Bitcoin price: All eyes on FOMC, negative inflation could slash hopes for crypto

- Monetary conditions have tightened and cryptocurrencies have recovered from the drawdown of negative inflation surprise from last week.

- Analysts at Arcane Research predict massive volatility in Bitcoin price due to conflicting rate hike expectations.

- Analysts retain a bearish outlook on Bitcoin, predict decline in BTC if the asset fails to hold the $18,923 level.

Crypto traders are awaiting September 21 FOMC and there is a spike in volatility in Bitcoin and altcoin prices. Bitcoin price suffered a 15% decline over the last seven days as crypto traders de-risked and braced for monetary policy tightening.

Also read: XRP price: What to expect from CFTC Commissioners meeting with Brad Garlinghouse

Bitcoin price decline to continue alongside interest rate hikes

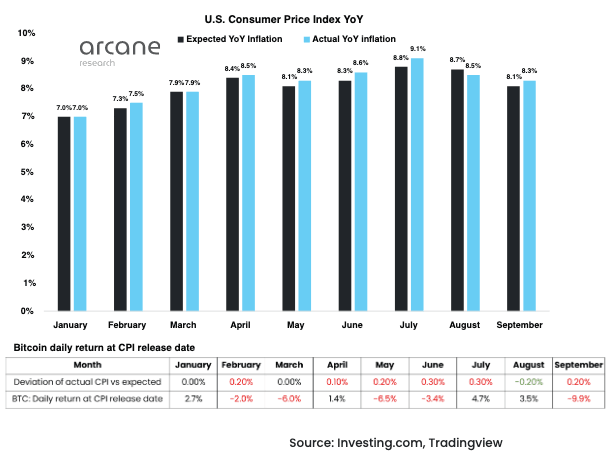

Bitcoin price plummeted alongside a nosedive in equities last week. The August Consumer Price Index (CPI) exceeded expectations by 0.2%, as year-on-year inflation hit 8.3%. Bitcoin price witnessed a massive drawdown in response to the market’s risk-averse reaction to CPI news.

US Consumer Price Index YoY

The Bitcoin price decline last week was the worst when compared to previous CPI-related drops in the asset in 2022. The brutal reaction was a result of expectation mismatch and uncertainty among investors, ahead of this week’s FOMC. Analysts at Arcane Research believe the crypto market has priced in a lofty interest rate hike.

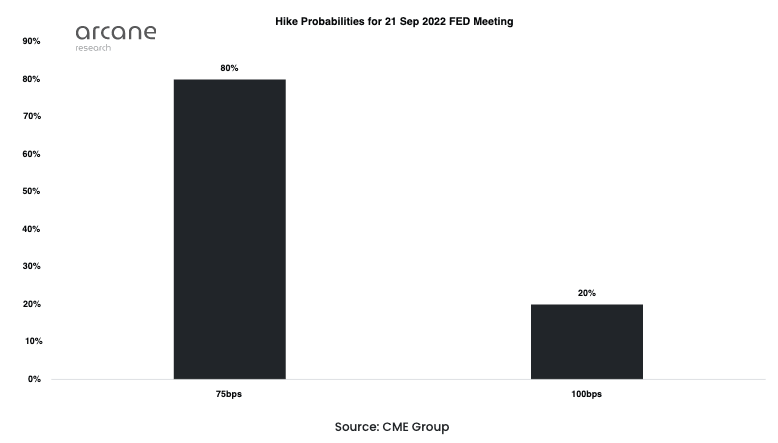

Hike probabilities for 21 Sep 2022 FED meeting

Currently, the expectation is 75bps and there is an 80% likelihood of the same. However, investors are prepared for a possible 100bps hike and this week’s decision is key to Bitcoin’s price trend. All FOMC events have resulted in volatility in Bitcoin price and analysts caution investors to prepare for a new burst in BTC volatility on September 21.

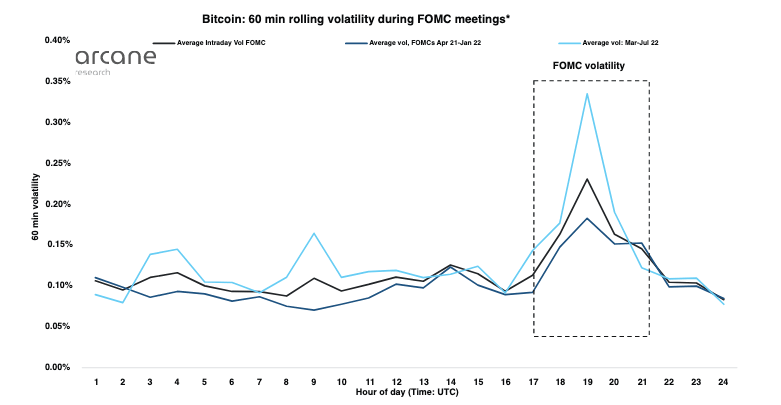

Bitcoin volatility during FOMC meetings

Bitcoin price tends to move in a highly correlated manner with Nasdaq and S&P 500 during key macro events like FOMC meetings.

Trading strategy for Bitcoin during FOMC statement release, press conference

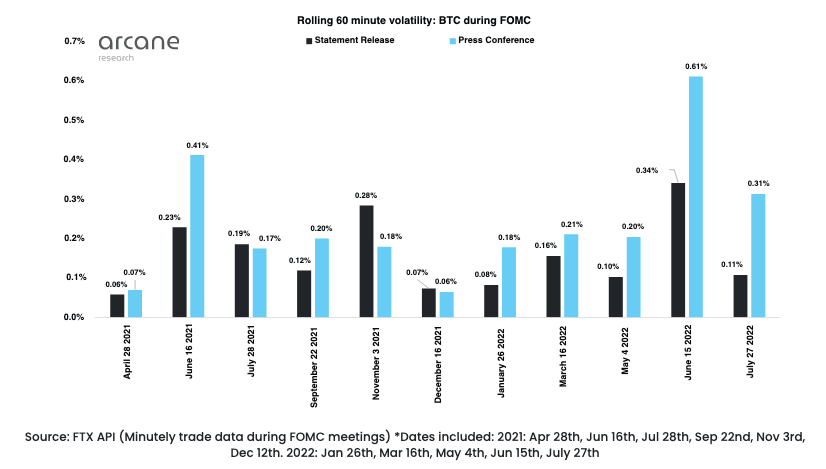

To aid traders in setting up trades during the FOMC meeting, researchers presented a rolling 60-minute volatility chart and concluded the effects of FOMC statement release and press conference on Bitcoin volatility.

Rolling 60 minute volatility: BTC during FOMC

Active day traders are the ones most affected by FOMC-induced volatility in Bitcoin price. Therefore, conflicting rate hike expectations for September 21 guarantee exceptionally high volatility. A 100 bps rate hike is likely to have a negative short-term impact on Bitcoin price and a softer hike of 75 bps would reflect positively.

Over longer time frames intraday volatility is irrelevant however, the Federal Reserve’s medium-term view and hike cycle play a key role in determining the direction of Bitcoin’s trend reversal.

BigCheds, a crypto analyst and trader evaluated the Bitcoin price trend and noted that BTC needs to hold above $18,923. A decline below this price level implies a bearish trend reversal in Bitcoin price.

BTC-USD price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.