- ETH/USD is currently fighting to exchange hands past Andrews Pitchfork.

- The market is generally bullish at the moment with most of the assets correcting higher.

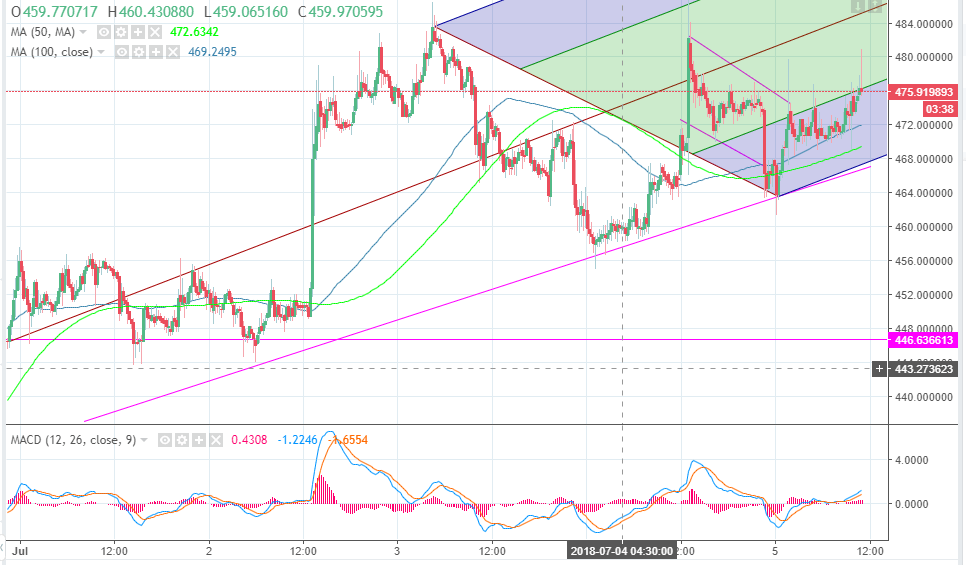

Ethereum price smashed its way out of the short-term bullish flag pattern, but first, it descended to test the support at $464 at the opening of the trading session on Thursday. The crypto then embarked on an upward roll breaching past the resistance at $472. ETH/USD is currently fighting to exchange hands past Andrews Pitchfork with the higher pitch at $483.5 on July 3 and the lower pitch at $463 traded on July 5 as seen on the chart.

The price is looking forward to $480 (critical resistance). If Ethereum can find a support above Andrews Pitchfork, ETH/USD could retrace the steps heading to $500. In the event the sellers enter and call for lower corrections, there are several support zones, for instance, at $472, $464 and $460. The lower demand area at $452 - $444 will also stop downside movements.

Cryptocurrency market overview

The market is generally bullish at the moment with most of the assets correcting higher on the day. Bitcoin, for example, is consolidating above $6,600 while it up 0.68%. NEO is among the biggest gainers in the market spiking over 4%. Other assets are, however, correcting lower like IOTA price is down 1.88% besides, Ripple and Bitcoin Cash are making subtle declines of below 1% on the day.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

VanEck sees Bitcoin reaching $61 trillion market cap, Marathon buys $100 million BTC

Bitcoin declined by 1% on Thursday following asset manager VanEck's forecast that the top digital asset will reach a $61 trillion market capitalization by 2050.

Ethereum Classic price sets for a rally following retest of key support

ETC edges higher by 2.3% and trades around $22.60 at the time of writing on Friday after testing a key support area the day before. On-chain data showing increased account growth suggests a bullish move ahead. Ethereum Classic price faced rejection by the daily resistance level of $25.13 earlier this week.

Celebrity meme coins lose their shine

Celebrity meme coins report by Jupiter Slorg on Thursday shows that these tokens have been in deep waters since early July after experiencing heavy growth in June. In a recent analysis, Jupiter Slorg revealed that celebrity meme coins are down by an average of 94% from their all-time highs.

Ripple gains 5%, Mark Cuban says Kamala Harris’ nomination could affect SEC lawsuit

Ripple (XRP) made a comeback above key psychological resistance early on Wednesday. Crypto traders are optimistic after the Ethereum Exchange Traded Fund (ETF) launch. Entrepreneur and investor Mark Cuban recently shared his comments on how Kamala Harris’ nomination to the Presidential elections could influence crypto regulation.

Bitcoin: Will BTC manage to recover from recent market turmoil?

Bitcoin recovers to $67,000 on Friday after finding support around $63,500 a day before. Still, BTC losses over 1.50% on the week as Mt. Gox persists in transferring Bitcoin to exchanges.