Bitcoin Price Prediction: BTC/USD seesaw movements target $4,000 – Confluence Detector

- Bitcoin price dives under $5,000 triggering a fresh round of losses across the crypto market.

- BTC/USD deals with weak support areas and stacks strong resistance zones.

Bitcoin price is too vulnerable to losses after the support at $5,000 was shattered on Monday during the European session. The seesaw movements experienced last week seem to have made a comeback. Other major cryptocurrencies are also in grave danger with Ethereum under risk of testing levels under $100 and Ripple $0.1.

BTC/USD is dancing at $4,815 in wake of a 9.66% loss on the day. A bearish trend prevails amid continuously increasing price volatility. However, higher support is needed, preferably at $4,800 to help the bulls re-focus their attention energy on levels close to $6,000, which could eventually help avert possible breakdown to $4,000.

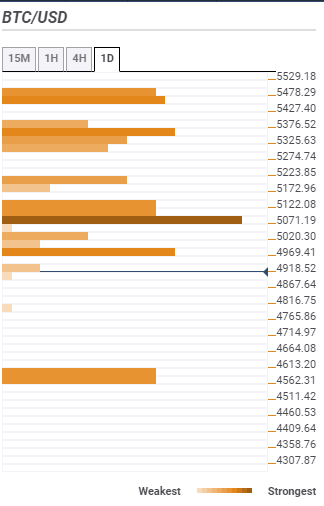

Bitcoin confluence support and resistance

Support one: $4,613 – As highlighted by the pivot point one-day support two.

Support two: $4,562 – Home to the 161.8% Fibonacci one-day.

Resistance one: $4,969 – As highlighted using the previous 15-minutes, the SMA five 15-mins and the pivot point one-day support one.

Resistance two: $5,223 – This zone hosts the previous low 4-hour and the SMA five 1-hour.

Resistance three: $5,376 – Highlighted by the SMA five 4-hour and the previous high 4-hour.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren