Binance Coin price pumps on improving fundamentals – forecasting a bullish move to $380

- Binance Coin price breaks above a key descending trend line as it rallies to $335.

- Binance exchange announces its 31st project, Hashflow, on the Binance Launchpool.

- Previously sidelined investors return to back BNB's move to $380.

Binance Coin price is on the move on Monday, oblivious to the upcoming Fed's FOMC (Federal Open Market Committee) meeting on November 2. Market participants anticipate stricter measures as the Fed fights inflation. A 0.75% interest rate hike could mean pressure mounting on the crypto market as investors keep their hands-off riskier assets.

Meet Hashflow on Binance Launchpool

Binance exchange has announced the launch of its 31st project on the Binance Launchpool. Hashflow (HFT) is a DEX (decentralized exchange) that links traders with professional market watchers.

According to a blog post released by the world's largest exchange by trading volume, users now have an opportunity to stake both BNB and BUSD in separate pools to farm HFT tokens for the next 30 days – starting from November 11, 2022, at 00:00 UTC.

Following Hashflow's time on the Binance Launchpool, HFT will move to the innovation zone, where trading will open with three pairs, HFT/BTC, HFT/BUSD and HFT/USDT.

Binance Coin price exploded in the wake of the Hashflow news to trade 7.8% higher on the day. This sudden movement in BNB price reflects a spike in investor risk appetite as they prepare to farm HFT. Demand for BNB will go up as long as Hashflow appeals to investors over the next 30 days.

Looking at the Supply Distribution metric from Santiment, large volume investors, also known as whales in crypto jargon, are throwing their support behind BNB. It is this increase in demand that could be fueling BNB's rally. Holders with between 10,000 and 100,000 BNB now number 188 after gradually growing from 181 on September 21.

Binance Coin Supply Distribution

Binance Coin price suddenly flipped bullish even though last week's forecasts seemed highly bearish. The buyer congestion at $250 allowed bulls to regain control. With buying pressure behind BNB growing aggressively, its price had no option but to obliterate resistance at $300.

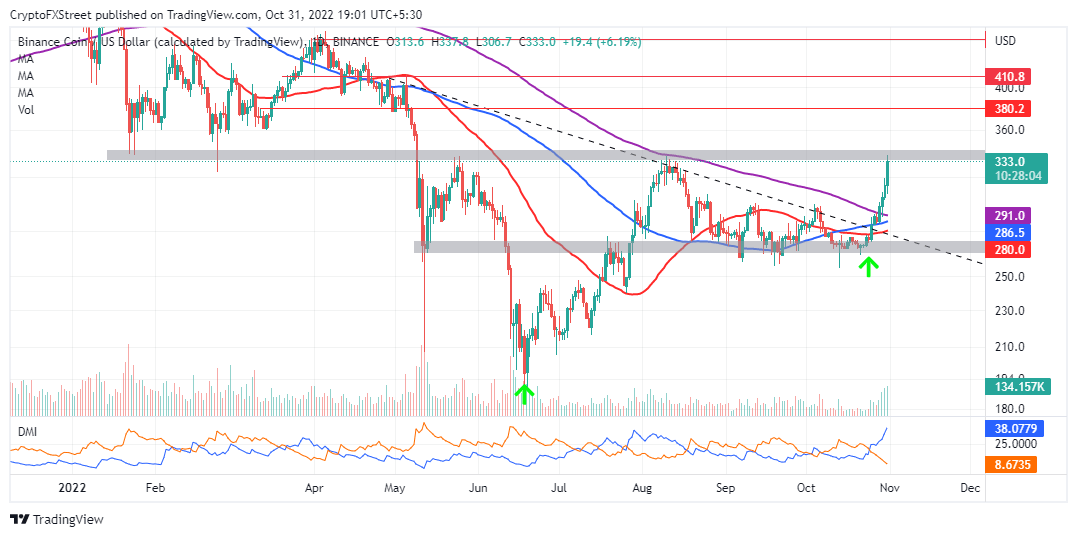

Binance Coin is trading at $332 after brushing shoulders with $335. Its technical outlook remains positive, looking at the DMI (Directional Movement Index). Buyers will be at the helm of the uptrend if the divergence between its -DI and the +DI keeps expanding.

BNB/USD daily chart

Traders scanning for more long positions must wait for a confirmed break above the seller congestion at $340. BNB's uptrend will be secured if the 100-day SMA (simple Moving Average) (in blue) crosses above the 200-day SMA (in purple). BNB will probably hold above support at $330 while waiting for the second breakout phase to $380.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B16.21.28%2C%252031%2520Oct%2C%25202022%5D-638028225022853113.png&w=1536&q=95)