Bitcoin Price Prediction: Is BTC/USD fundamentally ready to take on $10,000? Confluence Detector

- Bitcoin’s chance of hitting $10,000 in jeopardy as traders fail to gather enough trading volume to sustain gains.

- The significant hurdle at $9,937 continues to give buyers a hard time in the battle to reclaim the ground above $10,000.

Bitcoin price has showcased its bullish strength following a break above the stubborn resistance at $9,900. The move also opened the road for gains, eying $10,000. Meanwhile, an intraday high has been formed at $9,977. The prevailing trend is bullish but due to the shrinking volatility, further advancement may remain a pipe dream. For now, the price is trading at $9,883 after a minor retreat. Gains above $9,900 as well as higher support would increase the chances of trading above $10,000 before the weekend.

From a technical perspective, Bitcoin is ready to bring down the resistance at $10,000.The gap the 50-day SMA is making above the MACD suggests that the king of cryptocurrencies is in the bulls’ hands. Moreover, the sideways moving RSI is inclined upwards, an indication that buyers are still in control. If a breakout fails to come into play, there is a chance that consolidation will continue to take precedence in the short term. The MACD puts emphasis on the consolidation with its horizontal motion at the mean line (0.00).

BTC/USD daily chart

-637274468529566647.png&w=1536&q=95)

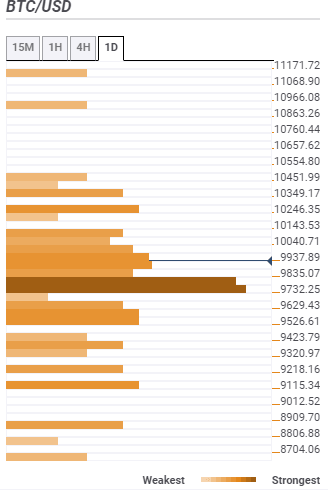

Bitcoin daily confluence support and resistance levels

Resistance one: $9,937 – This zone is highlighted by the Fibo 38.2% one-day, the previous high 15-minutes, the Bollinger Band 15-minutes middle curve, SMA ten 15-minutes and the previous high 1-hour.

Resistance two: 10,040 – Highlights the previous low 1-hour, the Bollinger Band 15-minutes lower curve, SMA 50 15-minutes and the previous low 4-hour.

Resistance three: $10,143 – This zone is home to the previous month high.

Support one: $9,835 – Highlights the SMA ten 4-hour, Fibo 61.8% one-day, the Bollinger Band 1-hour and the SMA five 4-hour.

Support two - $9,732 – Home to the SMA 200 1-hour, Fibo 38.2% one-week and SMA 100 1-hour among others.

Support three: $9,629 – Hosts the Fibo 23.6% one-month and the pivot point one-day support two.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren