Bitcoin Price Prediction: Seven days of Crypto-Christmas underway?

- Bitcoin price has fallen beneath the $17,000 barrier as the bears have induced a 10% downswing.

- BTC may have close to an 80% chance of closing the month of December with positive returns.

- A breach above $17,145 is needed to aim for higher bullish targets.

Bitcoin price shows bearish technicals, but optimism for the end of the year Santa-rally persists. Nearly 100 years of stock market data suggest risk assets have a high chance of performing well.

Bitcoin price nears Christmas

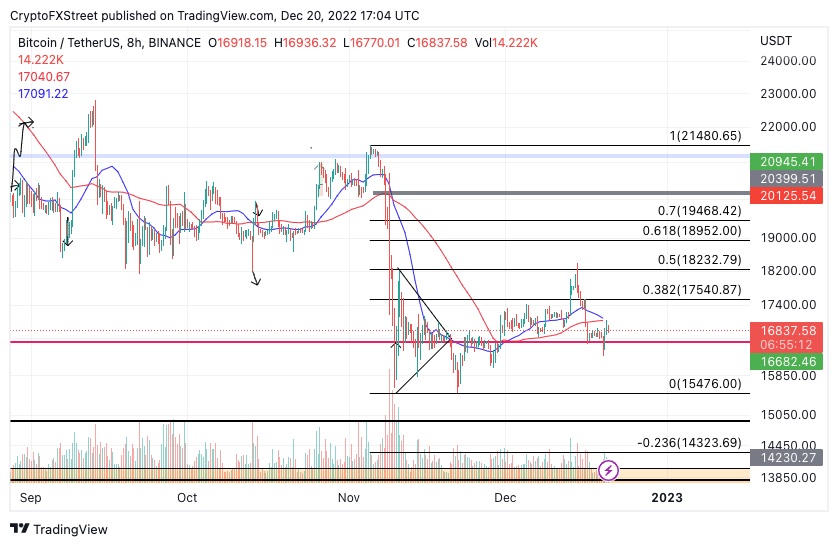

Bitcoin price is putting up a fight after experiencing a 10% selloff last week. On December 14, the peer-to-peer digital currency displayed optimistic signals. The bulls had climbed back to the $18,000 level, and moving averages provided cushion during turbulent times in the market.

Within 24 hours, what had first appeared to be just another profit-taking consolidation, quickly morphed into a seller's frenzy. Bitcoin pierced through the 8-day exponential and 21-day simple moving averages and continued treading south into the mid-$16,000 zone.

Bitcoin price currently auctions at $16,933, a 4% rise from the Monday morning low at $16,256. Although the countertrend spike is a positive gesture, in the grand scheme, the BTC price could be setting up for additional selloffs in the coming days. The recently breached moving averages confirm this bias as they are set to collide while the BTC price auctions are below.

A classical crossing of moving averages will likely entice bears to add to their positions. If the market is genuinely bearish, a breach of the Monday low at $16,256 could induce a downswing to challenge the yearly low at 15,476 for a 7% decline. If a double bottom does not form near the yearly low, then a $14,000 BTC will be imminent.

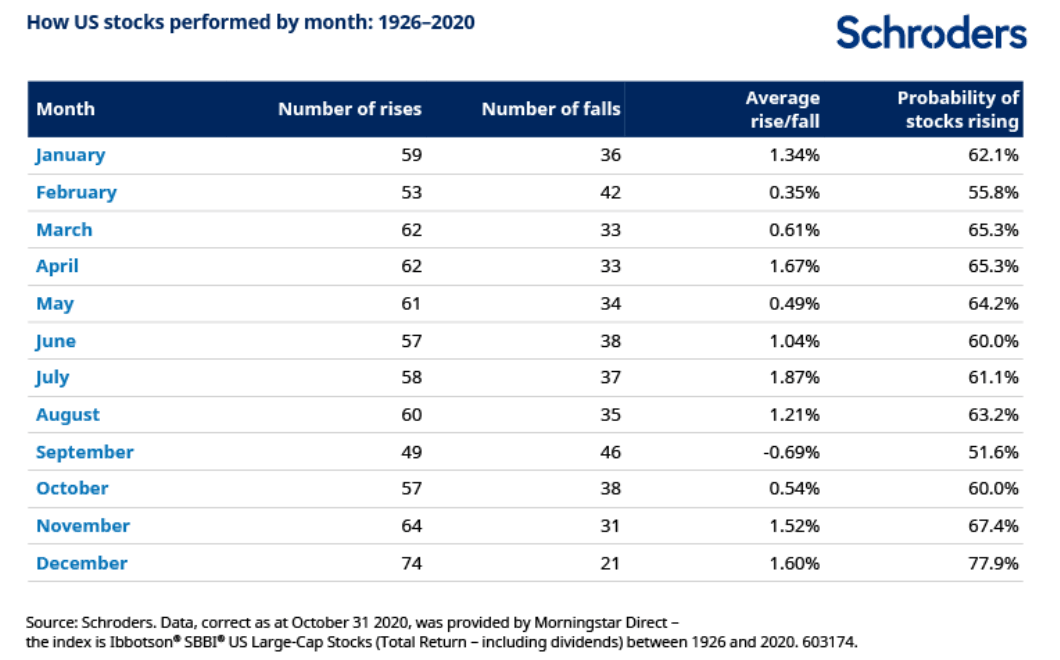

The bearish technicals may be challenging for traders to accept, as many in the space anticipate a Santa rally. In recent days, Schroders, a global asset and wealth management firm, made the case that risk assets have nearly an 80% chance of closing in December with positive returns.

The wealth management firm collected data on US large-cap stocks since 1926 and found that December was the best-performing month. According to Schroeders, large-cap stocks have a 77.9% chance of closing December in a net positive. The firm calculates these metrics by dividing all percentage gains vs. percentage losses within a month. Investors should remember that Bitcoin has seen over a 90% correlation to the stock market this year. One could argue that the peer-to-peer digital currency will continue to mirror the stock market's price fluctuations until the end of the year.

Bitcoin price is currently down 2% from December's opening price of $17,167. It is worth noting that Schroders identified positive returns with a minimum of 1.5% above the previous month. Thus, the Bitcoin price would need to rise by 3.5% and sustain price action near $17,550 by January 1 to align with Schroder's 100-year stock market data. The earliest signs of a Santa rally would be a bullish hurdle-and-flip of the colliding moving averages into support. The indicators are currently positioned near the monthly open at $17,150.

BTC/USDT 8-Hour Chart

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.