US Dollar off the lows with dust settling over CPI releases

- The US Dollar faces a near 1% loss for this week thus far.

- The December CPI release came in a touch softer as projected, triggering a surge in Risk On sentiment.

- The US Dollar Index (DXY) snaped below 109.00 and is looking for support.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, is off the lows for now on Wednesday in the US Consumer Price Index (CPI) release aftermath. Numbers came in either in line or a touch softer than expected, which is perceived as disinflationary. Although it was not a stellar surprise as on Tuesday with the Producer Price Index (PPI), where all data points came in lower or at the lowest estimate, the CPI reading is enough to bring back that initial Federal Reserve rate cut for 2025 from September to July.

For the remainder of this Wednesday all eyes will shift to the Federal Reserve speakers. They might come out with some guidance or even cautious guidance that the number of rate cuts might not match market expectations.

Daily digest market movers: Did traders just got excited over nothing?

- The US Consumer Price Index data for December has been released.

- The monthly core CPI came in as expected at 0.2% compared to 0.3% the previous month. The monthly headline CPI increased steadily by 0.4% against 0.3% expected.

- The yearly core CPI reading rose steadily by 3.2%, while the headline reading ticked up 2.9% compared to 2.7% in November.

- At 14:00 GMT, Federal Reserve Bank of Chicago President Austan Goolsbee will discuss the economy at the Wisconsin Bankers Association 2025 Midwest Economic Forecast Forum.

- At 15:00 GMT, Minneapolis Fed President Neel Kashkari will give welcoming remarks and participate in a fireside chat with Jay Debertin, President and CEO of CHS, Inc., as part of the Minneapolis Fed’s 2025 Regional Economic Conditions Conference.

- At 16:00 GMT, Federal Reserve Bank of New York President John Williams delivers keynote remarks at the "CBIA Economic Summit and Outlook 2025" event organized by the Connecticut Business and Industry Association (CBIA) in Connecticut.

- Equities are rallying over 1% in both Europe and the US on the back of the US CPI release.

- The CME FedWatch Tool projects a 97.3% chance that interest rates will be kept unchanged at current levels in the January meeting. Expectations are for the Federal Reserve (Fed) to remain data-dependent with uncertainties that could influence the inflation path once President-elect Donald Trump takes office on January 20.

- US yields are nosediving in the CPI release aftermath. The 10-year benchmark trades around 4.659% at the time of writing on Wednesday, fading from its fresh 14-month high of 4.802% seen on Monday.

US Dollar Index Technical Analysis: Carefull now for the kneejerk

The US Dollar Index (DXY) has become volatile, and it has the Federal Reserve to thank. With little to no real guidance from Fed officials, markets need to treat each data point as an assessment of where they think the Fed will initiate its policy rate move this year. Jumping from one data point to the next, it is quite normal for the DXY to also jump around the chart and see a volatility peak.

