Bitcoin Weekly Forecast: BTC bull run to flourish unhinged beyond $52,000

- Bitcoin price action seems to be stuck between two crucial hurdles at $35,000 and $44,000.

- On-chain metrics do not paint a clear picture as they did but suggest that bulls are hanging on.

- A daily candlestick close above $52,000 will invalidate any bearish outlook and hint at the potential start of a bull run.

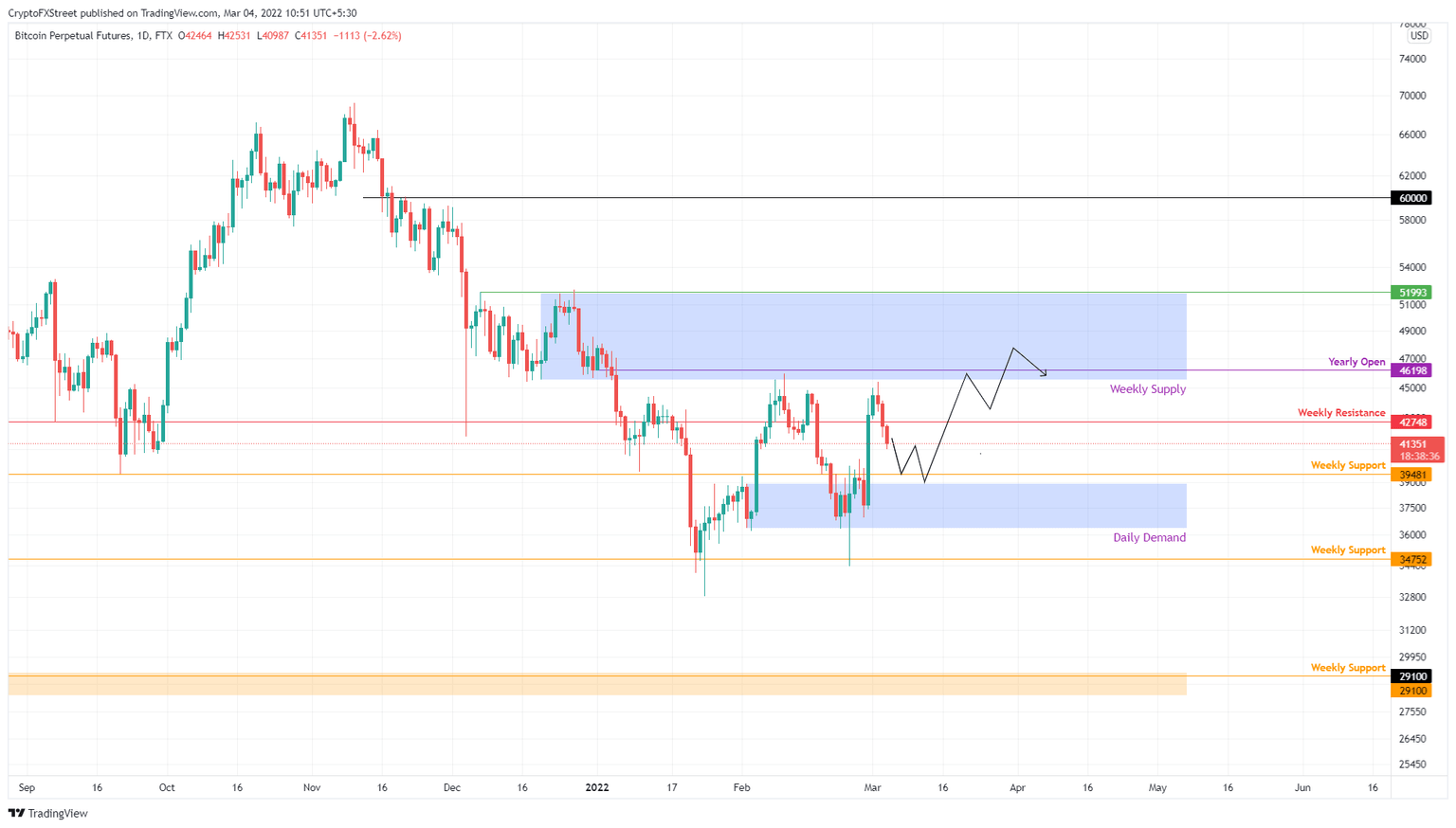

Bitcoin price is hovering between a weekly supply and a daily demand zone, leading to a bracketed movement. The recent run-up fell short of retesting the upper boundary and is currently correcting to find a stable support level.

