Binance Coin price recovers to $250 as Kepler hard fork goes live; Beacon Chain retirement announced

- Binance Coin had a positive reaction to the Kepler hard fork activating on the testnet on Tuesday.

- The update is set to align BNB Smart Chain with the Ethereum Shanghai upgrade, improving EVM compatibility.

- The BSC team also announced that by May 2024, the BNB Beacon Chain will be retired, citing it to be redundant.

The world’s third biggest Decentralized Finance (DeFi) chain, BNB Smart Chain (BSC), formerly known as Binance Smart Chain, is preparing to bring itself into the same league as Ethereum. The chain is set to undergo a crucial upgrade next month, which is fielding positive reactions presently after going live on testnet.

Binance brings its ‘Shanghai’ upgrade

Binance BSC is scheduled to witness the arrival of the Kepler hard fork on January 23, 2024, but before the upgrade hits the mainnet, it will be making its presence felt on the test net. The Kepler hard fork for the latter was activated on Tuesday as per the plan and is currently being tested by developers and users.

The Kepler hard fork, in many ways, is the Shanghai upgrade of Binance since this hard fork will align the DeFi chain with the recent changes noted on Ethereum. As staking withdrawal, along with other updates, came to Ethereum with the Shanghai hard fork, the Kepler upgrade will align BSC with the same changes.

One of the key features for BSC will be Fast Finality, which will be focused on incentivizing validators efficiently, which will ensure faster and more reliable transaction confirmations. Furthermore, Kepler will improve the EVM (Ethereum Virtual Machine) compatibility of the BSC.

But beyond this update, Binance is also set to retire BNB Beacon Chain by April and May next year. As part of its Fusion Roadmap, the Beacon Chain was designed as a staking and governance layer.

The BNB Beacon Chain, designed for staking and governance, once vital to BSC, is evolving

— BNB Chain (@BNBCHAIN) December 19, 2023

With changes in the blockchain landscape, redundancy and complexities prompt the discontinuation of the Beacon Chain.

Read ahead to learn more [1/5]https://t.co/8MfyU5vuRk

However, as per Binance, the evolution of BSC and changes in the blockchain landscape has made the Beacon Chain redundant. This has also introduced development complexities and security vulnerabilities.

Thus, to fix this, Binance will be retiring the chain in phases by May 2024, with the first phase set to go live in April 2024. The update titled “Sunsent fork” will first disable cryptocurrency issuance and minting features as well as BSC validator creation in April 2024. This will be followed by three other updates, with the final sunset form set to take place a month later, which will halt the Beacon Chain.

Binance Coin price poised to go higher

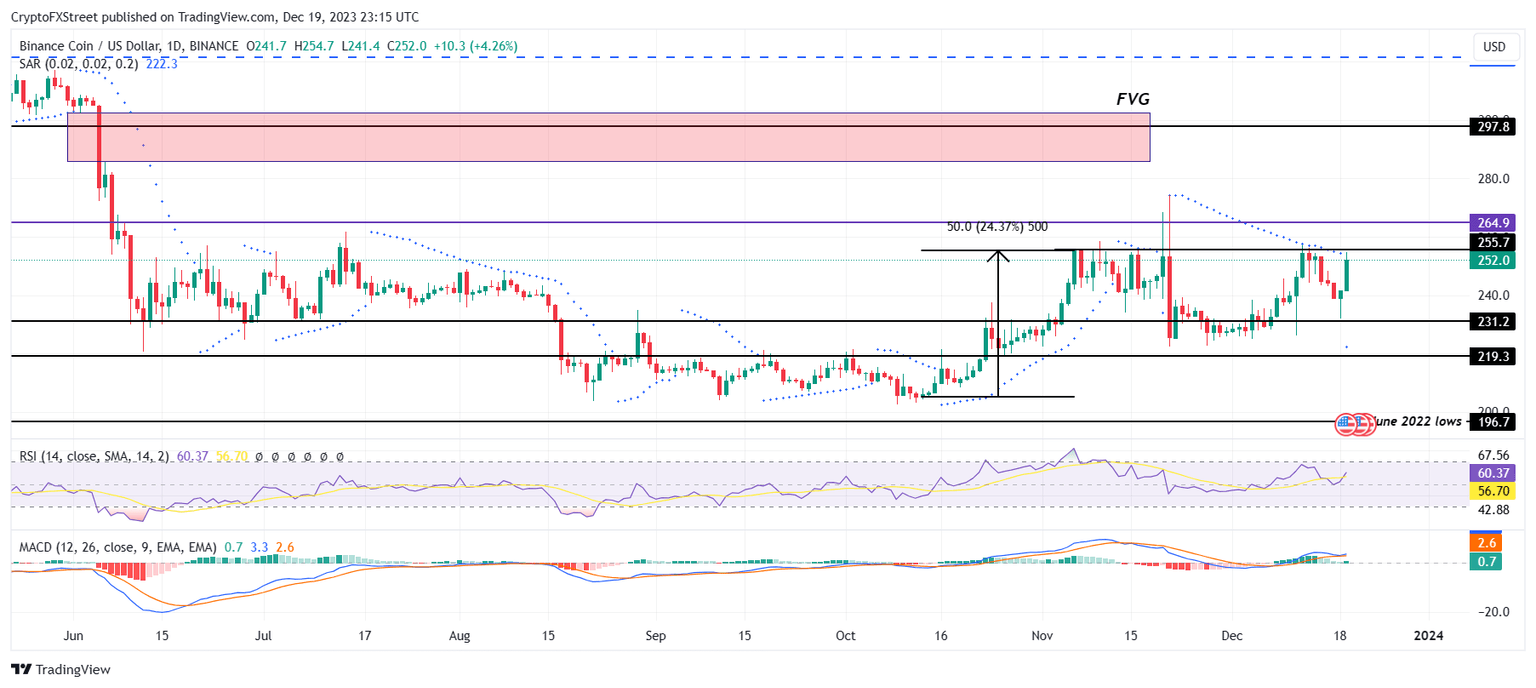

Interestingly, the Binance Coin price had a bullish day despite the Beacon Chain retirement announcement. The altcoin made it back up above $250 to trade at $252 at the time of writing and tested $255 as a resistance level for the fifth time in the past month and a half.

This barrier has not been surpassed since the beginning of November this year but is expected to be broken this time around. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicators suggest bullishness is running high currently.

This will not only push BNB through $255 but also set the altcoin up for reclaiming $264 as support to mark a six-month high.

BNB/USD 1-day chart

However, if the breach fails, Binance Coin could retrace to $231 and remain consolidated, but losing this support level would invalidate the bullish thesis and bring BNB down to $219.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.