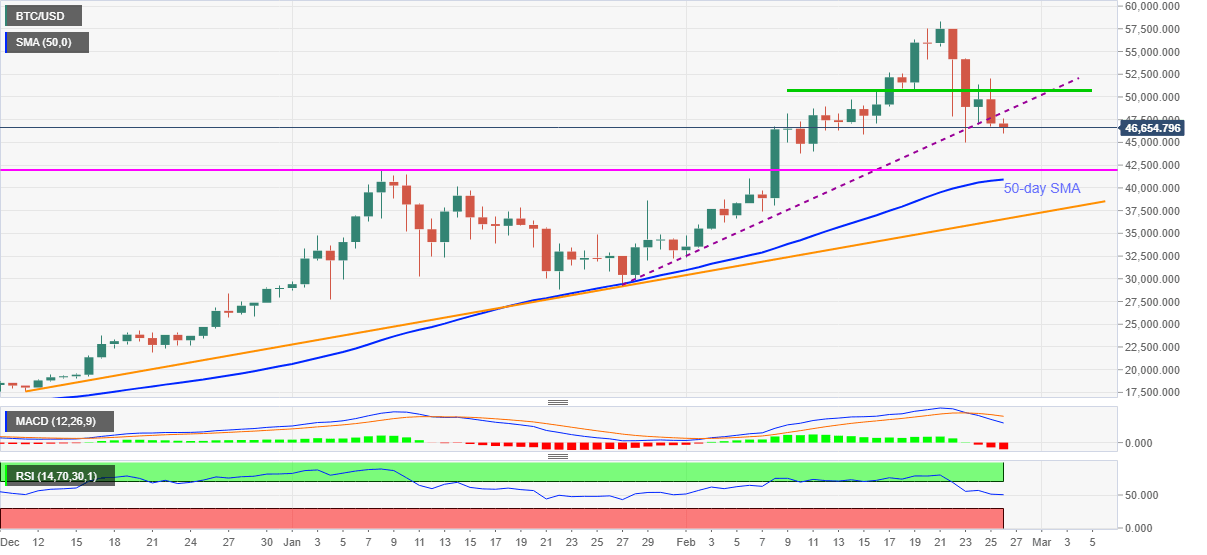

Bitcoin Price Analysis: BTC bears eye $42,000 on key support break

- BTC/USD stays depressed near intraday low, extends downside break of the key support line.

- Bearish MACD, absence of oversold RSI directs sellers to January top.

- One-week-old horizontal line adds to the upside barrier.

Bitcoin sellers are on the move as they attack $46,500, down 1.30% intraday, during early Friday. In doing so, the crypto major jostles with the recently flashed intraday low of $46,013 while keeping the previous day’s break of an ascending trend line from January 27.

Considering the absence of oversold RSI and bearish MACD, coupled with the trend line breakdown, BTC/USD is ready for further downside towards the January month high around $41,990.

However, any further weakness by the quote will be tamed by the 50-day SMA level of $40,923 and the $40,000 threshold.

In a case where the Bitcoind sellers dominate past-$40,000, an upward sloping trend line from December 11, 2020, at $36,560 now, will be crucial to watch.

Alternatively, corrective pullback beyond the previous support line near $48,250 needs to cross the horizontal line comprising multiple levels since February 16, around $50,900.

Should the BTC/USD buyers dominate past-$50,900, they will be able to challenge the recently flashed record top of $58,355 with $55,500 being the likely intermediate halt during the rise.

BTC/USD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.