Bitcoin price hits $17,000 but might be poised for a pullback in the short-term

- Bitcoin price is bullish after a massive rally towards $17,000.

- The digital asset hasn’t experienced a significant pullback since September 3.

Bitcoin has just hit $17,000 for the first time since January 2018. Although the sentiment is positive, many investors are increasingly growing greedy, which can usually lead to a steep correction in the short-term.

Bitcoin investors are extremely greedy

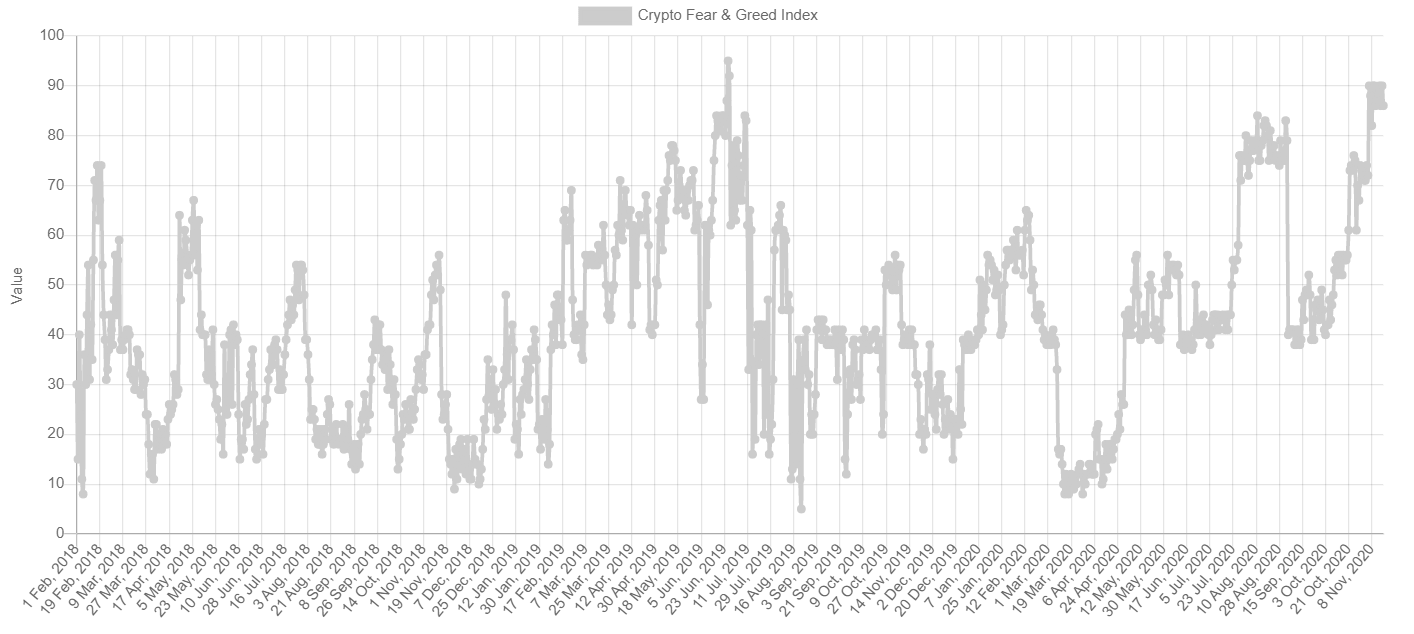

According to the Crypto Fear and Greed Index, it seems that Bitcoin investors have become extremely greedy since November 6. History has shown that when high levels of greed are maintained for a long time, Bitcoin price tends to suffer a steep correction.

Crypto Fear and Greed chart

The last time the situation mentioned above happened was on September 2, when Bitcoin price plummeted from a high of $11,954 to a low of $9,960 within 24 hours. Before the crash, this chart was showing a lot of greed since August 2.

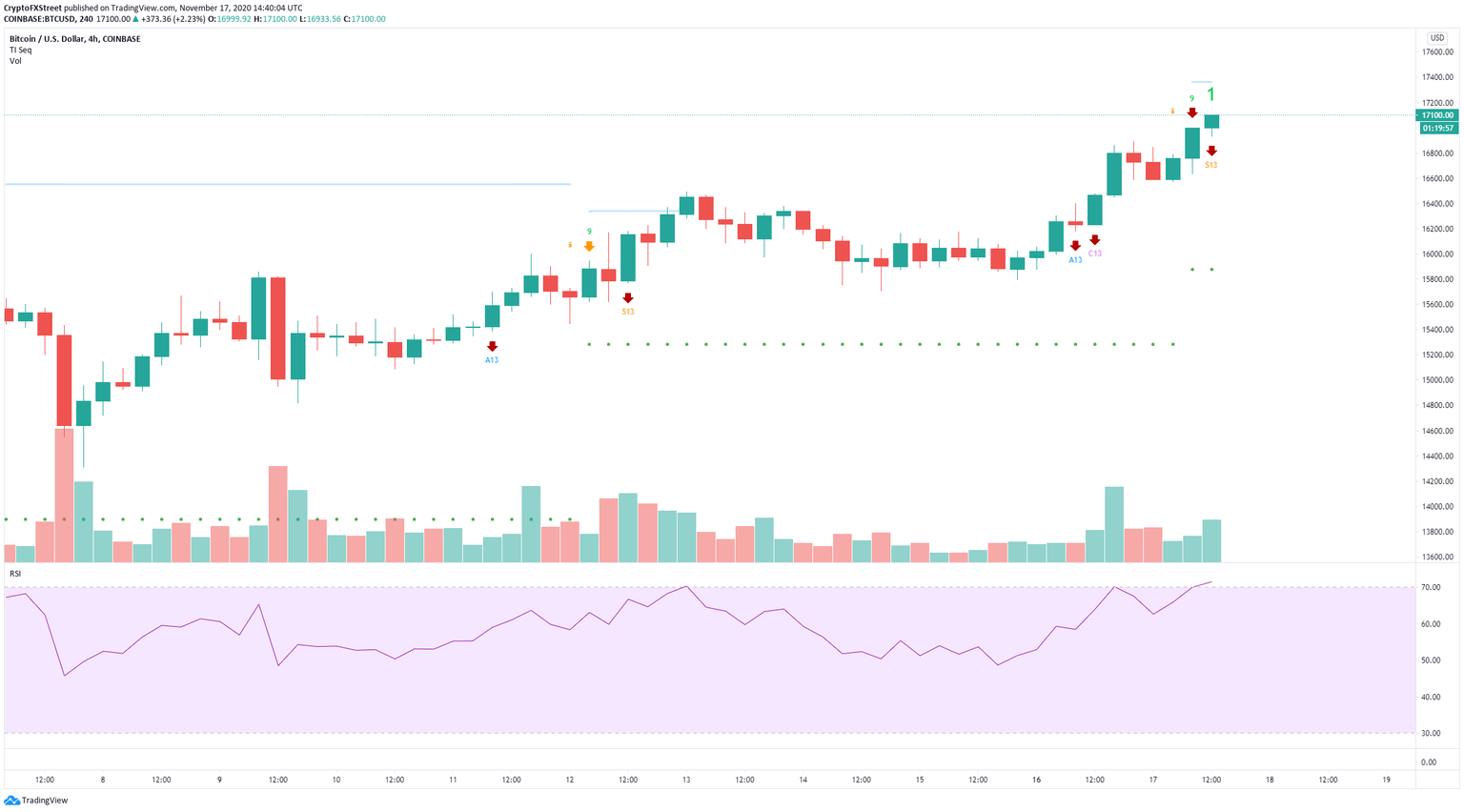

BTC/USD 4-hour chart

The current levels of greed are extremely high, hinting at a possible pullback in the short-term, however, this period could last for several weeks or even months. On the 4-hour chart, the TD Sequential indicator has just presented a sell signal in the form of a green nine candle in conjunction with an overextended Relative Strenght Index (RSI), which adds more selling pressure.