Bitcoin price hopes for bulls’ return

Bitcoin price experienced a solid bounce from the $36,398 to $38,895 demand zone on February 28 and rallied 22%. This uptrend fell short of $138 to retest the weekly supply, extending from $45,550 to $51,860.

Regardless, the bears took over, leading to a 9% downswing so far. A further descent is likely to encounter the upper limit of the demand zone, where BTC is likely to find some sort of support that absorbs the incoming selling pressure.

If buyers make a comeback, there is a good chance Bitcoin price will kick-start another uptrend that attempts to shatter through the weekly supply. A successful bounce that pushes the big crypto to produce a daily candlestick close above $52,000 will create a higher high relative to the December 27 swing high, indicating the potential start of an uptrend.

This development will open the path for investors to expect Bitcoin price to head back to $60,000 or set a new all-time high at $80,000.

BTC/USDT 1-day chart

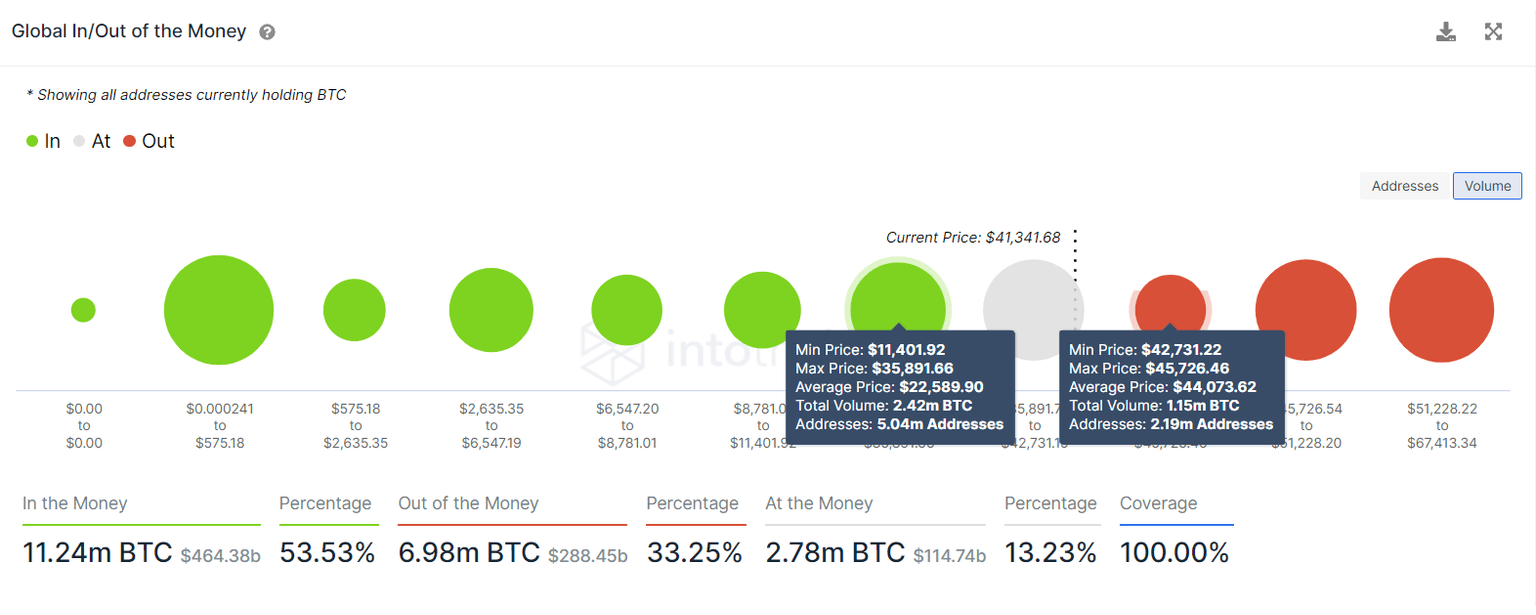

This optimistic scenario assumes that Bitcoin price does not shatter the daily demand zone. IntoTheBlock’s Global In/Out of the Money (GIOM) model, indicates that a key point to overcome for this outlook is $44,073. Here, roughly 2.19 million addresses that purchased $1.5 million BTC are underwater.

