Bitcoin shows signs of recovery as Bitgo begins final Mt. Gox distribution

- Bitgo moves $2 billion worth of Mt. Gox BTC after performing a test transaction.

- Glassnode data shows that long-term BTC holders are maintaining their holdings as selling pressure has reduced.

- Metaplanet announced that it had acquired 57.1 BTC worth $3.3 million.

Bitcoin (BTC) is up over 3% on Tuesday as investors reacted positively to the final lap of Mt. Gox supply pressure. Meanwhile, Glassnode data reveals investors have resumed accumulation, hoping to see Bitcoin record higher prices.

Mt. Gox Bitcoin supply pressure about to end as long-term holders tighten their balances

According to Arkham Intelligence, a wallet connected with collapsed exchange Mt. Gox ran a test transaction. The wallet is said to hold $2.19 billion in BTC and is suspected to be a Bitgo exchange wallet, the final distributor of the Mt. Gox creditor funds.

A few hours after the report, Bitgo eventually moved $2 billion worth of Mt. Gox Bitcoin as it looked to distribute funds to creditors. This is likely the last lap of the Mt. Gox repayment supply hitting exchanges.

BREAKING: Bitgo has just moved $2B of Mt. Gox BTC. pic.twitter.com/3aPFPhmGGN

— Arkham (@ArkhamIntel) August 13, 2024

The transfer triggered mixed reactions from market participants. While some saw it as a bearish move, others expressed bullish sentiment, speculating that Bitcoin could attempt a move back into the $70K zone.

The bullish sentiment seems to be slightly prevailing, as Bitcoin has been up over 3% in the past 24 hours.

The move aligns with a recent weekly on-chain report from Glassnode, which revealed that Bitcoin investors are gradually returning to an accumulation behavior.

According to Glassnode data, the Accumulation Trend Score (ATS), which measures a weighted balance change across the market, recorded its highest value of 1.0, indicating increased accumulation in the past weeks.

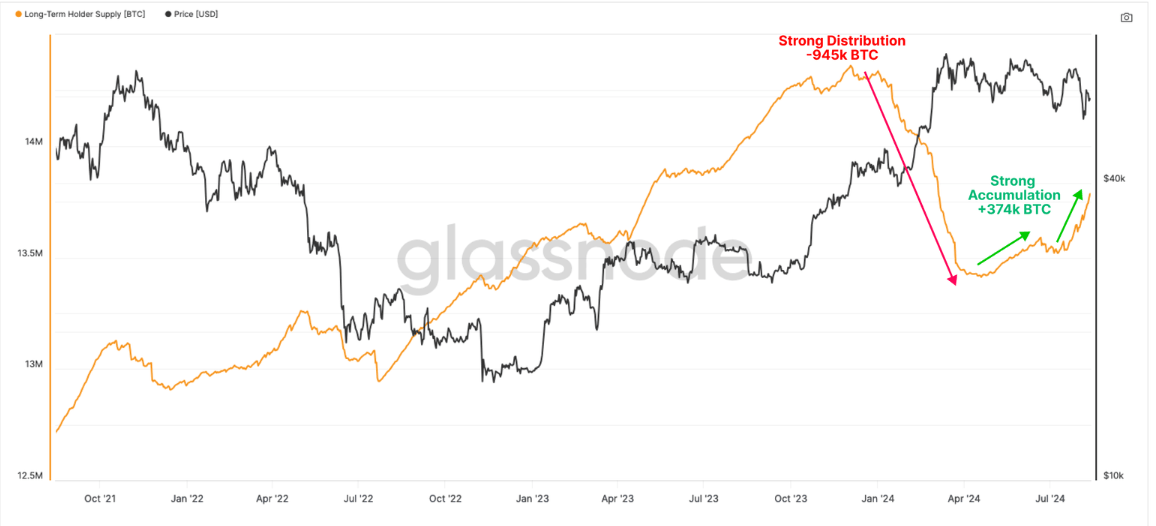

The total supply held by long-term holders (LTH) also increased, with 374K BTC entering LTH status since May. "From this, we can infer that the propensity for investors to hold onto their coins is now a larger force relative to their spending pressures," wrote Glassnode.

Bitcoin Total Supply Held by LTH

Meanwhile, Bitcoin found support around the Active Investor Cost Basis during the recent decline, suggesting investors may still be looking forward to a rally.

The LTH sell-side Risk Ratio, which measures the weight of profit and loss realized by investors, has also remained at lower levels than previous all-time highs. This suggests that LTHs have seen lower profits in this cycle compared to past cycles. Hence, they may be looking forward to BTC making another move towards its all-time high.

"An elevated percentage of Bitcoin network wealth is held by this investor cohort relative to previous cycle ATH breaks, which suggests there is a degree of investor patience on display, and waiting for higher prices. Additionally, the lack of panic selling amongst this cohort in lieu of the largest price contraction of the cycle highlights a resilience of their aggregate conviction," concluded Glassnode

This attitude may also be impacting institutional investors' behavior towards Bitcoin. Japanese investment company Metaplanet recently announced that it has acquired 57.1 Bitcoin worth $3.3 million, bringing its total holdings to 303 BTC.

Marathon Digital also revealed the pricing of oversubscribed senior convertible note offerings worth $250 million, which it aims to use to acquire more Bitcoin.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi