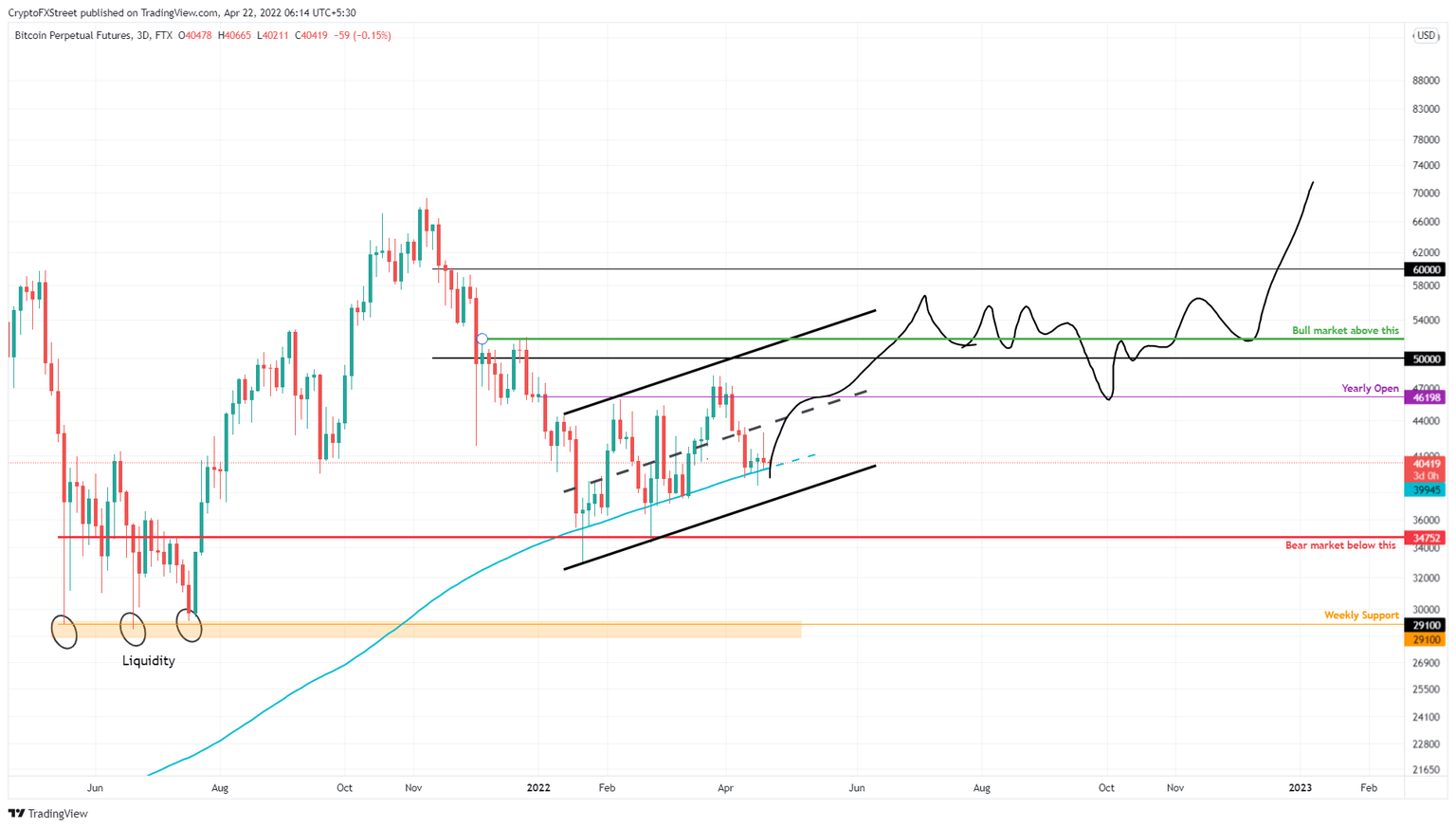

While the short-term outlook might seem bearish at first glance, the three-day chart shows that the recent downswing has held firmly above the 200 three-day Simple Moving Average (SMA) at $39,946.

Investors can expect more accumulation on the recent dip, leading to a quick recovery. Market participants can expect the U-turn to make a run at the yearly open at $46,198 after shattering the 50-day and 100-day SMAs acting as blockades.

In a bullish case, BTC is likely to continue climbing higher and retest the 200-day SMA at $47,997. If the bullish momentum persists, BTC might even wick up to retest the $50,000 psychological level.

BTC/USDT 3-day chart

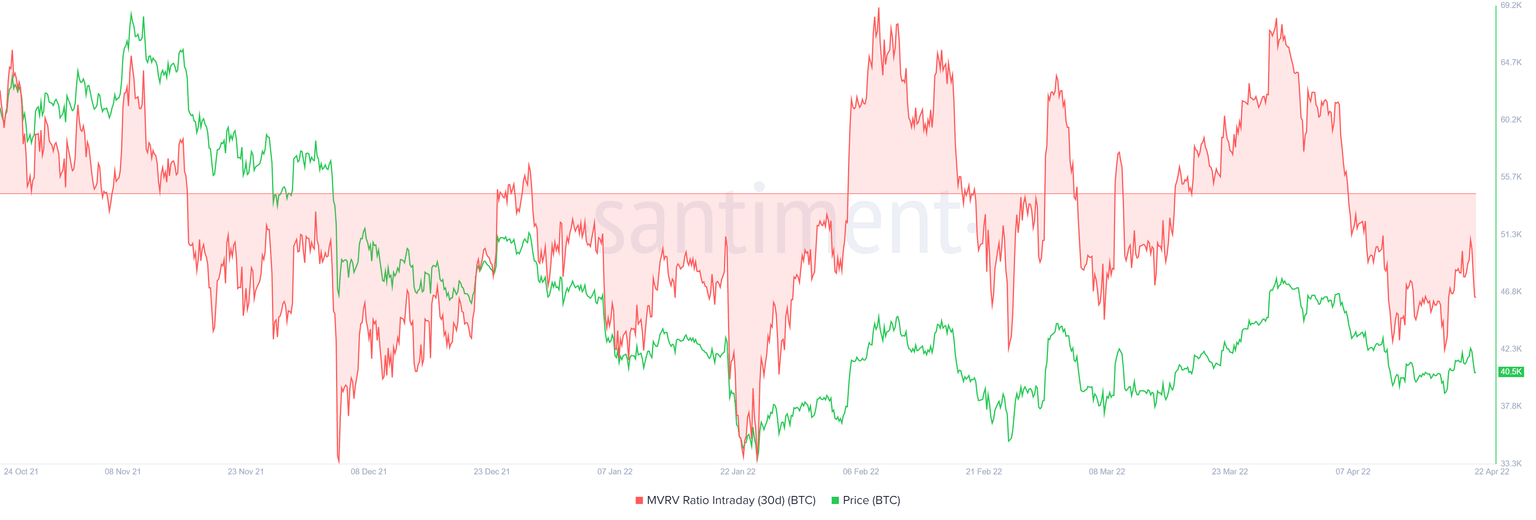

From a shorter-term perspective, the 30-day MVRV ratio intraday indicator is hovering around the local bottom at -8%. The last few times the ratio dipped this low, Bitcoin price set a local bottom and triggered a run-up. Moreover, the recent crash has put holders under loss, further alleviating any selling pressure.

Therefore, if history repeats, BTC is likely to catalyze another move to $46,200 or higher, which coincides with the outlook described from a technical standpoint.

BTC 30-day MVRV intraday

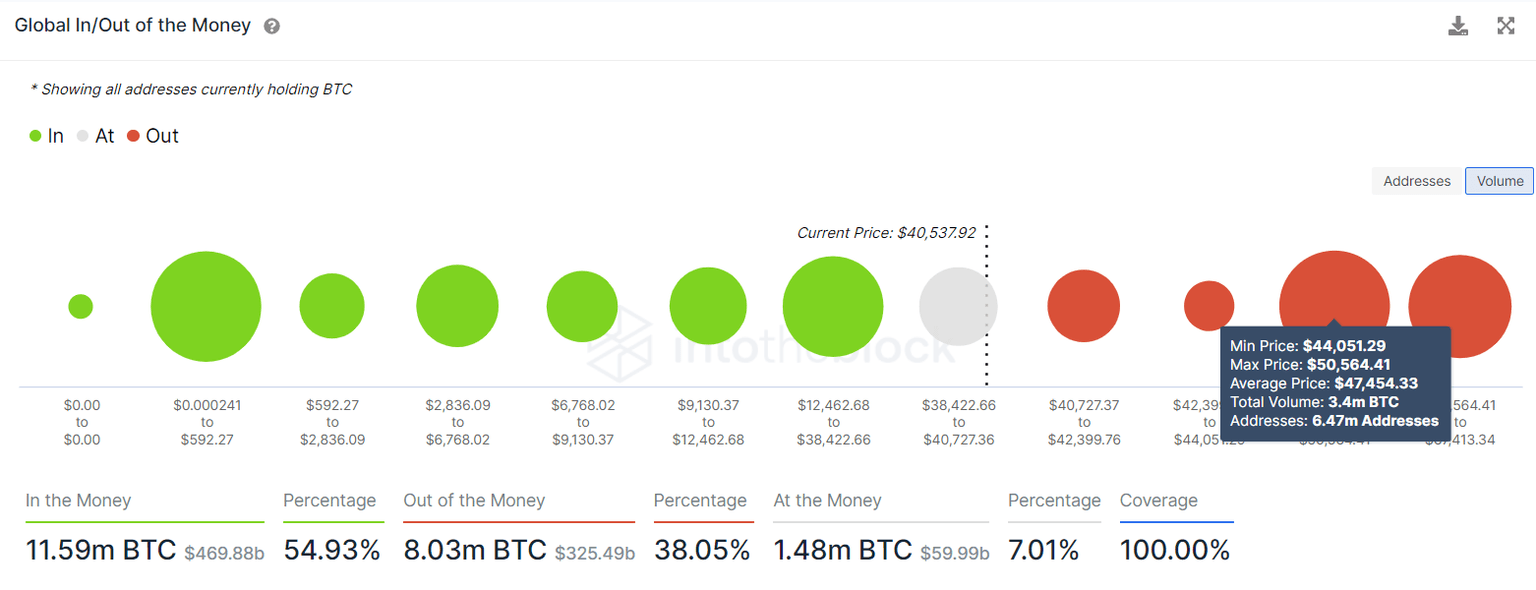

Additionally, IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that the immediate hurdles up to $44,000 are weak. Therefore, a quick surge in buying pressure could easily push BTC higher.

The “Out of the Money” investors that purchased nearly 3.4 million BTC at an average price of $47,454 are likely to pose a big threat to the upside. Interestingly, the upside limit for BTC from a technical perspective is also capped at around $47,998 aka the 200-day SMA.

BTC GIOM

While things are looking up for the big crypto, a breakdown of the $40,100 to $40,500 support area could send it crashing to $34,752. A daily candlestick close below this significant foothold will create a lower low and invalidate the bullish thesis.

In this situation, BTC market makers might tug BTC to nosedive and collect the sell-stops present below the $30,000 level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.