Bitcoin price struggles to climb above $24,300 but on-chain metrics remain positive

- Bitcoin price has attempted to hit a new all-time high in the past 24 hours but got rejected at $24,100.

- It seems that institutional interest in Bitcoin continues rising, according to various metrics.

Bitcoin price has been quite volatile in the past four days after establishing an all-time high at $24,295 on Binance. Despite the volatility, BTC remains trading at $23,600 at the time of writing while many on-chain metrics seem to have turned bullish.

Bitcoin price could soon hit a new all-time high

According to Ki Young Ju, CEO of on-chain analysis platform, Cryptoquant, more than 12,000 BTC flowed out from Coinbase to a cold wallet. Apparently, the exchange makes a new custody wallet after an OTC deal with institutions.

12,006 $BTC flowed out from Coinbase a few hours ago.

— Ki Young Ju 주기영 (@ki_young_ju) December 23, 2020

As I said, it went to custody-looked-like wallets. It seems that Coinbase makes a new cold wallet for each customer after the OTC deal for institutions.

I'm very bullish on $BTC.https://t.co/MrM1IgzB3B pic.twitter.com/whmG287Pus

If this is truly the case, it would mean that thousands of Bitcoin have been bought by institutions in the past 48 hours. According to Cole Garner, an on-chain analyst on Twitter, Bitcoin has reached a critical inflection point when it comes to its adoption curve.

1/ We've reached a critical inflection point in bitcoin's adoption curve.

— Cole Garner (@ColeGarnerBTC) December 23, 2020

A moment wholly unique in the history of markets.

Are you ready for what comes next? #Bitcoin pic.twitter.com/g4A2x5Gvsg

It certainly seems that there is a lot of institutional money coming to the cryptocurrency market, pushing Bitcoin to higher highs. The Whale Exchange Ratio metric has flashed a buy signal again, which seems to be an accurate indicator of local Bitcoin bottoms.

BTC Whale Exchange Ratio chart

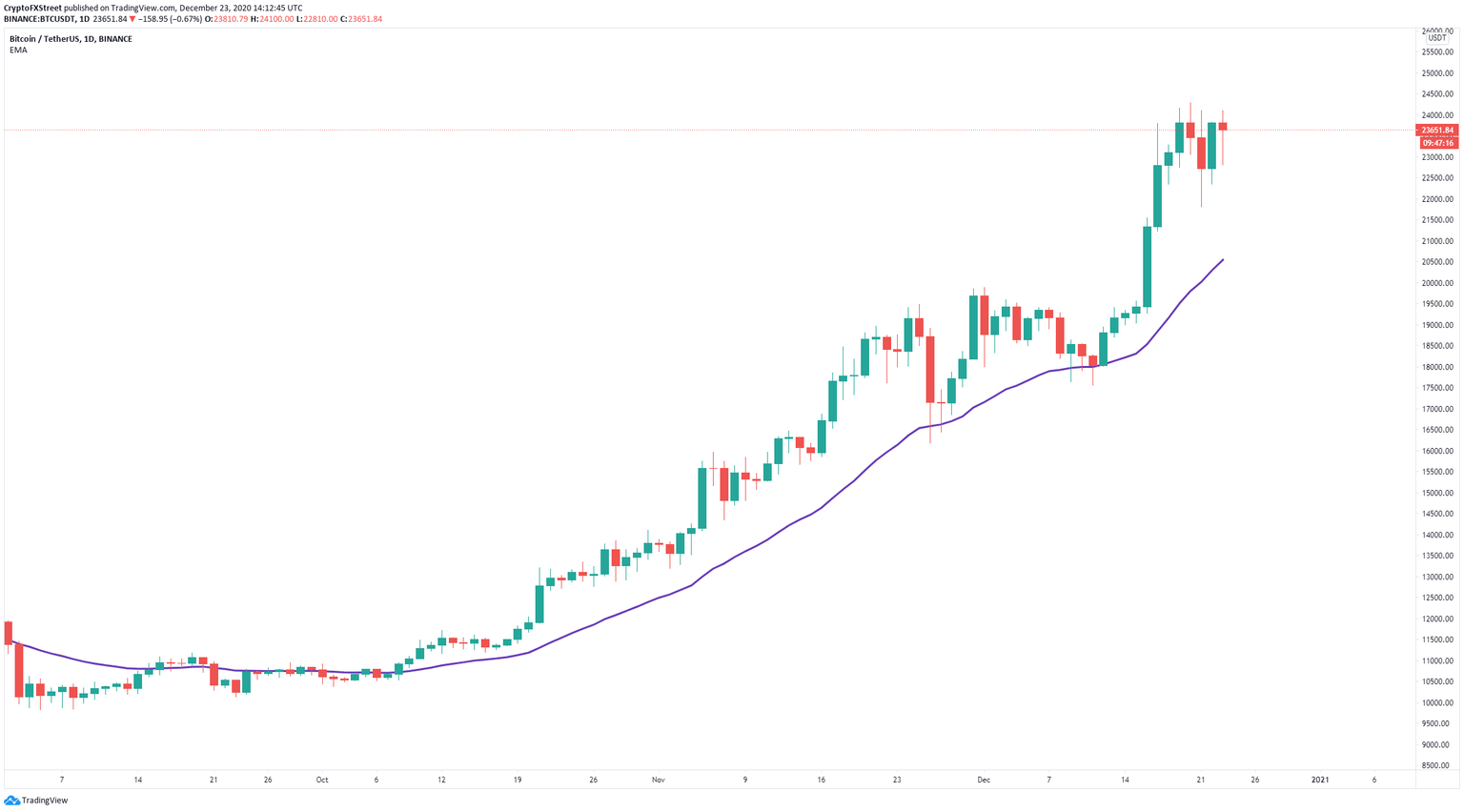

The most important support level for Bitcoin on the daily chart has been the 26-EMA, which was defended several times on the way up and marked good ‘dip-buying’ opportunities.

BTC/USD daily chart

Currently, the 26-EMA is located at $20,602, which means that a dip towards this level will not represent a risk to Bitcoin’s uptrend. The only resistance to the upside is $24,295, which is the last all-time high. A breakout above this point can quickly push Bitcoin price towards $25,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.