Bitcoin Price Forecast: BTC holds near $100K ahead of Donald Trump's inauguration

- Bitcoin price edges slightly lower on Thursday after rallying 4% following the US Consumer Price Index (CPI) release on Wednesday.

- Traders should keep watch on US Retail Sales data on Thursday, as it could increase volatility to Bitcoin price.

- K33 report suggests that selling BTC at the inauguration is gradually becoming less compelling.

Bitcoin's (BTC) price edges slightly lower and trades around $99,200 on Thursday after rallying 4% following the previous day’s US Consumer Price Index (CPI) release. Despite this recent rise in BTC prices, traders should keep watch on US Retail Sales data for December on Thursday, as it could provide more volatility to Bitcoin price. A K33 report suggests that selling BTC at the US President-elect Donald Trump’s inauguration is gradually becoming less compelling daily.

Bitcoin reclaims $100K mark following US CPI data release

Bitcoin’s price rose 4% and reclaimed its $100K mark following Wednesday's release of the US Consumer Price Index (CPI) for December. On a yearly basis, the data showed that headline CPI came in line with expectations, while core inflation accelerated at a slower-than-expected pace and slower than the prior reading for November. This was perceived as disinflationary and favored risky assets like Bitcoin.

"Although it was not a stellar surprise as on Tuesday with the Producer Price Index (PPI), where all data points came in lower or at the lowest estimate, the CPI reading is enough to bring back that initial Federal Reserve rate cut for 2025 from September to July," reports Filip Lagaart analyst at FXStreet.

Traders should keep watch on US Retail Sales data for December on Thursday, as it could increase volatility in the Bitcoin price. Last night's release of the Federal Reserve’s (Fed) Beige book noted that most of the Fed's 12 districts reported strong holiday sales, exceeding expectations. Some also think that the initial weekly jobless claims figures are very low. So far, the US Dollar (USD) is positive, ING's FX analyst Chris Turner notes.

Moreover, Senior Analyst at FXStreet Yohay Elam reports about the US Retail Sales, "Generally, a strong report would support the US Dollar and weigh on Gold and Stocks – good news for the economy is bad news for equities.” Like Stocks, risky assets like Bitcoin may suffer with a strong report.

Bitcoin sell-off chances decrease ahead of Donald Trump's inauguration

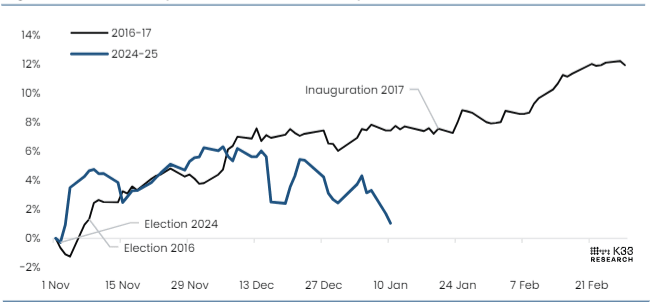

A K33 report states, "Selling BTC at the inauguration is gradually becoming less compelling every day as we inch closer to the inauguration." The market jumped the gun with Trump enthusiasm in November until mid-December, but conservatism and caution have since prevailed.

The report further explains that the S&P500's early post-election reaction in 2024 closely mirrored that of 2016 However, following the December 18 Fed meeting, the index's pattern diverged from 2016. In 2016, the S&P 500 stabilized at mid-December highs, saw low volatility until the inauguration, and then faced a yearlong uptrend as Trump entered the Oval Office.

"During Trump's first term as president, he frequently referenced stock market indices to emphasize economic growth associated with policies, tax cuts, deregulation, and trade deals, a factor we expect to re-emerge throughout his second term," says the report.

The report concluded that earlier this week, “the S&P 500 closed its post-election gap, and BTC reached 2-month lows. While our monthly outlook favored selling the inauguration, we'd like to rephrase this strategy as selling BTC at the inauguration is considerably less appealing unless the coming six days offer a substantial resurfacing of momentum. De-risking would be path-dependent on next week's price action and short-lived as we hold bullish long-term expectations for Trump's impact on BTC.”

S&P 500, Trump election performance comparisons (2016 vs 2024) chart. Source: K33 Research

Jag Kooner, Head of Derivatives at Bitfinex, told FXStreet, "Markets typically see heightened volatility around major political events and Trump's upcoming inauguration could spark short-term price swings for Bitcoin, with volatility possibly extending into the following weeks, depending on policy announcements and market reactions.”

Kooner continued, “However, it must be noted that historically, markets have trended up on a 1-3 month horizon after Presidential inaugurations."

Bitcoin Price Forecast: BTC bulls aim for all-time highs

Bitcoin price reclaimed its $100K mark and closed at $100,497 on Wednesday. However, it edges slightly down on Thursday, trading around $99,200 at the time of writing.

If BTC continues its upward momentum and finds support around the $100,000 level, it could extend the rally to retest the December 17, 2024, all-time high of $108,353.

The Relative Strength Index on the daily chart reads 55, above its neutral level of 50, indicating a rise in bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator flipped a bullish crossover on Wednesday, giving a buy signal and suggesting an uptrend.

BTC/USDT daily chart

However, if BTC continues its correction and closes below $90,000, it will extend an additional decline to retest its next support level at $85,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.