Crypto Today: Bitcoin in a slump, Ethereum liquidations highest since 2022, Ripple makes steady gains

- Bitcoin ranges under $60,000 on Tuesday as crypto traders await US macroeconomic releases this week.

- Ethereum notes spike in liquidation of long positions, revisits 2022 high as ETH hovers under $2,750 resistance.

- XRP makes steady gains, back above key support at $0.57.

Bitcoin, Ethereum, XRP updates

- Bitcoin trades at $58,894 at the time of writing. The asset has noted nearly 12% increase in derivatives trade volume in the last 24 hours. Consistent capital inflow to Spot Bitcoin Exchange Traded Funds (ETFs) and a positive sentiment among traders could influence BTC price and catalyze gains.

- Ethereum trades at $2,648 on Tuesday. The altcoin faces resistance at $2,750. Data from CryptoQuant shows $160 million in long liquidations when Ether dipped under $2,100 in August. The long position liquidations hit the highest since 2022.

- XRP extended gains on August 13. Ripple made a comeback above key support at $0.57 as traders digest the Securities & Exchange Commission’s (SEC) lawsuit ruling and Ripple’s recent announcements.

Chart of the day

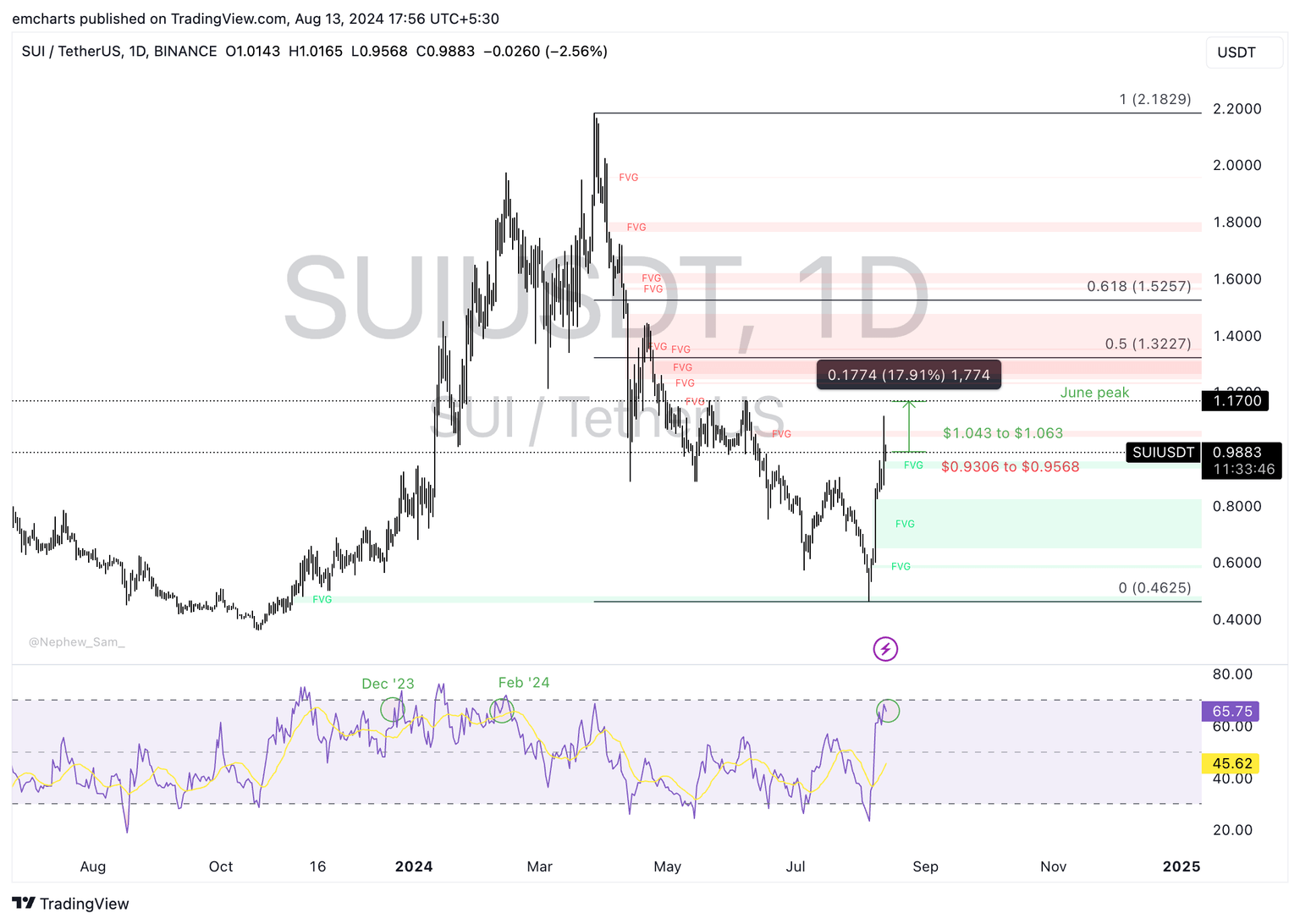

SUI/USDT daily chart

SUI trades at $0.9883 at the time of writing. The token could extend gains to is June 2024 peak of $1.17. SUI faces resistance in the Fair Value Gap (FVG) between $1.043 to $1.063 and support in the imbalance zone between $0.9306 to $0.9568.

In the event of a correction, SUI could collect liquidity in its imbalance zone seen in the chart above. The Relative Strength Index (RSI) reads 65.75, under the overbought level at 70. On previous occasions when RSI climbed to this level the asset has rallied before a correction.

Market updates

- DeFi sector dominance dips to a three-year low per data from IntoTheBlock.

DeFi as the sector with the strongest product-market fit in crypto reached 3-year low lately relative to global crypto market cap.

— Arthur (@Arthur_0x) August 13, 2024

I expect this to bottom out over the coming months and make a great comeback as we enter a new interest rate cycle. pic.twitter.com/oOd7iy2IDN

- Binance to list Toncoin (TON) and users can obtain the token by staking BNB, FDUSD and TON, staking starts on August 15, 2024.

- Liquidators of Three Arrows Capital sue Terraform Labs and seek $1.3 billion, claim $462 million LUNA investment reduced to $2,700 in the aftermath of the collapse.

Industry updates

- On-chain data shows that a wallet address that received $2.19 billion in Bitcoin from Mt. Gox began test transactions an hour ago. The address is believed to be associated with Bitgo, an exchange partner for Mt.Gox’s fund distribution to creditors.

- Token Terminal data shows USD Tether on Tron is a third of Visa’s annual settlement volume.

USDT on @trondao = 1/3 of @Visa's annual settlement volume.

— Token Terminal (@tokenterminal) August 12, 2024

In Q2 '20, USDT on TRON had a settlement volume of $25.2 billion.

In Q2 '24, that same figure was $1.25 trillion.

pic.twitter.com/adicMrxvjg

- Japan’s Metaplanet bought an additional 57 Bitcoin, holds over 303 BTC.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.