Bitcoin bull plans thwarted by US Dollar rally

- Bitcoin tumbles as the rise in the US Dollar Index continues.

- An escalation of the war in the Middle East could trigger a more risk-off scenario, causing a further uptick in the Greenback.

- Bitcoin price must drop to key weekly levels before investors consider buying the dips.

Bitcoin (BTC) price remains rangebound on Tuesday, with no directional bias in sight and moving inside a consolidation range since the beginning of March. With the US Dollar Index continuing to rally, BTC could see a further drop.

Bitcoin and macroeconomic outlook

Bitcoin’s reaction to macroeconomic events has declined significantly in the past few months. Despite that, there is a strong connection between the US Dollar and BTC — an inverse correlation, to be precise. As mentioned in a previous publication, the US Dollar Index – which gauges the value of the Greenback against a basket of six foreign currencies – rose 1.84% in the last three weeks, causing Bitcoin to crash 16%.

It looks likely that the US Dollar Index’s ascent will continue until it tags 107.17, the midpoint of the 13% crash noted between September 2022 and July 2023. In such a case, BTC could continue its descent until it tags the weekly imbalance, extending from $59,111 to $53,120.

Read more: Key Bitcoin price levels to buy the dips

US Dollar Index 1-week chart

Greenback’s reaction to the Middle East war

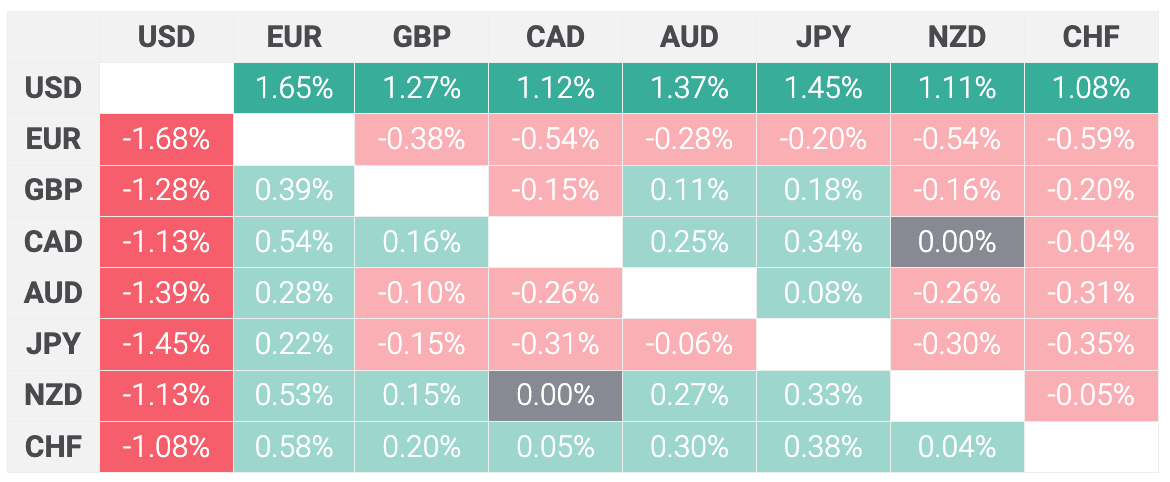

The conflict in the Middle East seems to have intensified after Iran’s drone strike over the weekend. As the entire world awaits Isarel’s next step, the geopolitical tension has caused the US Dollar to appreciate due to the increase in safe-haven demand. As mentioned in our FXStreet publication, the Greenback had the strongest rise against the Euro.

Read more: Middle East tensions escalate over the weekend after Iran attacks Israel

As the US Dollar Index trades at 106.34, three factors need to be considered in determining whether BTC will continue to crash or reverse.

- Multi-month resistance levels between 105.00 and 106.00 and if they will be flipped into a support zone.

- Geopolitical tensions and their lasting effect on the Greenback.

- Higher interest rates.

In addition to these, the fourth halving event scheduled on April 20 will also have a significant influence on Bitcoin price.

Read more on Bitcoin halving, rising dominance and US Dollar’s impact on BTC price - Link

For now, Bitcoin's price needs to dip in the weekly imbalance, extending from $59,111 to $53,120, to see how the pioneer crypto reacts and draw conclusions on what could happen next.

The short-term outlook remains unclear and could potentially trigger a crash, but the long-term outlook remains bullish.

BTC/USDT 1-day chart

Read more: Bitcoin Weekly Forecast: BTC’s rangebound movement leaves traders confused

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.