Bitcoin, Ethereum, XRP, Dogecoin, Toncoin and Cardano are undervalued, analysts say, predicting price bounce

- Bitcoin and several altcoins ranking in the top 10 by market capitalization are undervalued, per Santiment data.

- Analysts predict a short-term bounce based on the Market Value to Realized Value of these assets in the last 30 days.

- Crypto market broadly steadies, with market capitalization up by 0.6% in the past 24 hours.

Crypto market steadied in the early hours of Wednesday. The market capitalization of all assets climbed 0.6% to $2.49 trillion, per CoinGecko.

Analysts at on-chain intelligence tracker Santiment have identified signs of a short-term bounce in the top 10 cryptocurrencies.

These assets are undervalued and likely primed for a rally

Santiment analysts noted that Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Dogecoin (DOGE), Toncoin (TON) and Cardano (ADA) show signs of being undervalued. The Market Value to Realized Value (MVRV) metric on a 30-day timeframe shows bullish signs for these assets, as seen in the Santiment chart below.

The on-chain indicator MVRV is used to study the aggregate investor behaviors as price moves to/from their cost basis. As MVRV on a given timeframe turns negative, it implies that the asset is undervalued on average.

Analysts note that almost all crypto assets are undervalued when average trader returns are considered.

The chart below shows the 30-day MVRV ratio for the assets and the decline in active wallet addresses in assets like DOGE and TON in the same timeframe. The 30-day MVRV for the assets is:

Bitcoin -4.0% (interpreted as mildly bullish)

Ethereum -4.3% (mildly bullish)

XRP: -3.5% (mildly bullish)

Dogecoin: -16.7% (very bullish)

Toncoin: -0.6% (neutral)

Cardano: -12.6% (very bullish)

Santiment chart on average trader returns, undervalued assets

According to Santiment analysts, lower 30-day MVRV values signal undervalued assets and a potential short-term bounce in prices.

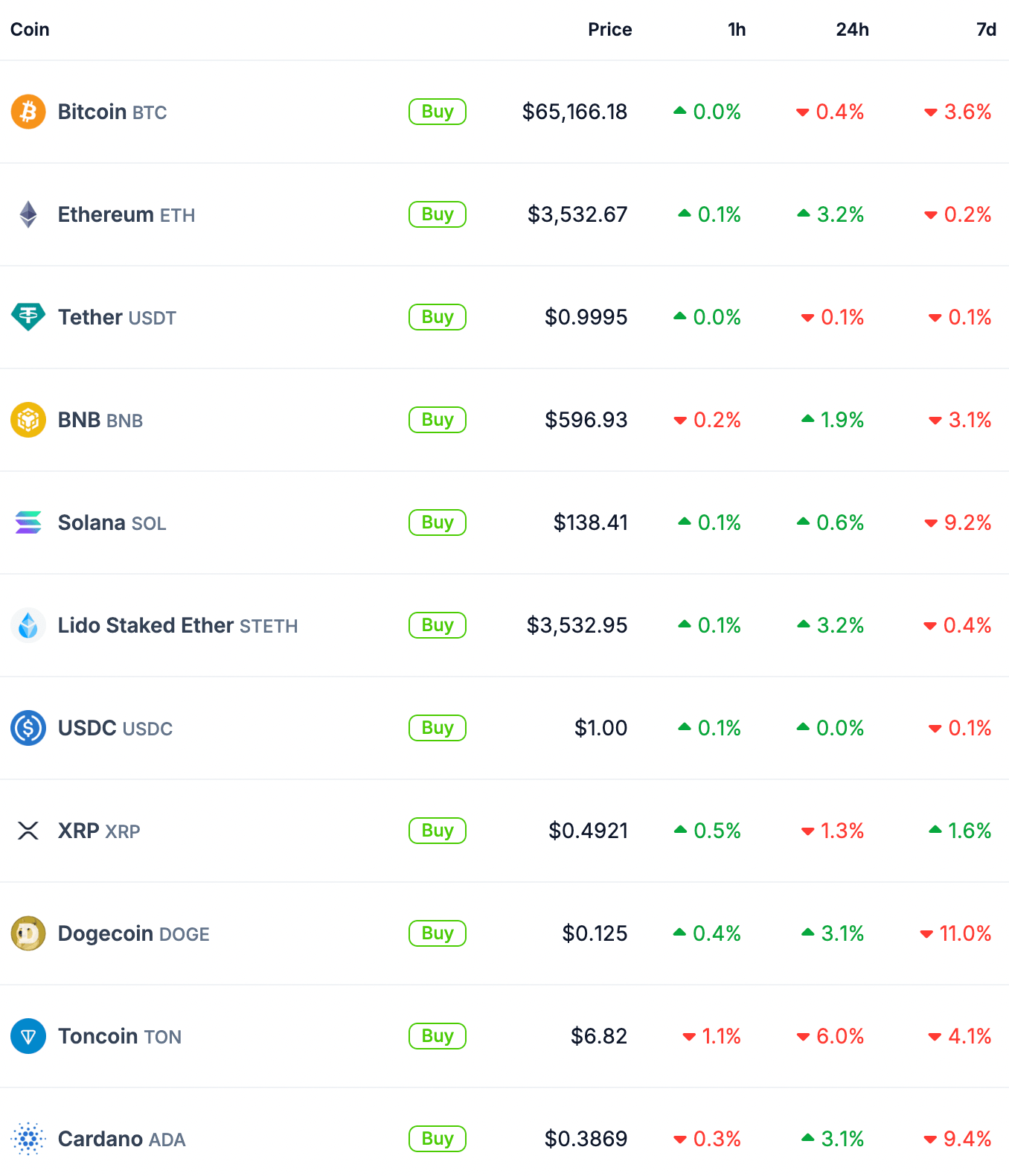

Bitcoin is trading above key support at $65,000 and Ethereum sustained above $3,500 on Wednesday, per CoinGecko data. Other cryptocurrencies in the top 10 have attempted a recovery in the past hour and 24 hours, while returns are largely negative in the seven-day timeframe.

Crypto top 10 prices as seen on CoinGecko

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.