Binance Coin price exhausts uptrend at $360 as investors book profits

- Binance Coin price snaps out of its northbound move at $360 for a potential retracement to $300.

- The MACD could soon validate a sell signal bolstered by the RSI’s return into the neutral region.

- Whales backing the positive outlook in BNB price do not seem bothered by the ongoing short-term pullback.

- The 200-day EMA support at $313 could invalidate the foreshadowed sell-off to $300.

Binance Coin price is trending 6.0% lower on Monday after maxing out a two-week bullish move to $360 from support around $256. The native exchange token exchanges hands at $331 at the time of writing while bulls hunt for substantial support.

Retail investors may wait for a slightly lower price before reentering the market. Therefore, this retracement could be temporary, especially if large-volume investors, also known as whales, continue backing a Binance Coin price rally.

Binance Coin price gives up gains as investors book profits

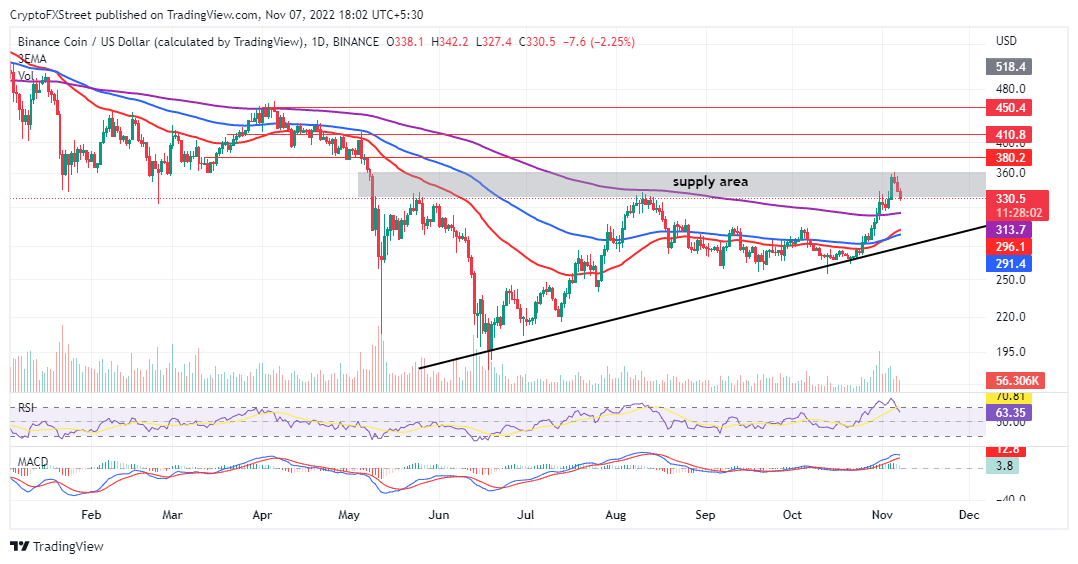

Binance Coin price rebound seemed unstoppable but bulls ran into solid resistance at $360, resulting in a retracement. Short-term support at $330 has allowed BNB to take a pit stop. However, its technical outlook could scream sell as the Relative Strength Index (RSI) slides into the neutral region after topping out at 83 in the overbought area.

BNBUSD daily chart

Declines could extend below $330 and probably revisit a rising trend line with support around $330. However, waiting for confirmation of the sell-off is essential, especially if the Moving Average Convergence (MACD) indicator drops toward the mean line. A sell signal will manifest with the 12-day Exponential Moving Average (EMA) (in blue) crossing below the 26-day EMA (in red).

Possible take-profit targets to the downside include the 200-day EMA (in purple) at $313, support at the 50-day (EMA) (in red) and the 100-day EMA (in blue).

Whales stay put as Binance Coin price retraces

Binance Coin will likely resume its uptrend much faster than expected if whales keep their support intact. Addresses holding 100,000 to 1,000,000 BNB tokens currently account for 7.40% of the network’s total supply, up from 6.61%, as recorded on October 29.

Binance Coin Supply Distribution

From the chart below, this cohort of investors seems unbothered by the trend correction from $360 to $330. As more whales take up BNB, its price is bound to gain traction, thus cushioning bulls from potentially overarching losses – and probably leading to a resumption of the Binance Coin price uptrend.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B15.32.44%2C%252007%2520Nov%2C%25202022%5D-638034293776712139.png&w=1536&q=95)