Bitcoin price may not hit the $51,000 target amidst smart money influence

- Bitcoin price volume profile has sneaky bearish elements.

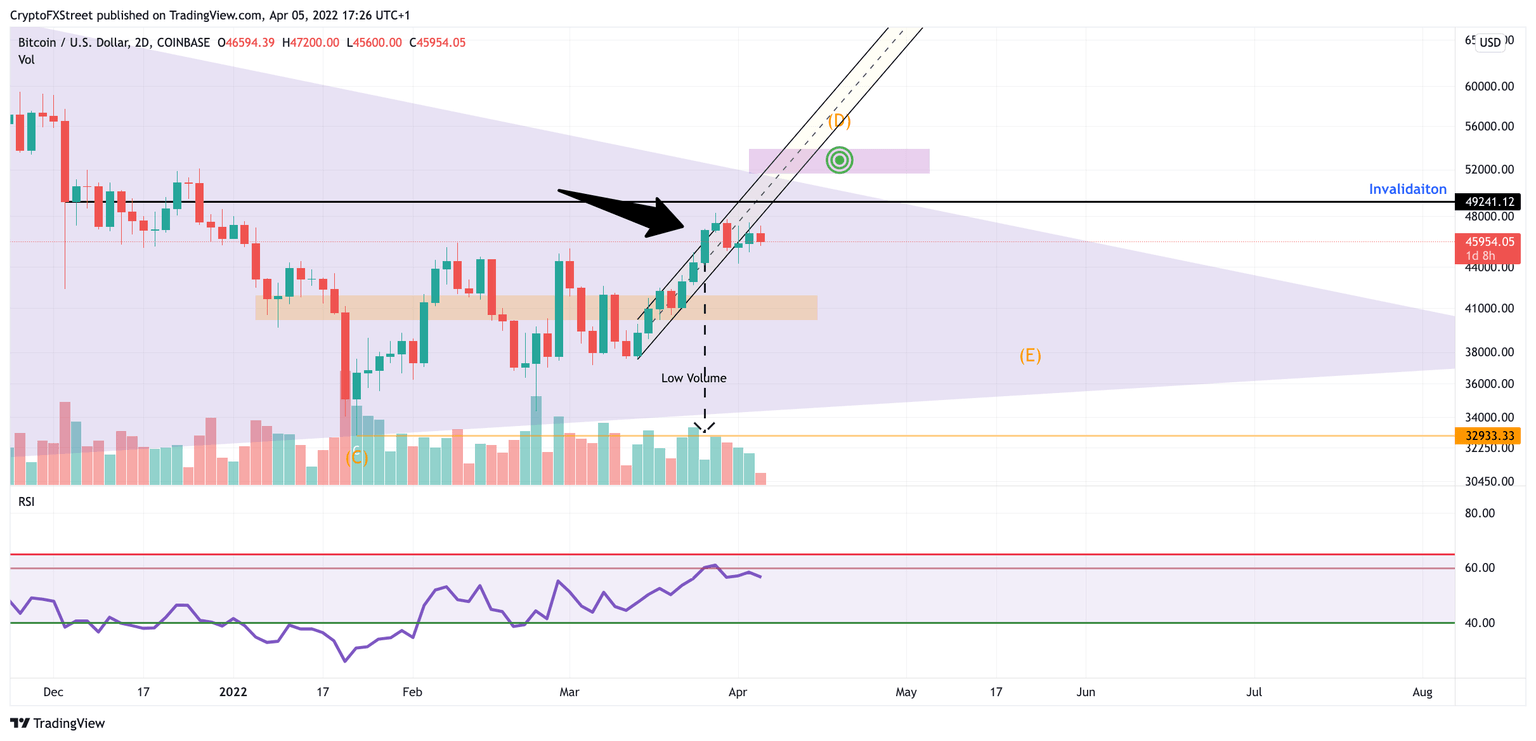

- BTC price has breached a parallel trend channel with proper RSI resistance.

- Invalidation of the bearish model will be a close above $49,241.

Bitcoin price has been coiling into a Wave 4 triangle pattern all year. There is a chance the D wave of the triangle is now complete.

Bitcoin price has smart money influences hidden in the volume

Bitcoin price has shown the first signs of concern for the 20% bull rally it accomplished in March. The overall macro thesis for BTC is a coiling Wave 4 triangle. Last month's Bitcoin price provided multiple confluences insinuating an extended price target in the 51,000 range for the prospective D wave of the coiling triangle. Now it seems there is a possibility the target may be getting front-run by smart money influences.

BTC price volume profile shows sneaky evidence of an "exchange of hands" for the current uptrend. The largest bullish engulfing candle with a high of $46,750 within the uptrend has a low volume compared to previous candles and the subsequent consolidation candlesticks. The Relative Strength Index also found resistance at the 60 levels, while Tuesday's price of $45,600 hovers below a breached daily trend channel.

When put all together, Bitcoin price could begin falling back towards the lows at $38,000 and even $34,000 to print the final E wave of the Wave 4 triangle.

BTC/USD 2-Day Chart

An invalidation for the bearish model can only occur if the Bitcoin price can establish a settling price above $49,241. If this were to occur, targets at $51,000 and $52,000 would be back on the table, resulting in a 15% rise from the current Bitcoin price.

Author

FXStreet Team

FXStreet