Binance Coin Price Forecast: BNB needs to retrace before a bullish breakout

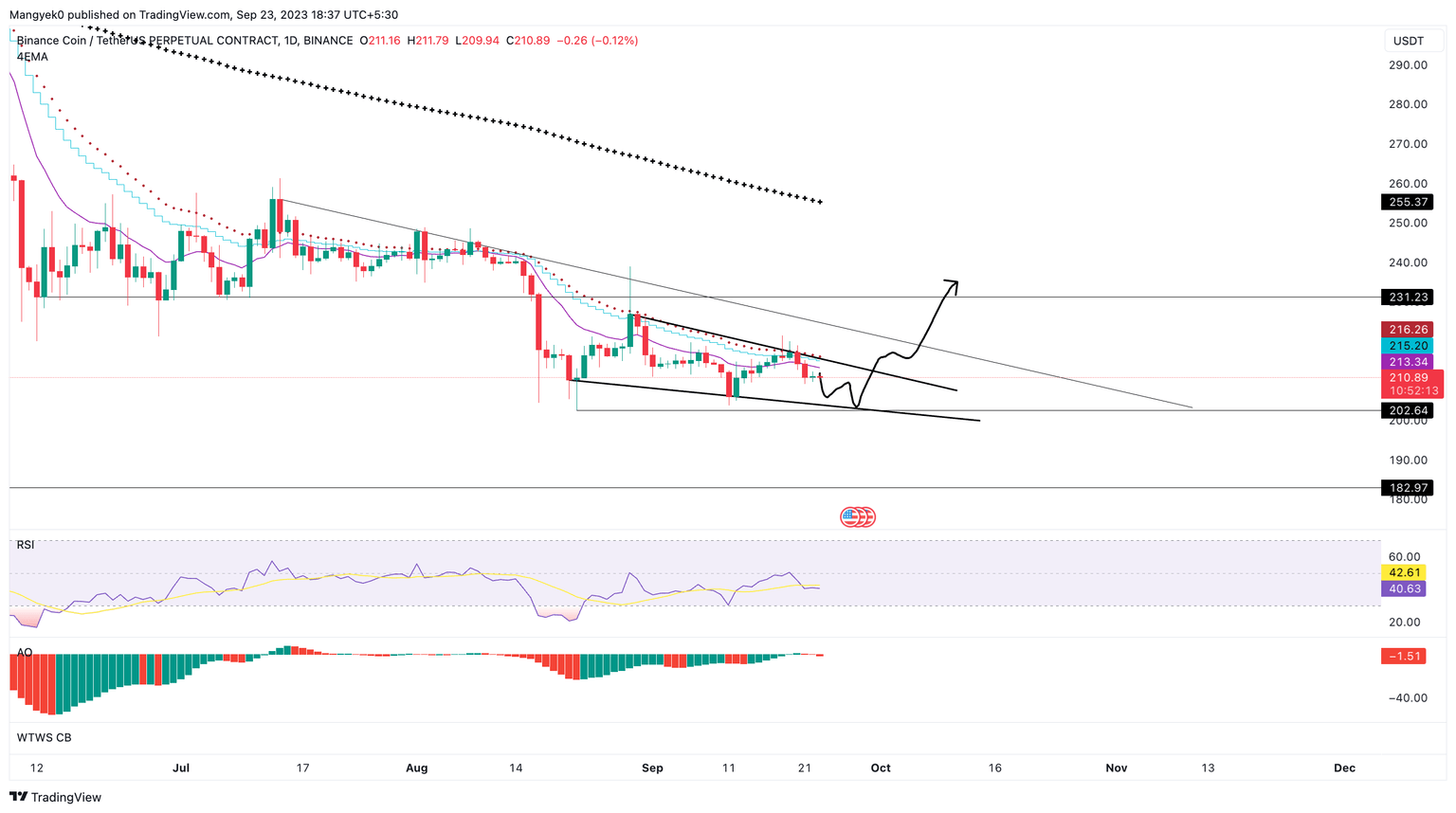

- Binance Coin price is traversing a falling wedge pattern on the daily chart.

- BNB is likely to retrace to $202.64 before triggering a breakout to $231.23.

- Invalidation of the bullish outlook will occur on the breakdown of the $202.64 level.

Binance Coin price is in a downtrend, showing signs of consolidation and a potential bottom formation. A further retracement followed by a bounce could be key to catalyzing a bullish breakout.

Also read: Binance Coin price at risk as FUD surrounding a Binance collapse intensifies

Binance Coin price sets the stage for future move

Binance Coin price has produced two lower highs and two lower lows in the past month. Connecting these swing points using trend lines reveals a falling wedge formation. Considering the current position of BNB at $210.77, investors can expect BNB to slide lower.

In total, Binance Coin price could drop another 4% until it retests the support level at $202.64. This barrier is key as it could attract sidelined buyers and complete the falling wedge pattern consisting of three lower lows and two lower highs. The bounce that originates here has the potential to trigger a breakout and tag the next key hurdle at $231.23.

This move would constitute a 14% gain for Binance Coin price and is where investors should book profits.

BNB/USDT 1-day chart

On the other hand, if Binance Coin price breaches below the $202.64 support level and flips it into a resistance level, it will create a lower low and invalidate the bullish thesis. This development could further trigger a 10% descent that tags the $182.97 support level.

Read more: US Judge denies SEC request to inspect Binance.US

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.