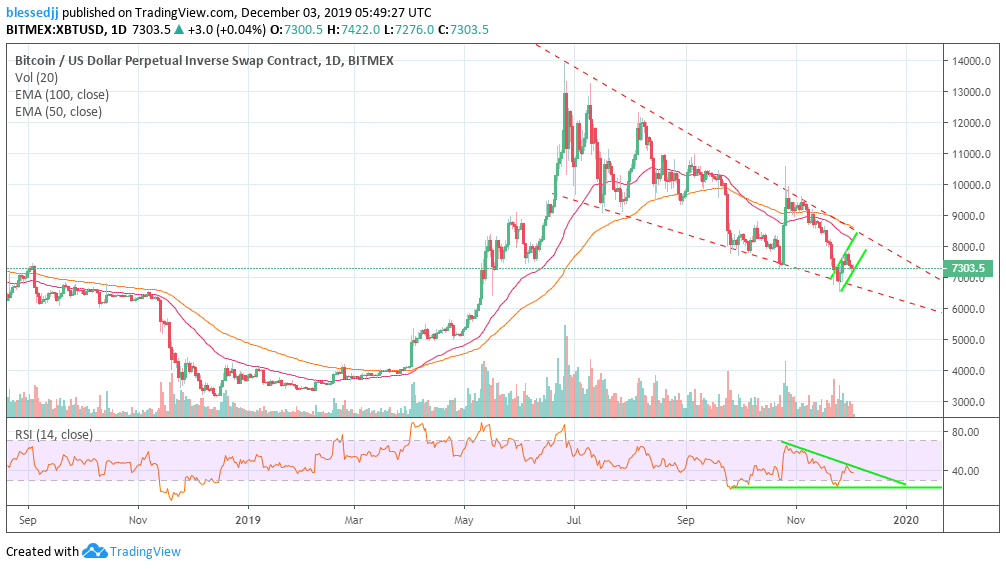

Bitcoin Price Prediction: BTC/USD next rendezvous could be $6,000 – Confluence Detector

- Losing $7,500 support was detrimental for Bitcoin as the next stop could be $6,500.

- Bitcoin must resume the uptrend above the initial resistance at $7,331 to pave the way for gains towards $8,000.

Bitcoin price has remained lethargic in action after it gave up $7,500 support. The recovery from Monday’s trip below $7,200 has not managed to clear the resistance at $7,400. BTC is trading at $7,300 following a downside correction from an intraday high around $7,412.

According to Joe DiPasquale, the CEO of BitBull Capital, a crypto fund a research firm, Bitcoin’s “the next stop would be $6,000,” especially after breaking below $7,500 support. Recovery will continue to drag because of the low volumes bring recorded. DiPasquale said via a tweet:

“If the current support at $7,500 is breached conclusively, the next stop would be $6,000. The maximum upside, meanwhile, is limited to $9,500. A break down is more likely than a break upward, however, due to low volumes, repeated new lows, and low sentiment.”

Bitcoin Confluence Detector

Bitcoin initial resistance is seen at $7,331. A cluster of indicators calls the same zone home, turn, making it impenetrable. Some these indicators range from the SMA ten 15-minutes, SMA five 15-mins, SMA 100 15-mins, previous low 4-hour, Bollinger Band 1-hour middle and SMA 200 15-mins among others.

If the buyers managed to pull Bitcoin above the resistance above, the rest of the journey towards $8,000 will be relatively smooth. However, various hurdles a $7,483, $7,710 and $7,938 will still give buyers a hard time.

As far as support is concerned, $7,255 is the first anchor, currently highlighted by the Fibo 23.6% daily and the Fibo 23.6% one-month. Other subtle support areas include $7,104, $6,952 and $6,573.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren