Bitcoin Cash price peeks 15%, liquidates millions in short positions amid Franklin Templeton ETF hype

- Bitcoin Cash price skyrocketed 15% to record an intra-day high of $210.7 alongside Bitcoin’s 5% surge.

- The ascension saw up to $4.31 million short positions liquidated, against $459,000 longs.

- Santiment attributes the uptick in BTC and its BCH fork to ETF mania following latest Franklin Templeton announcement.

Bitcoin Cash (BCH) price skyrocketed on September 12, outperforming most altcoins in a striking move considering the current lull in the cryptocurrency market. BCH even outperformed Bitcoin (BTC) price, from which it is forked, with momentum indicators suggesting a continued uptrend. The rally comes on the back of the ongoing Bitcoin Spot Exchange-Traded Fund (ETF) applicant.

Bitcoin Cash joins BTC in a northbound move

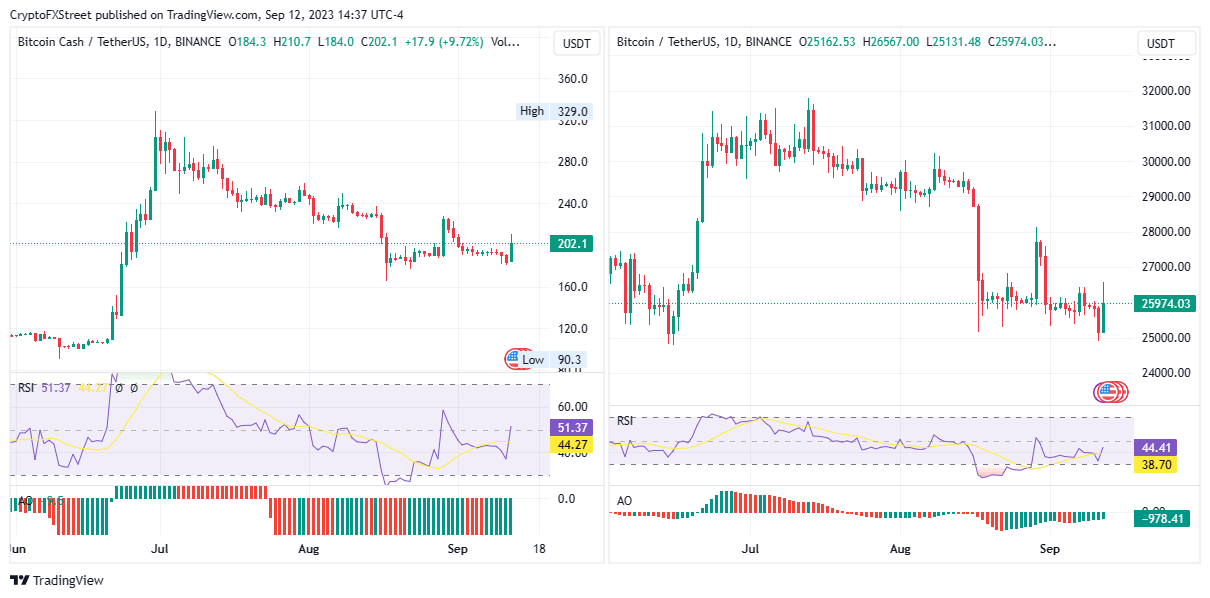

Bitcoin Cash (BCH) price recorded a 15% surge to an intra-day high of $210.70. This was three times the gains Bitcoin (BTC) price made, rising 5% to reach the $26,500 range before they both pulled back.

BTC/USDT 1-day chart, BCH/USDT 1-day chart

The 15% rise in the price of Bitcoin Cash saw up to $4.31 million in short positions liquidated alongside only $459,000 in long positions.

BCH liquidations chart

According to behavior analytics platform Santiment, the uptick for BCH and BTC comes on the back of Franklin Templeton, the new entrant in the Bitcoin Spot ETF race, with up to $1.5 trillion in assets under management (AUM) to its belt.

#FranklinTempleton has filed for a spot #Bitcoin #ETF, and there is an uptick in crowd optimism. $BTC and its best known fork, $BCH, are the top two trending assets in #crypto. #BitcoinCash, in particular, has benefited from previous ETF announcements. https://t.co/UeSwx9dO3k pic.twitter.com/6DMuPvPG5b

— Santiment (@santimentfeed) September 12, 2023

Frankilin Templeton’s filing identifies Coinbase Trust Company as the custodian for the fund’s Bitcoin holdings. Similarly, Bank of New York Mellon has been identified as the custodian for the fund’s cash holdings.

