- Bitcoin buyers face significant resistance at $6,600 but the support at $6,300 has been instrumental.

- Investors can now trade Bitcoin ETNs via OTC brokerage accounts provided by NASDAQ Stockholm.

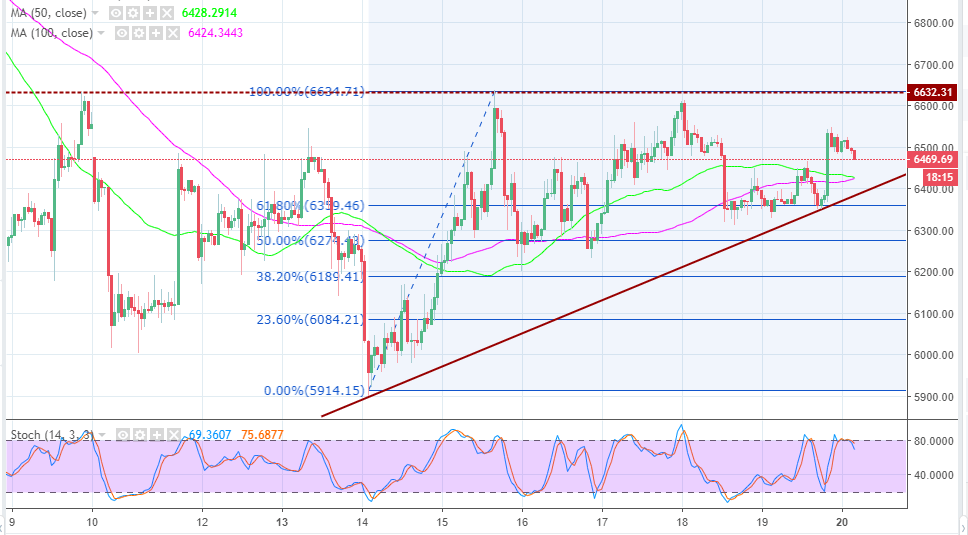

Bitcoin price keeps coming to halt at the critical resistance level at 6,600, followed by lower corrections towards the key support at $6,300. The price is forming a classic rising wedge pattern on the BTC/USD chart. Trading over the weekend saw Bitcoin retrace steps past the pivotal $6,500 and broke the above resistance but the crypto lost momentum around $6,610. The lower corrections that followed found support at the 61.8% Fib retracement taken from the highs of $6,634.71 and lows of $5,914.15.

The buyers intensified their attacks and BTC/USD pulled backed in a bullish engulfing candle above the short-term resistance at $6,400 and exchanged hands above the pivotal at $6,500. However, it created highs around $6,545 before reacting lower again. Bitcoin is currently trading at $6,483 while the trend is generally bearish. The 100 SMA is advancing to cross above the short-term 50 SMA and the stochastic on the one hour chart is heading south to confirm the bears' influence.

The path of least resistance is to the south at the time of press, but the upside is limited at $6,500. Further up, Bitcoin buyers must brace themselves for the difficulty at the critical $6,600. It is vital that they find a support above the critical level before forging ahead to the medium-term resistance at $6,800. On the downside, BTC/USD will short-term support at $6,400, but the stronger support is at the above mentioned 61.8% Fibo and $6,300.

In other news, Bitcoin ETFs are not yet a reality, but at the moment there is Bitcoin Tracker One, although it is available for trading via the broker’s OTC market. This is a silver lining for investors who were looking forward to Bitcoin ETF. They can invest their USDs in Bitcoin using exchange-traded notes or otherwise known as ETNs (Bitcoin Tracker One).

NASDAQ Stockholm is offering these investment opportunities on US brokerage accounts via an Over the Counter market in form of foreign debt instruments. The firm holds the BTC on behalf of the customers hence an element of custodial risk. Moreover, Bitcoin Investment Trust is also available on an OTC platform that is controlled by Grayscale Investments.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Fed-led rally could have legs towards $65,000

Bitcoin has risen 7% so far this week, supported by the US Fed interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Ethereum, BNB and POL holders on the watch as BingX faces loss of $26 million in hack

Crypto exchange BingX said on Friday that it suffered a hack, an attack that led to “minimal” losses that researchers at PeckShield estimate at $26.68 million. The attacker swapped the stolen altcoins for Ethereum, Binance Coin and Polygon tokens, according to on-chain data.

Pepe price forecast: Eyes for 30% rally

Pepe extends the upward movement on Friday after breaking above the descending trendline and resistance barrier on Thursday. PEPE’s dormant wallets are in motion, and the long-to-short ratio is above one, further supporting this bullish move and hinting at a rally on the horizon.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin (BTC) has risen 7% so far this week, supported by the US Federal Reserve (Fed) interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.