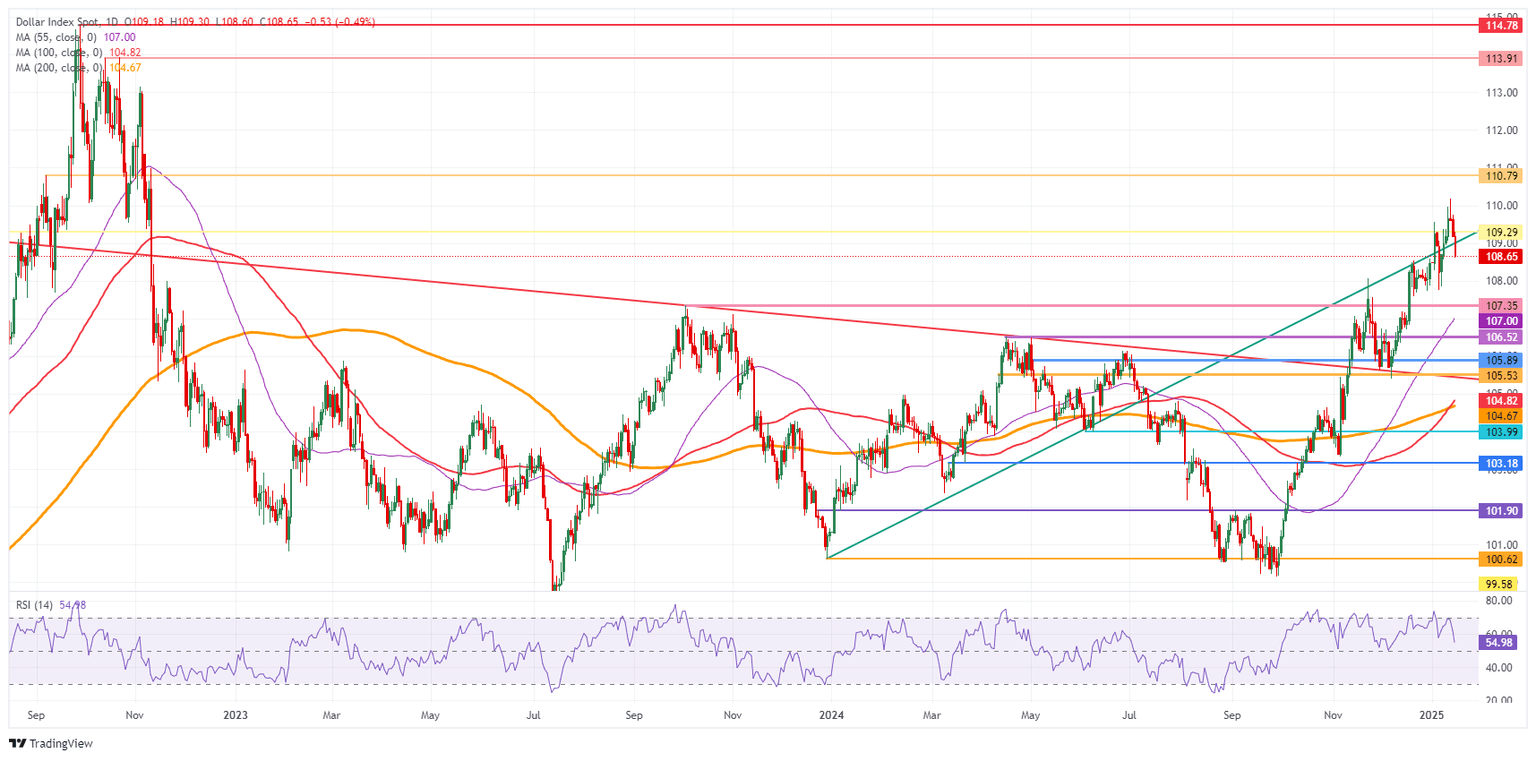

On the upside, the 110.00 psychological level remains the key resistance to beat. Further up, the next big upside level to hit before advancing any further remains at 110.79. Once beyond there, it is quite a stretch to 113.91, the double top from October 2022.

On the downside, the DXY is testing the ascending trend line from December 2023, which currently comes in around 108.95 as nearby support. In case of more downside, the next support is 107.35. Further down, the next level that might halt any selling pressure is 106.52, with interim support at the 55-day Simple Moving Average (SMA) at 107.01.

US Dollar Index: Daily Chart

Banking crisis FAQs

The Banking Crisis of March 2023 occurred when three US-based banks with heavy exposure to the tech-sector and crypto suffered a spike in withdrawals that revealed severe weaknesses in their balance sheets, resulting in their insolvency. The most high profile of the banks was California-based Silicon Valley Bank (SVB) which experienced a surge in withdrawal requests due to a combination of customers fearing fallout from the FTX debacle, and substantially higher returns being offered elsewhere.

In order to fulfill the redemptions, Silicon Valley Bank had to sell its holdings of predominantly US Treasury bonds. Due to the rise in interest rates caused by the Federal Reserve’s rapid tightening measures, however, Treasury bonds had substantially fallen in value. The news that SVB had taken a $1.8B loss from the sale of its bonds triggered a panic and precipitated a full scale run on the bank that ended with the Federal Deposit Insurance Corporation (FDIC) having to take it over.The crisis spread to San-Francisco-based First Republic which ended up being rescued by a coordinated effort from a group of large US banks. On March 19, Credit Suisse in Switzerland fell foul after several years of poor performance and had to be taken over by UBS.

The Banking Crisis was negative for the US Dollar (USD) because it changed expectations about the future course of interest rates. Prior to the crisis investors had expected the Federal Reserve (Fed) to continue raising interest rates to combat persistently high inflation, however, once it became clear how much stress this was placing on the banking sector by devaluing bank holdings of US Treasury bonds, the expectation was the Fed would pause or even reverse its policy trajectory. Since higher interest rates are positive for the US Dollar, it fell as it discounted the possibility of a policy pivot.

The Banking Crisis was a bullish event for Gold. Firstly it benefited from demand due to its status as a safe-haven asset. Secondly, it led to investors expecting the Federal Reserve (Fed) to pause its aggressive rate-hiking policy, out of fear of the impact on the financial stability of the banking system – lower interest rate expectations reduced the opportunity cost of holding Gold. Thirdly, Gold, which is priced in US Dollars (XAU/USD), rose in value because the US Dollar weakened.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.