Bitcoin slides with S&P 500 as Fed signals tapering $120B monthly bond purchases

Bitcoin (BTC) prices briefly fell below $44,000 on Thursday as the United States Dollar strengthened after the U.S. Federal Reserve policy minutes revealed its intentions to limit its bond-purchasing program this year.

Bitcoin risks $45,000 becoming new resistance

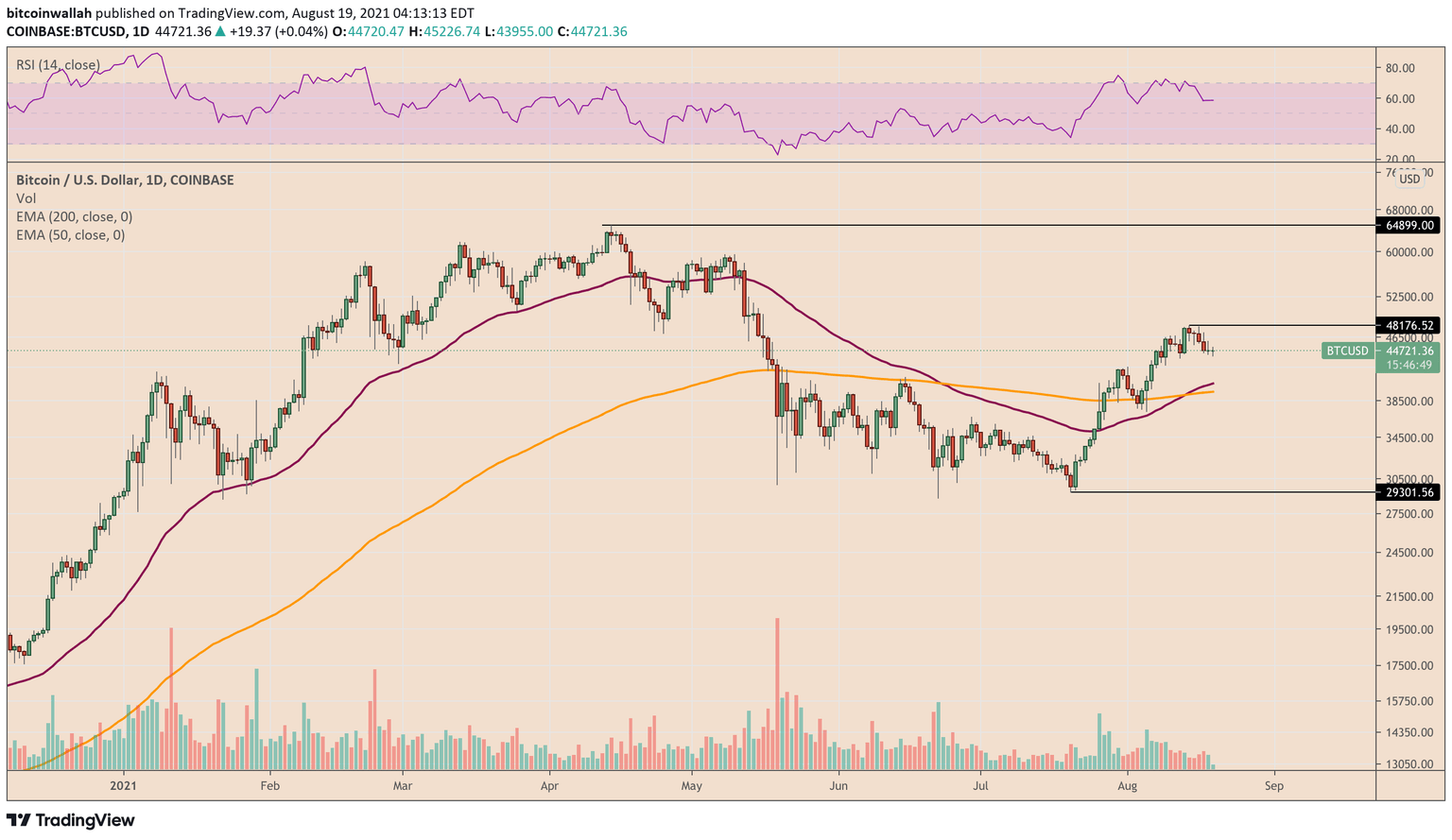

The spot BTC/USD rate dropped 1.71% to a new week-to-date low of $43,955. The pair’s plunge appeared as a part of a technical correction that started after it had reached a three-month high of $48,176 on Saturday, following a 64.42% price rally.

Bitcoin daily price chart. Source: TradingView

Bitcoin’s latest price decline also surfaced in line with a similar market bias on Wall Street. For instance, the benchmark S&P 500 index lost 47.81 points, or 1.1%, dropping to 4,400.27 during Wednesday’s final hours of trading.

Similarly, the Dow Jones and the Nasdaq Composite also plunged 1.1% and 0.9%, respectively. In addition, CNBC’s pre-market data revealed that futures tied to Wall Street indexes dropped on Thursday, hinting that the markets will likely continue their declines after the New York opening bell later on Thursday.

