Bitcoin a top three asset in the event of US debt default: Survey

Major cryptocurrency Bitcoin (BTC $27,422) could become a top three asset in the event of a theoretical debt default in the United States, according to a new survey.

As U.S. President Joe Biden prepares to meet with Congress on May 16 to discuss the U.S. debt ceiling, investors are seeking hedges to protect their savings in the event of default.

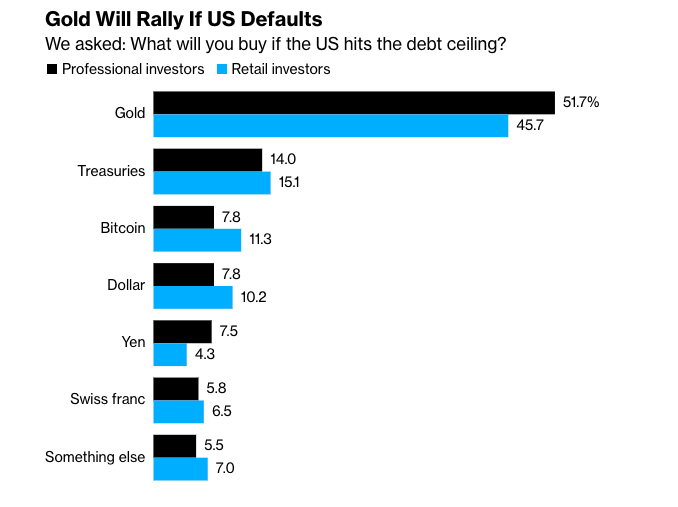

Gold, U.S. Treasurys and Bitcoin would be the top three assets should the U.S. fail to raise its debt ceiling and default on its debt, data from Bloomberg’s latest Markets Live Pulse survey suggests. The survey was conducted from May 8–12, involving a total of 637 respondents, including professional and retail investors.

More than 50% of finance professionals will buy gold if the U.S. government fails to avoid a debt default. U.S. Treasurys would be second, with Bitcoin the third most popular alternative for retail investors.

Data from Bloomberg Markets Live Pulse survey. Source: Bloomberg

This makes Bitcoin a more popular choice than the U.S. dollar, the Japanese yen or the Swiss franc. According to the survey’s data, about 8% of professional investor respondents and 11% of retail investor respondents said they are more willing to buy Bitcoin.

The poll comes as markets grow increasingly nervous about the U.S. debt ceiling. In early May, Treasury Secretary Janet Yellen warned that the U.S. risks a catastrophic default as soon as June 1 if the debt limit isn’t suspended or raised. President Biden subsequently declared that the “whole world” would be in trouble if the U.S. defaulted on its debt.

According to the Bloomberg survey, nearly 60% of respondents said the risks are bigger this time than in 2011. Forty-one percent of respondents also believe that a default directly threatens the U.S. dollar as the primary global reserve currency.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.