Base to decentralize further with fault proofs, testnet launch expected mid July

- Base, Coinbase’s Layer 2 chain plans further decentralization through the launch of fault proofs and higher community participation.

- Fault proofs are expected to go live for Base Sepolia testnet by mid July.

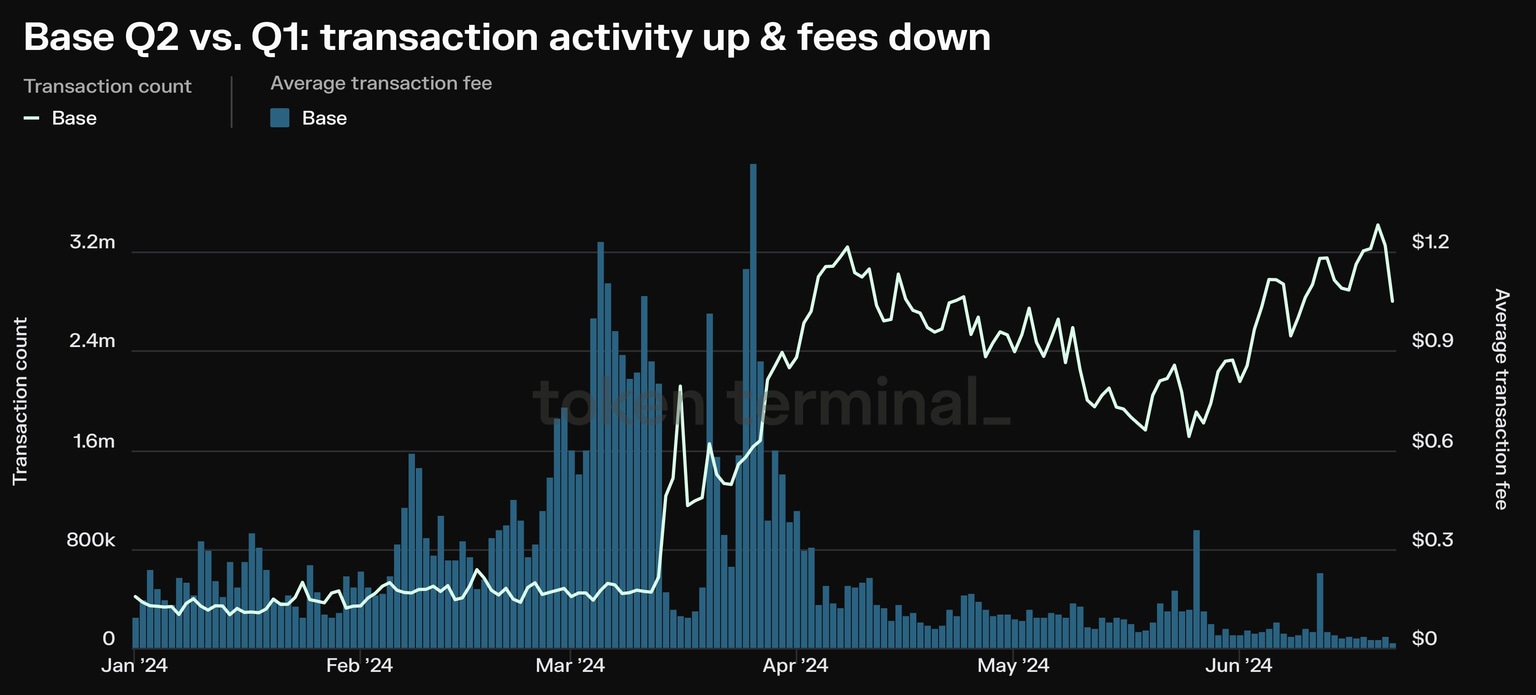

- Base has noted a spike in usage between Q1 and Q2 with applications like Uniswap, 1inch, and Circle among others.

Base, a Layer 2 scaling solution by Coinbase has observed a surge in usage of the chain, amidst decline in fees. Several applications on the Layer 2 chain contributed to the rise in activity.

Base recently announced its plans for further decentralization with an upcoming testnet launch of “fault proofs.”

Optimism based Layer 2 chains use Fault proofs to prevent operators from passing inaccurate transaction data to the underlying Layer 1. In Base’s case this would prevent the Layer 2 chain’s operators from passing false data to Ethereum and further decentralize the withdrawal mechanism of the scaling solution.

Base furthers decentralization with July testnet debut of “fault proofs”

Coinbase’s scaling solution Base is preparing to debut fault proofs, a mechanism to ensure that inaccurate information is not passed down to the Ethereum chain, on its Base Sepolia testnet in mid-July.

Per the official documentation, the implementation will boost the following:

- Permissionless output proposals: Layer 2 chains without fault proofs allow only the centralized proposer to create and submit output on the state of the chain. With the implementation, any operator on the chain can propose such claims, with less reliance on a centralized party.

- Permissionless challenges to output proposals: If someone makes a fraudulent claim, any operator can challenge it. Users can withdraw funds from Base to a Layer 1 chain without relying on a centralized actor.

Base has observed a surge in its utility as fees declined from Q1 to Q2 2024.

Base sees drop in fees, rise in utility

Data from crypto intelligence tracker TokenTerminal shows that from Q1 to Q2 2024, while there was a decline in fees for users on Base, there was a spike in usage. Several applications contributed to the increase in utility, including Uniswap, Frenpet, 1inch, Circle and Tarot Finance among others.

Base transaction activity and fees

The rising activity signals demand for the chain among users, and its increasing relevance among market participants.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.