Binance Pay service launched in the US as BNB price battles FUD over proof of reserves

- Customers in the US get access to mobile app payment system.

- Binance Pay supports sending, receiving and requesting money in over 150 cryptocurrencies instantly and at zero cost.

- Fear and uncertainty grips crypto market after Binance’s Proof of Reserves audit raises questions.

- BNB price up 2.9% on the day as Binance CEO CZ stands firm against money laundering claims.

United States-based customers are now eligible to access Binance exchange’s payment service, referred to as Binance Pay, for the first time since its launch in February 2022. Binance Pay is a mobile app payment service supporting sending and receiving money in more than 150 cryptocurrencies.

Yet, despite launching the app, Binance remains embroiled in controversy over the accusations of money laundering and the state of its finances, after the publication of an audit led to questions about whether it had sufficient reserves to meet all withdrawals in a case where it was subject to an FTX-style ‘run’. Binance Coin (BNB) price remains resilient, trading 2.9% higher on the day.

Binance Pay claims it enables instant and zero-cost payments

The Binance Pay mobile app service, which was launched ten months ago, means Binance’s US customers can now send, receive and request payments via the app. During the product launch in February, Binance CEO Changpeng Zhao (CZ) said that the “most obvious use cases for crypto” is to support payments and transfer of value.

“Pay eliminates the complexities of transferring crypto to contacts as users no longer need to enter a complex deposit or withdrawal address, pay gas fees, or wait an unspecified amount of time for transactions to successfully settle,” Binance said in a statement.

BNB price pumps as CZ fights through FUD

CZ has been involved in a battle to clear his exchange’s name following accusations of money laundering by top executives. An article published by Reuters alleged that the US Justice Department could charge the company’s officials for money laundering.

A few Binance headlines from the last 24 hours:

— Genevieve Roch-Decter, CFA (@GRDecter) December 12, 2022

- US Justice Department may charge Binance Execs for money laundering

- Binance locks withdrawals for some accounts amid what CEO calls 'just market behavior'

- Binance's proof of reserves raises red flags

However, Binance issued a statement stating that the firm had no “inner workings with the US Justice Department.” The statement, shared with Reuters, affirmed Binance’s commitment to supporting law enforcement, especially in cases of ransomware, hacks, scams and investment frauds.

Industry figures like the CEO of Kraken exchange, Jesse Powell, also raised questions regarding a recently released audit of Binance’s Proof of Reserves by accountancy firm Mazars. Powell asked journalists to look into the audit, raising some red flags like the inclusion of negative balances and the absence of wallet signing.

ok, I'll give you a hint. This is just the easy stuff that says this OBVIOUSLY is not a traditional Proof of Reserves, and should immediately have had actual journalists digging.

— Jesse Powell (@jespow) December 8, 2022

Why use collateral value? Why negative balances included? No wallet signing? Who issues BTCB & BBTC? pic.twitter.com/F9u4XJ5WSi

Binance CEO has, over the last few days, taken to Twitter to calm users while assuring them that the centralized exchange (CEX) is in good health. He accused the public of spreading fear and uncertainty (FUD) and asked users to ignore the noise and focus on building.

FUD helps us grow, even though they are thoroughly annoying.

— CZ Binance (@cz_binance) December 13, 2022

You can FUD about someone without explicitly mentioning their name, which spreads awareness.

It also helps unite their supporters because it forms a common defense alliance.

Short thread. 1/4 https://t.co/PlxhqV5cZS

In the meantime, Binance Coin (BNB) price trades at $276 following a 2.9% northbound move on the day. Yet, the native exchange token has suffered of late as Binance’s name has been dragged through the mud in the past few days.

Investors increased their appetite for selling BNB amid jitters of another FTX-like saga. According to the chart below, addresses with between 10,000 and 100,000 tokens currently hold 3.24% of the network’s total supply, down from 3.31% recorded on December 8.

Binance Coin Supply Distribution

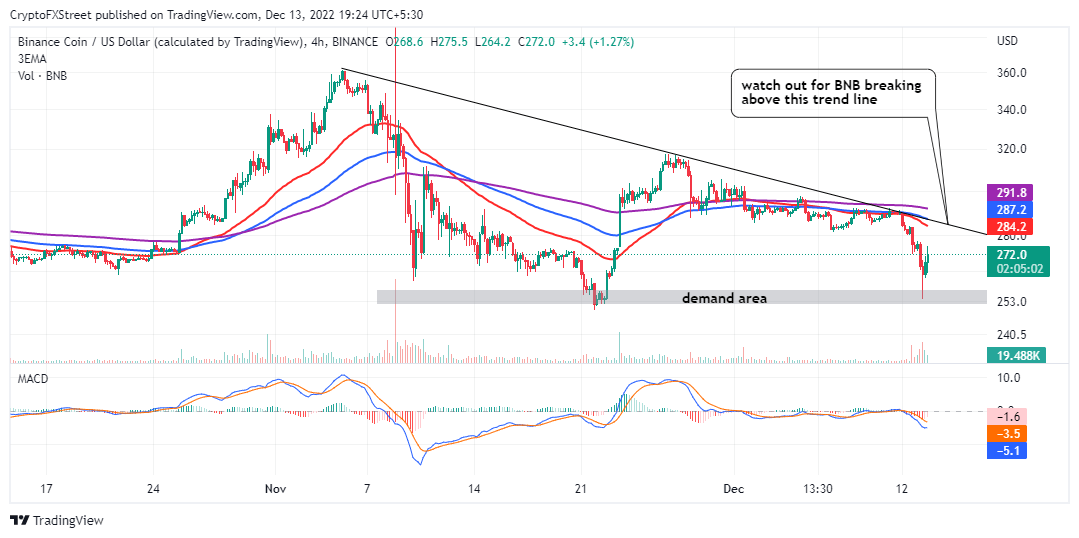

Despite the spike in selling pressure since the weekend, BNB price jumped to trade at $278 on Tuesday. As shown in the chart below, a break and hold above the trend line resistance is crucial for BNB to confirm a sustainable move to $300.

BNB/USD four-hour chart

It is worth mentioning that the Moving Average Convergence Divergence (MACD) indicator holds below the mean line, which means overhead pressure is still apparent. Therefore, failure to rise above the trend line could poke holes into Binance Coin price delicate buoyancy.

BNB could retest support at $265 and $250 to collect enough liquidity before potentially climbing the ladder for gains above $300.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B18.13.58%2C%252013%2520Dec%2C%25202022%5D-638065450203751571.png&w=1536&q=95)