A move beyond the average buy-in price would alleviate the selling pressure from “Out of the Money” investors trying to break even. Clearing this hurdle would open the gate for BTC to push to $50,000, which is the next cluster of underwater investors.

The resistance level at $44,073 is relatively weaker compared to the support area, indicating that a minor spike in bullish momentum could be enough to start a more profitable uptrend.

BTC GIOM

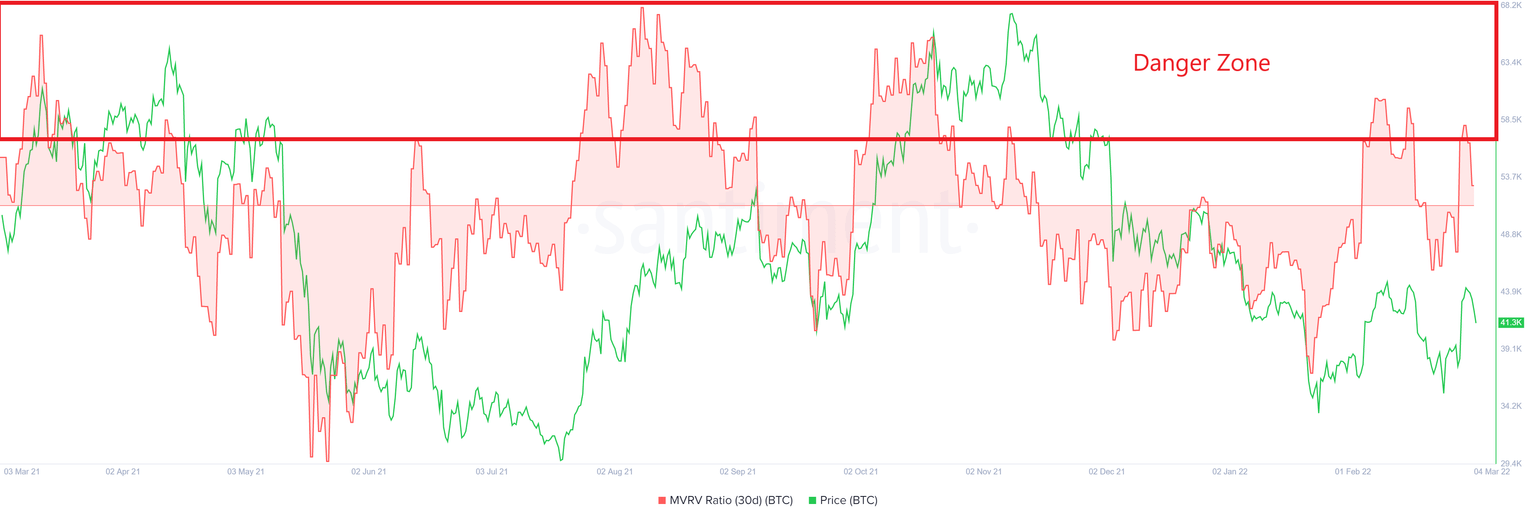

Further highlighting Bitcoin’s sideways movement is the 30-day Market Value to Realized Value (MVRV) model, which is hovering close to 0%. This on-chain metric is used to determine the average profit/loss of investors that purchased BTC over the past month.

For the past year, the 30-day has been accurate in predicting a local top. Any move into the 7% to 20% area would indicate a potential local top formation, leading to a quick retracement. The recent rally of Bitcoin pushed the MVRV to 7.3% and the formation of a local high, indicating that investors are quick to book profits due to the uncertainty in global markets because of the war between Russia and Ukraine.

BTC 30-day MVRV

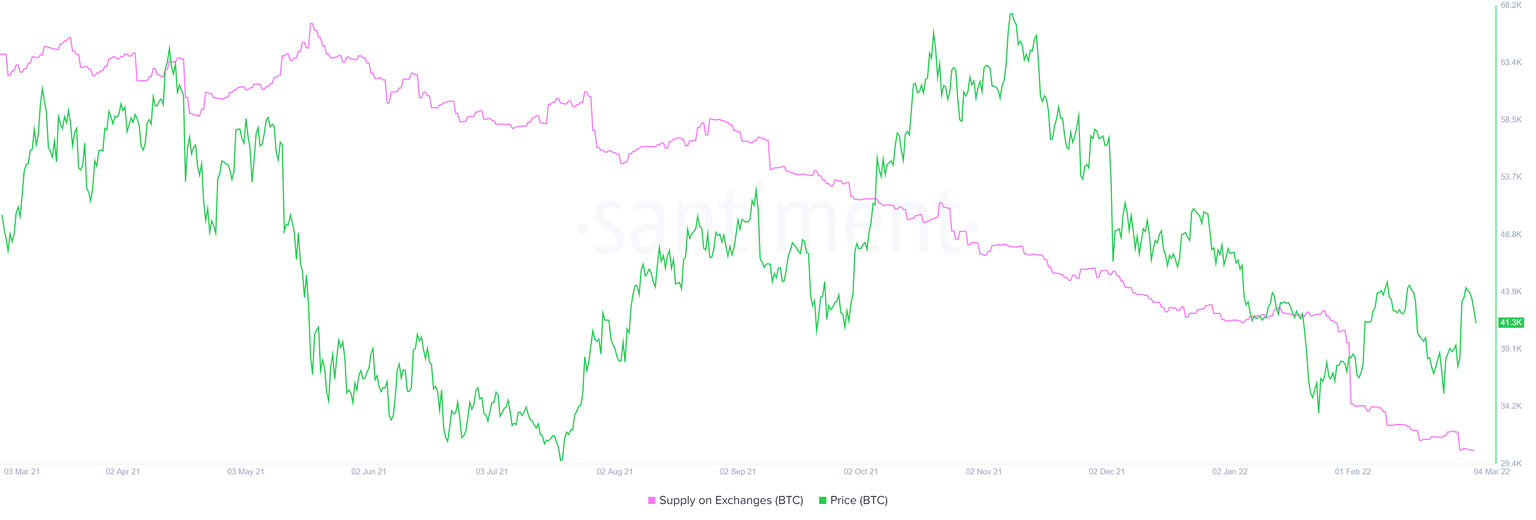

While these indicators are accurate for analyzing the short-term outlook, the supply on exchanges index can be used to determine the overall health of the long-term investors/holders. The total number of BTC held on exchanges has dropped from 2.64 million to 2.05 million over the past year.

Roughly 590,000 BTC tokens have moved out of exchanges and into cold storage wallets or interest-earning platforms, suggesting that these holders are optimistic about the future of Bitcoin and less likely to sell.

BTC supply on exchanges

While things are looking relatively safe for Bitcoin price, a breakdown of the $36,698 to $38,889 demand zone will pose a serious threat to the upswing. In this case, if BTC produces a weekly candlestick close below $39,481, it will create a lower low and hint at a continuation of the downtrend.

In this situation, BTC could crash to $29,100, where quite a bit of the sell-stop liquidity is present below it. This might lead market makers to knock the big crypto for a run below this level to acquire tokens at a discount.

However, based on GIOM, the immediate support level extends from $11,401 to $35,891, where roughly 5.04 million addresses purchased roughly 2.42 million BTC at an average price of $22,589. Therefore, a threat of a steep correction to $22,589 is also plausible, especially if the tussle between Russia and Ukraine escalates and becomes ‘nuclear’.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.