Bitcoin Price Prediction: A fundamental line in the sand

- Bitcoin price shows clear divergence and a downtick in volume as price ascends.

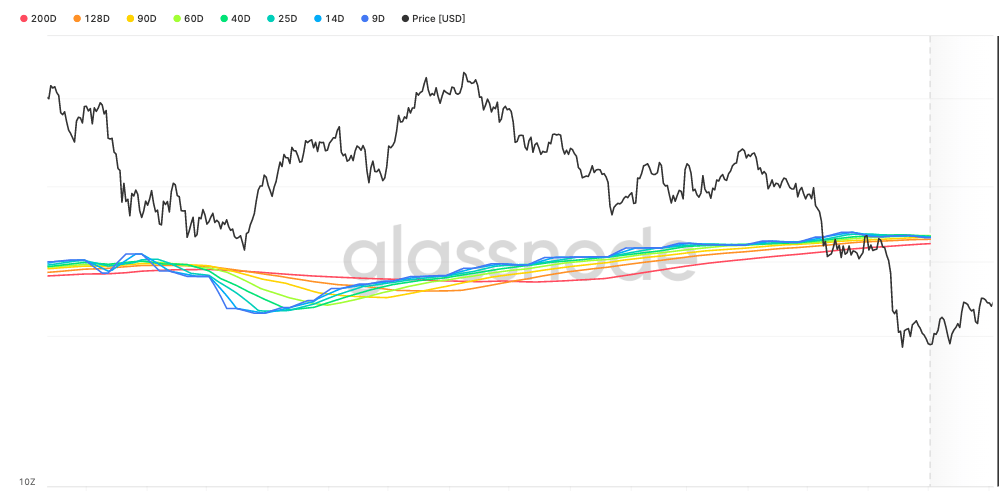

- Bitcoin price remains submerged behind Glassnode’s Difficulty Ribbon on-chain metric.

- BTC price remains fundamentally bearish until $30,000 is breached.

Bitcoin price shows fundamentals are likely sidelined from the market until higher targets are reached. Still, a trader understands to always look for opportunities and manage risk accordingly.

Bitcoin price shows stagnation

Bitcoin price is having trouble propelling towards higher targets. The peer-to-peer digital asset has performed quite erratically during July as traders experienced shakeouts and fakeouts in both directions. Because of the unpredictable behavior, the Bitcoin price ascent looks rather congested. This subtle display of uncertainty can be viewed as a weakness of trend amongst technical analysts. An opportunity to short the digital asset could present itself in the coming weeks.

Bitcoin price currently trades at $23.438. The Volume Profile indicator confounds the idea of a weakening trend as the cumulative volume tapers while the BTC price ascends. Additionally, the Bitcoin price is beginning to bear restrictions at both the $23,000 and $25,400 levels, causing a wedge-like pattern.

BTC/USDT 2-Hour Chart

Glass Node’s Difficulty Ribbon justifies the inconvenient times experienced by Bitcoin. The June 12 sell-off, which finally broke support, now has the Bitcoin price submerged below it. The bulls would need to re-hurdle the colorful barrier near $30,000 before confident fundamentalists re-enter the market.

Glassnode Difficulty Ribbon

BTC price remains fundamentally bearish until $30,000 is breached. However, traders with a keen eye may be able to make a profit in the coming days by shorting the notorious Crypto King. Still, the technicals suggest entry may be a bit too soon, but a breach of the intended market structure could be an early entry signal.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.