The Santiment report indicates that Bitcoin Cash is among the altcoins that have benefited the most from the previous announcements involving ETFs, rallying alongside Bitcoin price. For instance, when BTC rallied 7% following Grayscale’s recent victory on August 29, BCH soared around 20%.

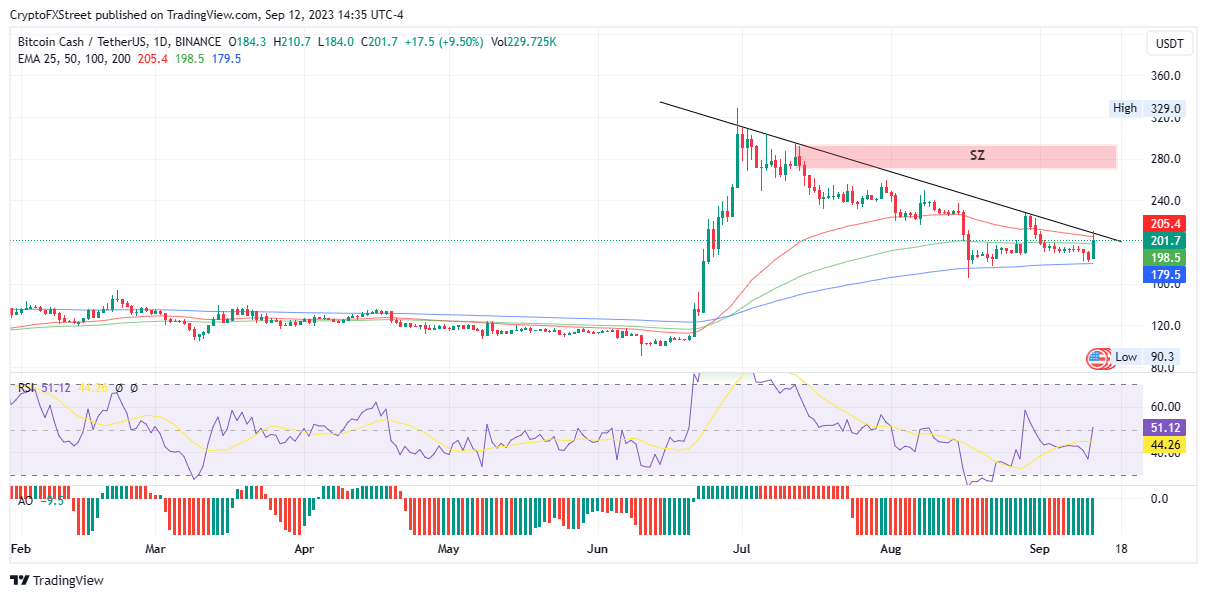

Bitcoin Cash price prognosis if BTC shows strength

Bitcoin Cash price could continue its move north if Bitcoin price shows strength. The BTC fork enjoys robust downward support offered by the 200-day Exponential Moving Average (EMA) at $179.50.

The September 12 move saw BCH overcome the 100-day EMA hurdle at $198.6, although this is pending confirmation that would happen once the token records a decisive daily candlestick close above the 50-day EMA at $205.40, vindicating itself from the foothold of the downtrend line.

The Relative Strength Index (RSI) remains northbound, bolstered by numerous green bars of the Awesome Oscillator, which points to rising momentum. If sustained, Bitcoin Cash price could extend 30% above the descending trendline to tag the supply zone at around the $280.00 range, where selling pressure abounds, to likely correct from here.

BCH/USDT 1-day chart

Conversely, if traders begin their usual profit-taking to cash in on the Franklin Templeton-infused gains, Bitcoin Cash price could drop, potentially losing the support offered by the 200-day EMA at $179.50 to tag the psychological $160.00 level potentially. Such a move would indicate a 20% slump.

However, the support due to the 200-day EMA is critical, as it coincides with the last lower high recorded on August 18. Therefore, a decisive daily candlestick close below $179.50 could mark the beginning of a new downtrend.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.