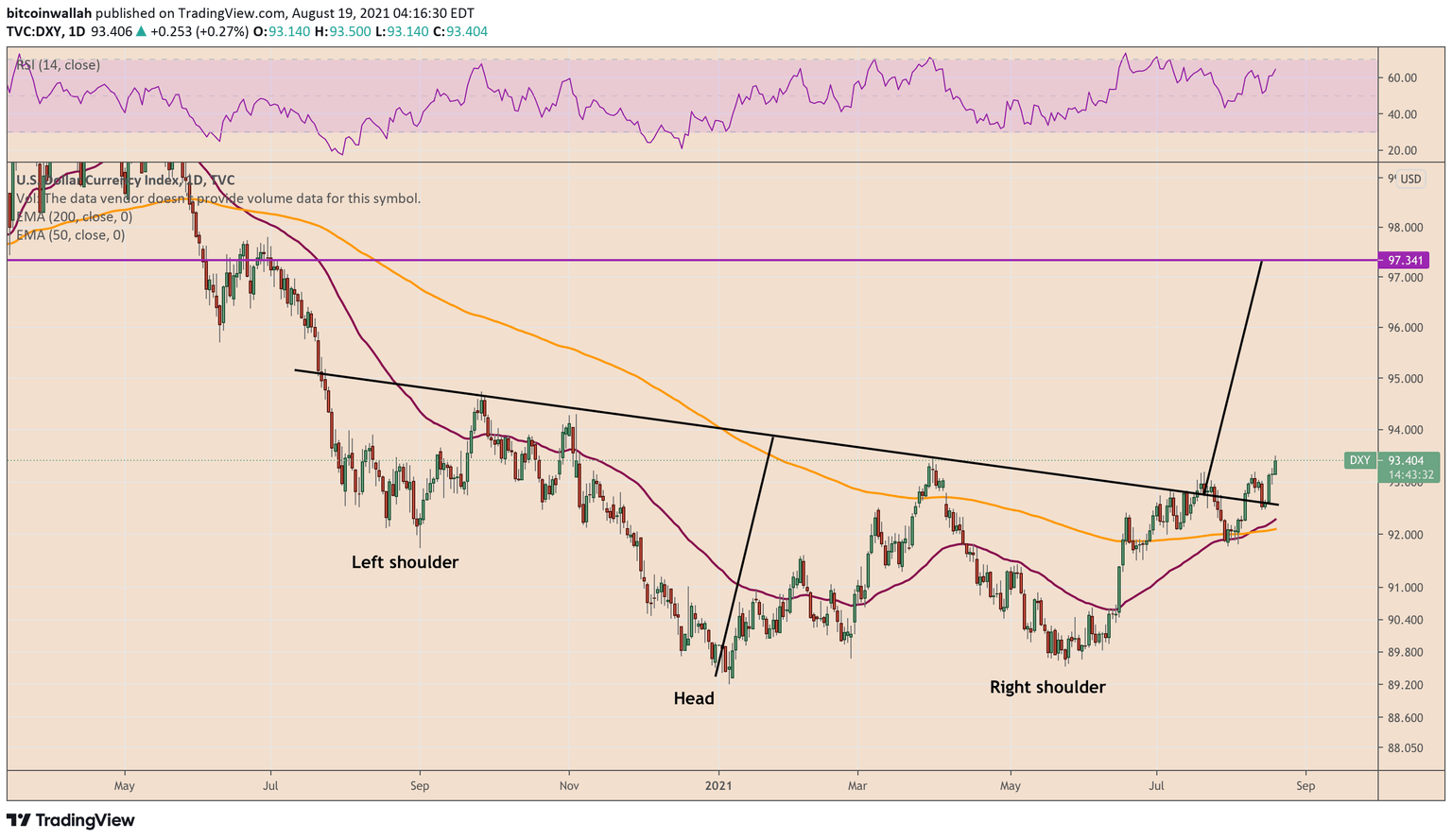

On the other hand, the U.S. dollar index (DXY) benefited from declining risky markets. The index, which measures the greenback’s strength against a basket of top foreign currencies, surged 0.39% to a six-month high of 93.50 before correcting lower by modest margins.

U.S. dollar index daily chart highlighting an inverse head and shoulder setup. Source: TradingView

Tapering alert

The U.S. Federal Reserve’s July 27–28 meeting, released Wednesday, showed an emerging consensus to unwind its $120-billion monthly purchases of Treasury and mortgage-backed securities.

Most central bank officials agreed that the U.S. economic recovery is on the right path, which is an appropriate reason to reduce the pace of asset purchases. But they did not reveal when they should begin the tapering, with only three remaining Federal Open Market Committee meetings left to attend this year.

Officials also agreed that scaling back asset purchases would position them to raise interest rates should the economic recovery persist as anticipated. But they said that they want to see stronger evidence that the labor market has recovered from the aftermaths of the COVID-19 pandemic, the minutes revealed.

