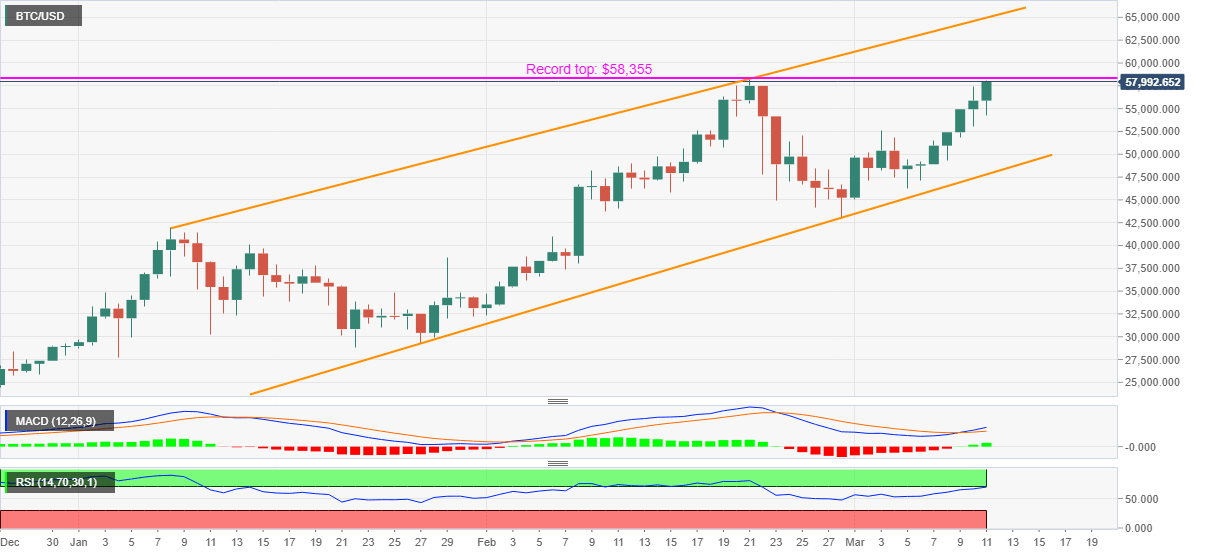

Bitcoin Price Analysis: BTC looks set to refresh record top above $58,000

- BTC/USD takes the bids near the all-time high marked during previous month.

- Bullish MACD contradicts overbought RSI inside ascending trend channel.

Bitcoin bulls are hammering the record top marked in February while taking the bids near $58,000 during early Friday. The crypto major gains support from upbeat MACD inside a bullish chart pattern to cross the previous all-time high of $58,355.

However, overbought RSI conditions seem to challenge the BTC/USD bulls afterward, which if ignored could escalate the rally towards the upper line of an ascending trend channel from early January, currently around $65,000.

It should be noted that the stated run-up may catch a breather near the $60,000 threshold.

On the contrary, the early month top near $52,650 can test short-term pullback of the BTC/USD ahead of the channel’s support, at $47,790 now.

In a case where the cryptocurrency pair defy the bullish chart pattern with a daily closing below $47,790, its drop below the latest swing low of $43,065 can’t be ruled out.

To sum up, Bitcoin bulls are in the driver’s seat during the journey to a fresh record top.

BTC/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.