Bitcoin Ordinals dropping popularity sees BTC hashrate and price decline

- Bitcoin Ordinals trading volume has declined for three consecutive days after hitting a peak of $18.13 million on May 8.

- The number of transactions has reduced to a third between May 8 and May 11.

- Bitcoin network’s hashrate and price have declined alongside the drop in on-chain activity of Ordinals.

Bitcoin Ordinals that enable the addition of text, images and code on the smallest unit of a BTC, a satoshi, have noted a decline in its popularity. The trade volume of Ordinals hit a peak on May 8 before its downward spiral and the number of transactions dropped from 17,000 to 6,000 in the three-day period between May 8 and 11.

Also read: Bitcoin falls below $27,600, erasing CPI-related gains

Bitcoin Ordinals on-chain activity declines

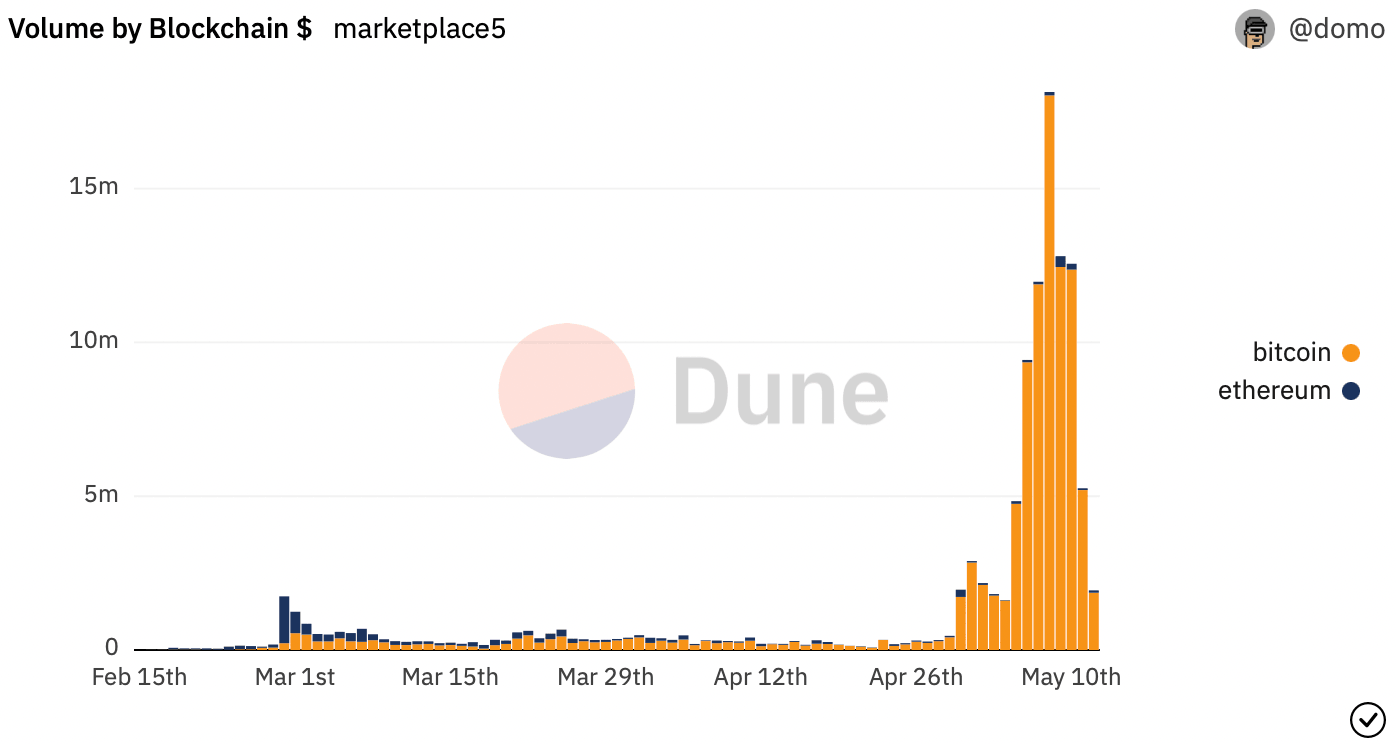

Based on data from the Dune panel, the trade volume of Bitcoin Ordinals is in a downward trend. After hitting a record high of $18.13 million on May 8, the trade volume declined for three days in a row to $4.86 million.

Trade volume by blockchain on Dune Analytics

The number of transactions declined to a third, from 17,000 on May 8 to 6,000 on May 11. The chart below shows a steep decline from May 8 to May 10.

Transactions by blockchain on Dune Analytics

Interestingly, the drop in Bitcoin Ordinals on-chain activity has negatively impacted the hashrate and price of BTC.

Bitcoin hashrate and BTC price drop

Bitcoin hashrate is 360.34M TH/s, down from 400M TH/s on May 10. Hashrate is the measure of the computational power of the network and determines the security and mining difficulty.

As Bitcoin transaction fees decline, there is a drop in miners in the BTC network and this negatively influences the hashrate. Alongside a decrease in the network’s hashrate, there has been a drop in Bitcoin price.

Bitcoin hash rate Year-To-Date (YTD)

Bitcoin price nosedived 4% since Thursday, wiping out gains that followed the US Consumer Price Index (CPI) data release. At the time of writing, BTC is exchanging hands at $26,445, nearly 10% below its May 5 high.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.