On inflation, the minutes showed Fed officials anticipating a temporary burst. They highlighted that their preferred gauge of inflation, after excluding volatile food and energy categories, was at 3.5% in June — a 30-year high — but anticipated declines by calling the upswing in consumer prices transitory.

Bullish exhaustion ahead?

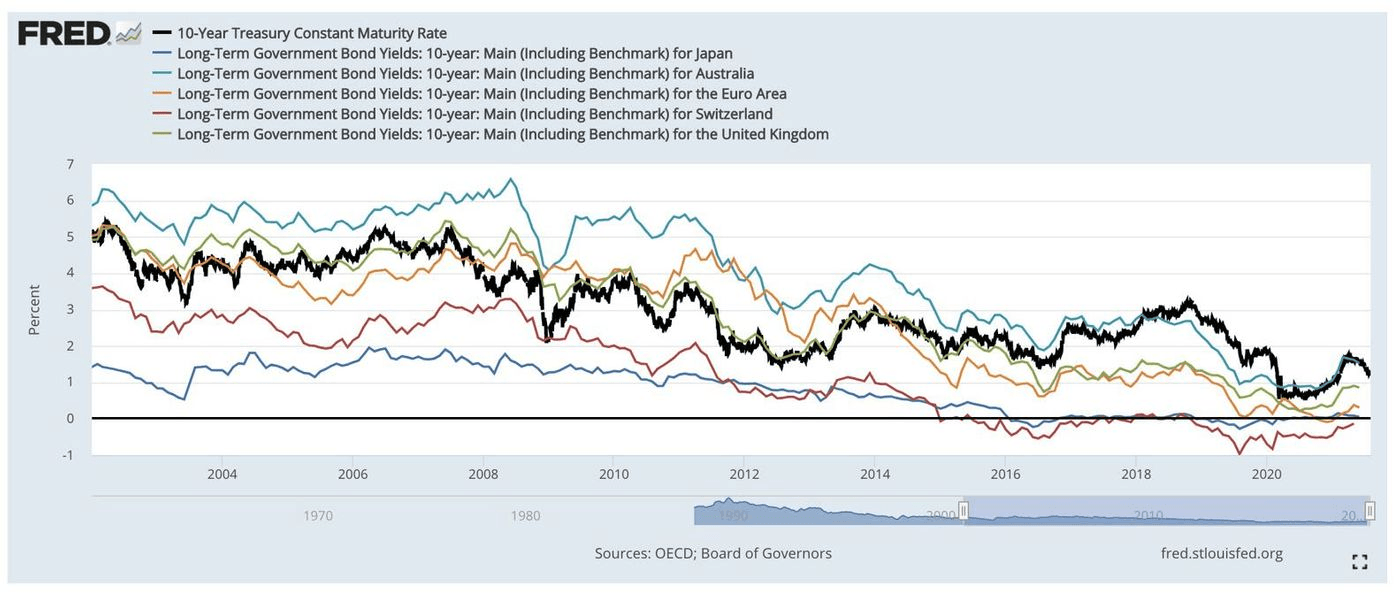

In detail, excessive bond-buying ended up sending U.S. debt yields to a low of 0.66% in 2020. Even the bounce back recorded at the beginning of 2021 kept the yields near their record lows. The trend was the same across the globe, wherein the amount of debt offering negative yields recently stood at $16.5 trillion, a six-month peak.

Long-term government bond yields are declining across developed economies. Source: FRED

The lower rate of returns has sparked a series of rotations in the equity market, with indexes logging record highs. The S&P 500 rallied 19.01% year-to-date to hit a lifetime peak of 4,480.26 points, while the Dow Jones jumped 16.30% year-to-date to reach an all-time high of 35,369.87 points.

Bitcoin, which emerged as a safe-haven alternative to the U.S. dollar and gold in 2020, also rose alongside the Wall Street index. In 2021, it has penned a record high near $65,000, with analysts crediting the Fed’s loose monetary policies as one of the leading catalysts behind its price rally.

But the biggest question remains of whether or not tapering will rotate capital out of the markets, which boomed during the period of quantitative easing, especially now Bitcoin that is sitting atop over 1,000% in profits following the Fed’s loose policy introduction in March 2020.

Jon Ovadia, founder of South Africa-based crypto exchange Ovex, noted that a declining cash flow from the Fed’s coffers would likely halt the growth of Bitcoin and similar risky assets in the near term.

“The factors that support the growth of Bitcoin, in particular, goes beyond just the Fed’s interference in keeping the economy healthy,” he explained, adding:

“However, on the macroeconomic front, Bitcoin investors will have to factor in the prospective impact and hang on to other fundamentals that abound in the crypto market to keep prices at record levels.”

Bitcoin will have refreshed record highs by Q1/2022

James Wo, founder and CEO of Digital Finance Group, called the latest price declines in Bitcoin and the equity market “reactionary” in nature. But he stressed that risk-on assets would continue their upward momentum in the long term due to inflationary pressures.

“Nominal inflation will take time to get back to levels seen before the pandemic,” he said.

“I continue to believe that we are still on track to reach all-time highs by Q4 2021–Q1 2022.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.