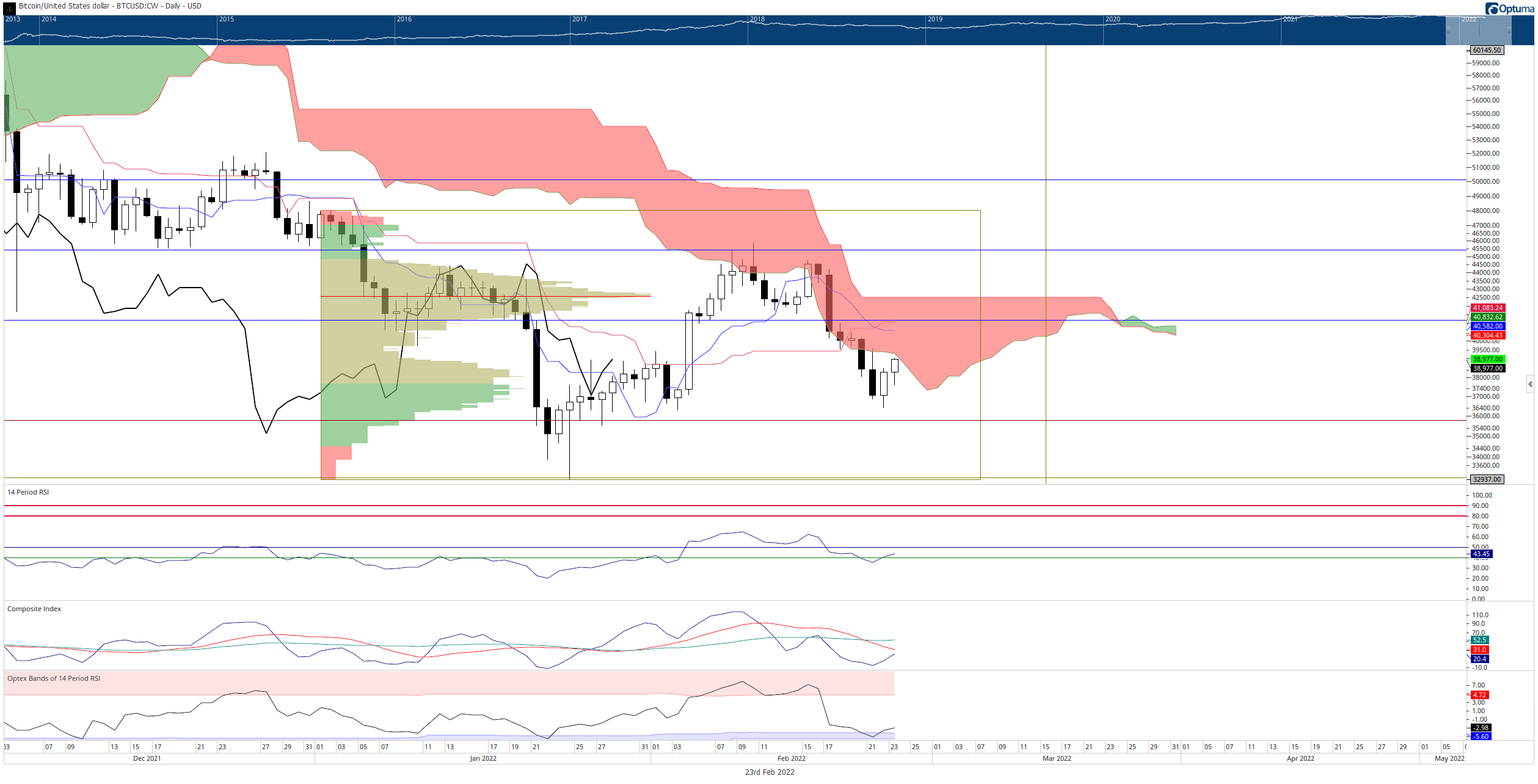

- Bitcoin price testing a return to the inside of the Ichimoku Cloud.

- $40,000 to $41,000 is the first crucial resistance zone bulls must break.

- Failure to return inside the Ichimoku Cloud could confirm a more significant bearish expansion towards $30,000.

Bitcoin price fell below the Ichimoku Cloud over the weekend and extended its losses to sub $40,000 for the first time since early February. However, Tuesday’s price action recovered nearly all of Monday’s losses. Buyers have extended the rally from yesterday, but near-term resistance threatens to terminate that bullish momentum.

Bitcoin price attempts to confirm a bottom and return to $40,000

Bitcoin price has suffered some significant bearish pressure over the past week. Risk-on markets across the globe continue to feel pressure due to Russia’s invasion of Ukraine.

Since last Tuesday (February 15, 2022), Bitcoin has dropped from a swing high of $44,760 to a swing low of $36,400 – nearly a 20% drop in a week. Whether the news or standard technical analysis behavior is to blame, BTC nonetheless returned to test a former resistance level as support – so far, it has held.

Bulls are likely to take over and push Bitcoin price back inside the Ichimoku Cloud to test the 61.8% Fibonacci retracement at $41,160 as resistance. Ultimately, bulls will need to return Bitcoin above the Ichimoku Cloud (Senkou Span B) to return BTC to a full-on bull market. A daily close above $42,685 would position Bitcoin into an Ideal Bullish Ichimoku Breakout, leading to moves beyond $50,000 and into the $60,000 value areas.

BTC/USD Daily Ichimoku Kinko Hyo Chart

However, downside risks are significant. If bears push Bitcoin price to a close below $36,500, then new 2022 lows and even a retest of the 2021 lows at $28,500 is almost a certainty.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.