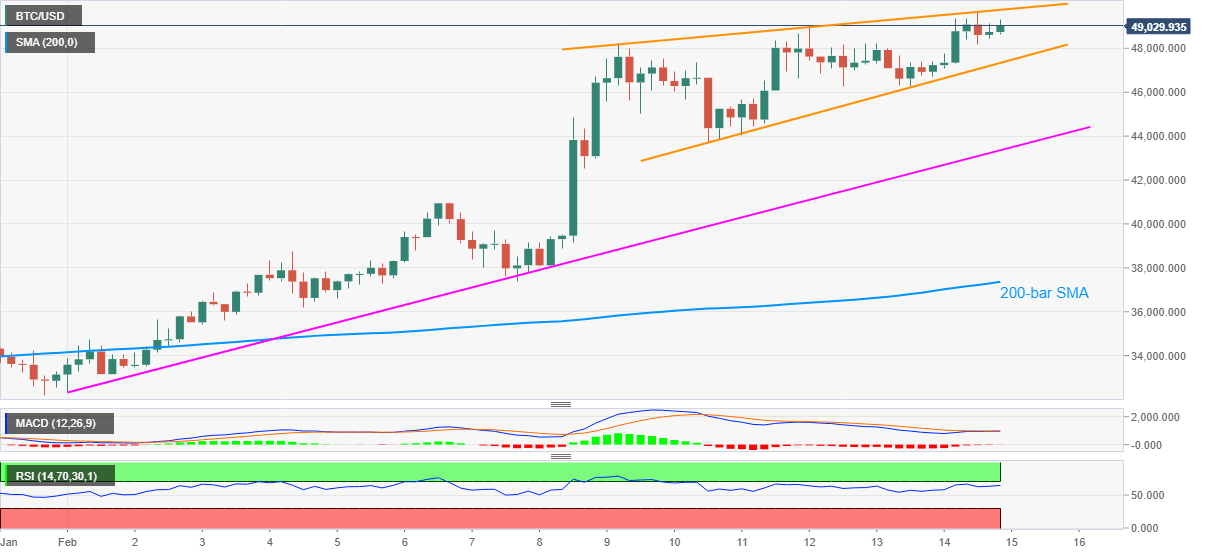

Bitcoin Price Analysis: Rising wedge at record top probes BTC bulls around 49,000

- BTC/USD struggles to refresh all-time high marked the previous day.

- Bearish chart formation at the top becomes more powerful if confirmed.

- MACD teases bulls but RSI nears overbought RSI, suggesting slow grind to the north.

- Monthly support line, 200-bar SMA adds to the downside filters.

BTC/USD fades upside momentum while easing to $49,000 during the early Monday’s trading. The cryptocurrency pair refreshed the record time the previous day while inching closer to the $50,000 threshold. However, the upper line of the bearish chart pattern, on the four-hour play, challenged the bitcoin bulls near $49,700.

While the rising wedge draws extra strength near the peak, MACD is flirting with the bulls. Also challenging the bearish chart formation could be the absence of the overbought RSI conditions, despite being near to the same.

As a result, BTC/USD traders may witness a slow grind towards the $50,000 threshold, with $49,750 acting as an immediate hurdle. However, any further upside will defy the bearish play and back the bulls cheering the market chatters over the $100,000 psychological magnet.

On the contrary, pullback moves may bounce off the stated pattern’s support line, currently near $47,300, failing to which will confirm the downside moves to the $40,000 threshold.

However, an upward sloping trend line from February 01, currently around $43,350, followed by the 200-bar SMA level of $37,365, can act as the extra bumps during the south-run.

Overall, BTC/USD remains the bull’s favorite despite the latest consolidation. Though, room for pullback can’t be ruled out, considering the bearish chart pattern.

BTC/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.