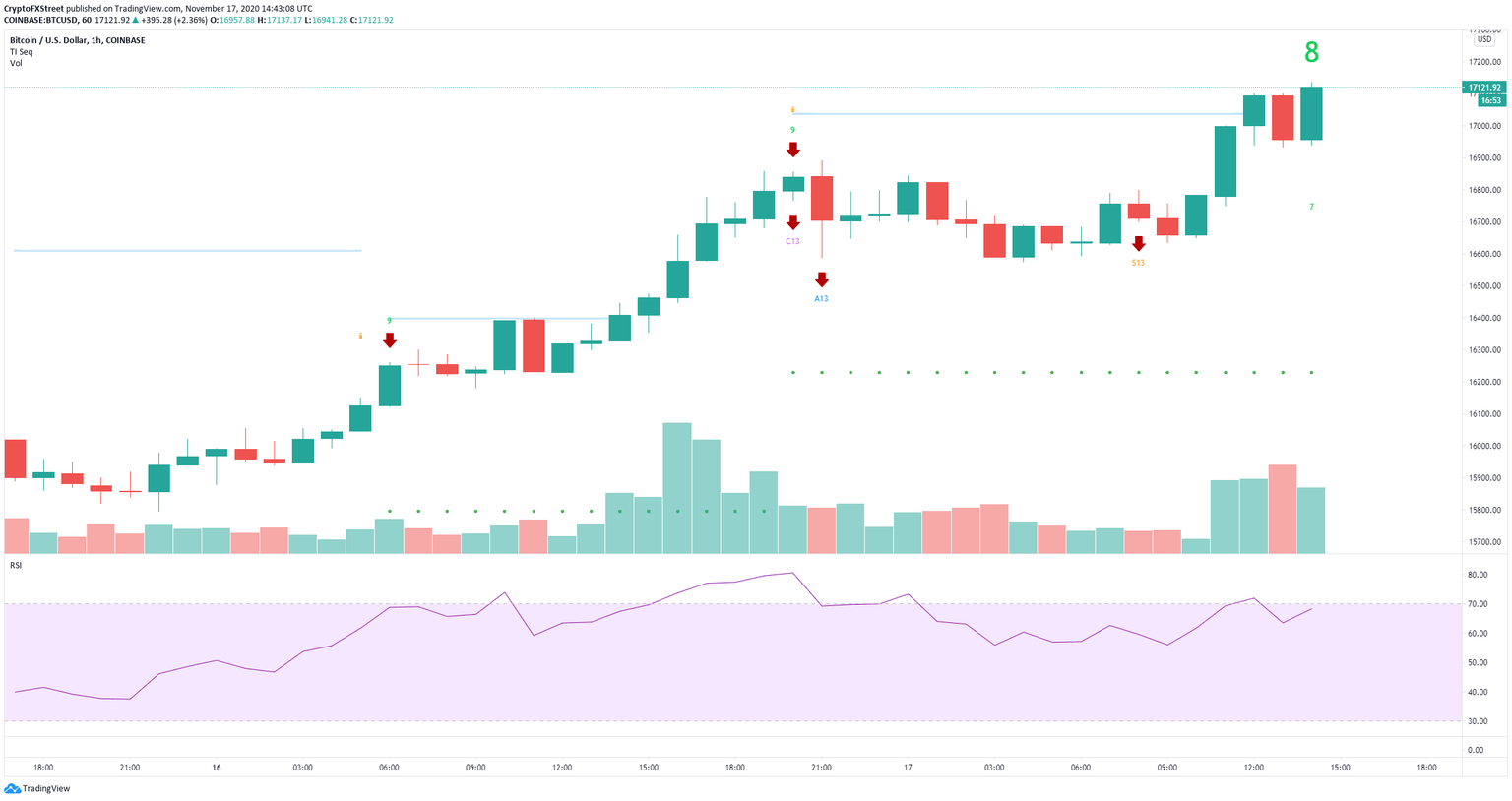

BTC/USD 1-hour chart

Additionally, it seems that on the 1-hour chart, the TD Sequential is also on the verge of presenting a sell signal. Validation of both signals could drive Bitcoin price towards $16,600 in the short-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.