- The Financial Accounting Standards Board (FASB) issued standards that will require companies to report their crypto holdings at fair value.

- Bitcoin price per the fair value model is set at $36,000, 14% below the market price.

- Grayscale Bitcoin Trust (GBTC), on the other hand, is seeing considerable growth ahead of potential ETF approval.

When Bitcoin price rallied this past month, it brought significant profits to its investors. This included not just retail but also institutional investors and companies such as MicroStrategy, Tesla and others that hold crypto assets.

There is the expectation of a further increase in January 2024 if the Securities & Exchange Commission (SEC) approves spot Bitcoin ETF applications. However, before it happens, the FASB made a change that might affect their overall profits and losses.

Daily Digest Market Movers: Bitcoin to receive fair value treatment soon

Bitcoin price fluctuation impacts the net profits and losses of crypto holders, and with different purchase prices, it also affects the reported income of the enterprise. The Financial Accounting Standards Board (FASB) published an Accounting Standards Update (ASU) on Wednesday that is set to improve the accounting for and disclosure of certain crypto assets.

Per the new standard, an entity holding certain crypto assets will be required to measure those crypto assets at “fair value”. This will be applicable at each reporting period with changes in fair value recognized in net income.

These amendments are set to come into effect during the 2025-2026 fiscal year, although the option of early adoption is also available.

Fair value of an asset refers to the actual worth of an asset, which is derived fundamentally and is not determined by the factors of any market forces that account for market price.

According to the fair value model of Glassnode, Bitcoin price is technically at $36,000, which is a steep 14% decline from the market price of $41,917.

Bitcoin Fair Value

This will largely affect the overall holdings of the crypto companies; however, by the looks of it, a cemented policy is a positive development for digital assets in the long run. This point of view was also shared by Michael Saylor, the CEO of MicroStrategy, who is presently the largest public holder of BTC. He tweeted,

“This upgrade to accounting standards will facilitate the adoption of BTC as a treasury reserve asset by corporations worldwide.

Technical Analysis: Bitcoin price dip makes no impact on Grayscale’s growth

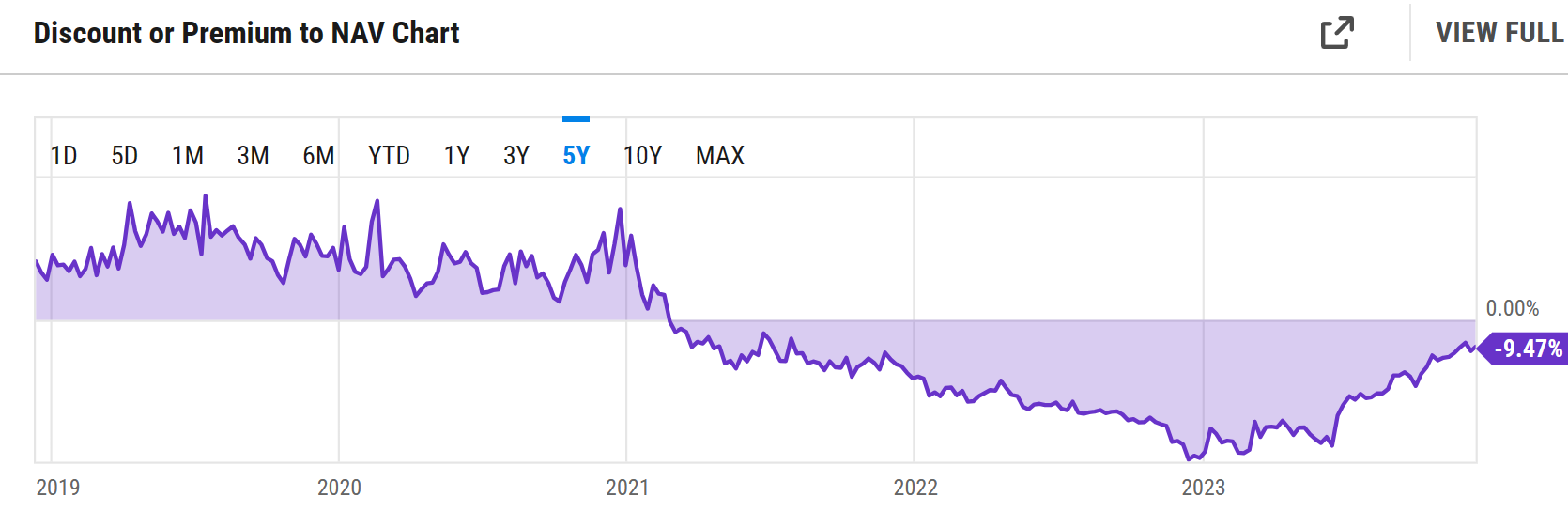

Bitcoin price has largely affected the value of Grayscale Bitcoin Trust (GBTC) in the past, but this impact is likely fading away. The potential of GBTC turning into a spot Bitcoin ETF by next month seems to have imbued considerable optimism in investors. This is evident by the fact that despite the cryptocurrency falling to $40,000 this week, GBTC’s premium kept improving.

While the premium to net asset value (NAV) is still negative at -9.47%, it is still a significant improvement from -44% six months ago. This is also a sign that Bitcoin price correcting has a much lesser impact on the ETP, and its value will likely be driven by broader market cues.

GBTC discount to NAV

With the hype surrounding the ETF, there is also a chance that GBTC might manage to completely recover from its present discount and trade at a premium as it did before February 2021.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum (ETH) experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Bitcoin Cash advocate Roger Ver arrested and charged with falsifying taxes

Bitcoin Cash (BCH) proponent Roger Ver, also an early Bitcoin investor, was allegedly picked up by Spanish authorities over the weekend on charges of tax fraud by the US DOJ.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong Kong ETFs.

Renzo's REZ dips after airdrop and Binance listing

Renzo users could claim their airdrop based on accumulated ezPoints. REZ dips about 35% after listing on Binance and several other exchanges. Renzo seems to have gotten over an earlier scare from ezETH depeg last week.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.