Bitcoin (BTC) has become considerably more decentralized in the past year, one metric suggests — and the trend is growing.

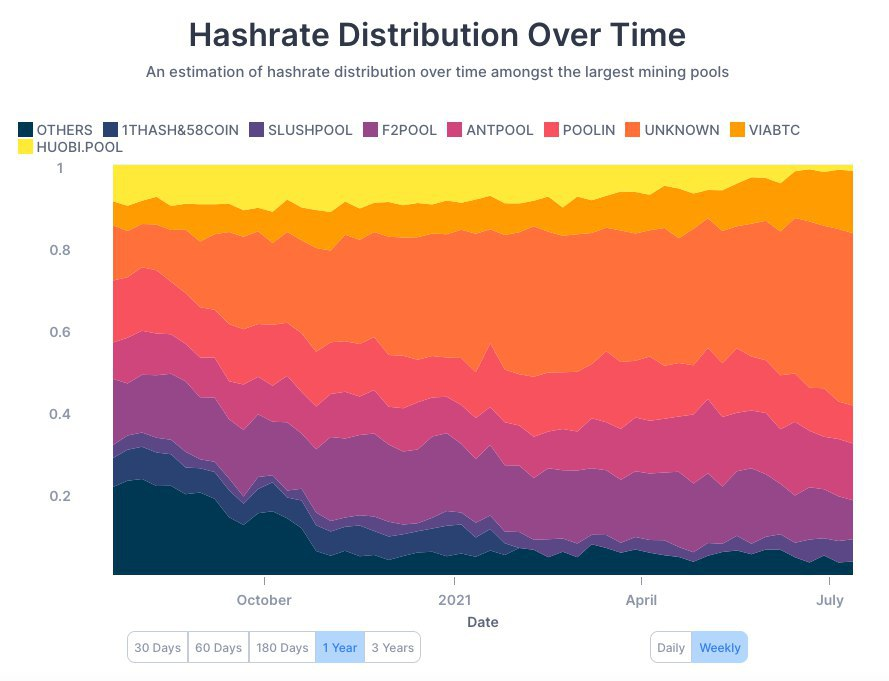

According to data from on-chain data resource Blockchain, hash rate distribution is increasingly favoring small, unknown miners.

Small guys increase slice of mining pie

Despite the past twelve months seeing a large price run-up, Bitcoin miners have not become more “corporate” — mining is actually seeing more anonymous, small-scale entities join in.

Looking at hash rate distribution, the trend is in evidence ever since the March 2020 crash, and this year has gathered pace.

The drawdown from $64,500 all-time highs precipitated the move towards smaller players, something which would be expected from a falling hash rate incentivizing them to mine.

Bitcoin mining hash rate distribution chart. Source: Blockchain

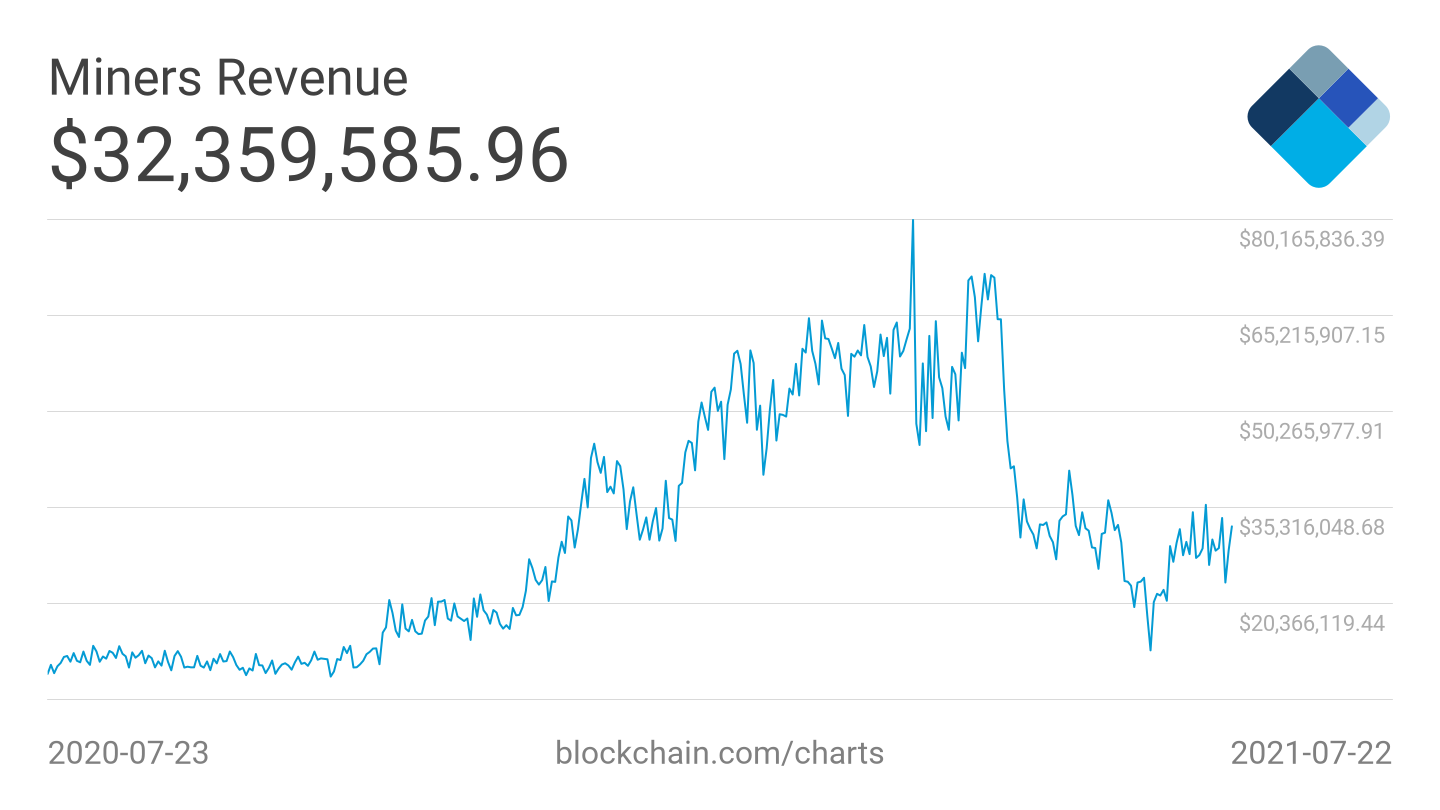

As Cointelegraph reported, meanwhile, the hash rate has stabilized over the past two weeks and begun reclaiming lost ground.

Analysis of revenues collected by the mining community as a whole underscores the recovery taking place, giving hope for the upward trend which characterized hash rate until May to resume.

At the time of writing, the hash rate totaled an estimated 95 exahashes per second (EH/s), up from the floor of 83 EH/s.

Bitcoin miner revenue chart. Source: Blockchain

Many miners "disproportionately sustainable"

Future changes among miners nonetheless appear to focus on larger players, which in the wake of the Chinese rout are gathering force in the United States and elsewhere.

A slew of announcements this month, including one mining firm planning to go public in the U.S., combines with news that the industry’s environmental credentials are changing rapidly.

“We’re also seeing a lot more disclosure from miners – 32% of the hash rate joined a council, Bitcoin Mining Council, and they produce quarterly disclosures now, and within that sample, the miners were 67% renewable or nuclear powered,” Nic Carter, co-founder of CoinShares, told CNBC Wednesday.

“So the miners that are disclosing — and a lot of these are western miners that are exposed to western capital markets — are disproportionately sustainable in their operations.”

Elon Musk, CEO of Tesla and SpaceX, hinted that Tesla may begin accepting Bitcoin for payments again in the coming months based on these environmental changes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Fed-led rally could have legs towards $65,000

Bitcoin has risen 7% so far this week, supported by the US Fed interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Ethereum, BNB and POL holders on the watch as BingX faces loss of $26 million in hack

Crypto exchange BingX said on Friday that it suffered a hack, an attack that led to “minimal” losses that researchers at PeckShield estimate at $26.68 million. The attacker swapped the stolen altcoins for Ethereum, Binance Coin and Polygon tokens, according to on-chain data.

Pepe price forecast: Eyes for 30% rally

Pepe extends the upward movement on Friday after breaking above the descending trendline and resistance barrier on Thursday. PEPE’s dormant wallets are in motion, and the long-to-short ratio is above one, further supporting this bullish move and hinting at a rally on the horizon.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin (BTC) has risen 7% so far this week, supported by the US Federal Reserve (Fed) interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.