Axie Infinity Price Prediction: AXS could retrace 22% after new all-time high at $157

- Axie Infinity price has risen a whopping 107% over the past 72 hours and shows no exhaustion whatsoever.

- A retest of the 423.6% trend-based Fibonacci extension at $157 could set a new all-time high.

- As investors begin to book profits, AXS could head as low as $120.

Axie Infinity price breached a bottom reversal pattern on September 29 and has not looked back even after doubling in value. While a retracement is likely, there is a chance AXS could set up a new all-time high before throwing in the towel.

Axie Infinity price undergoes an exponential run-up

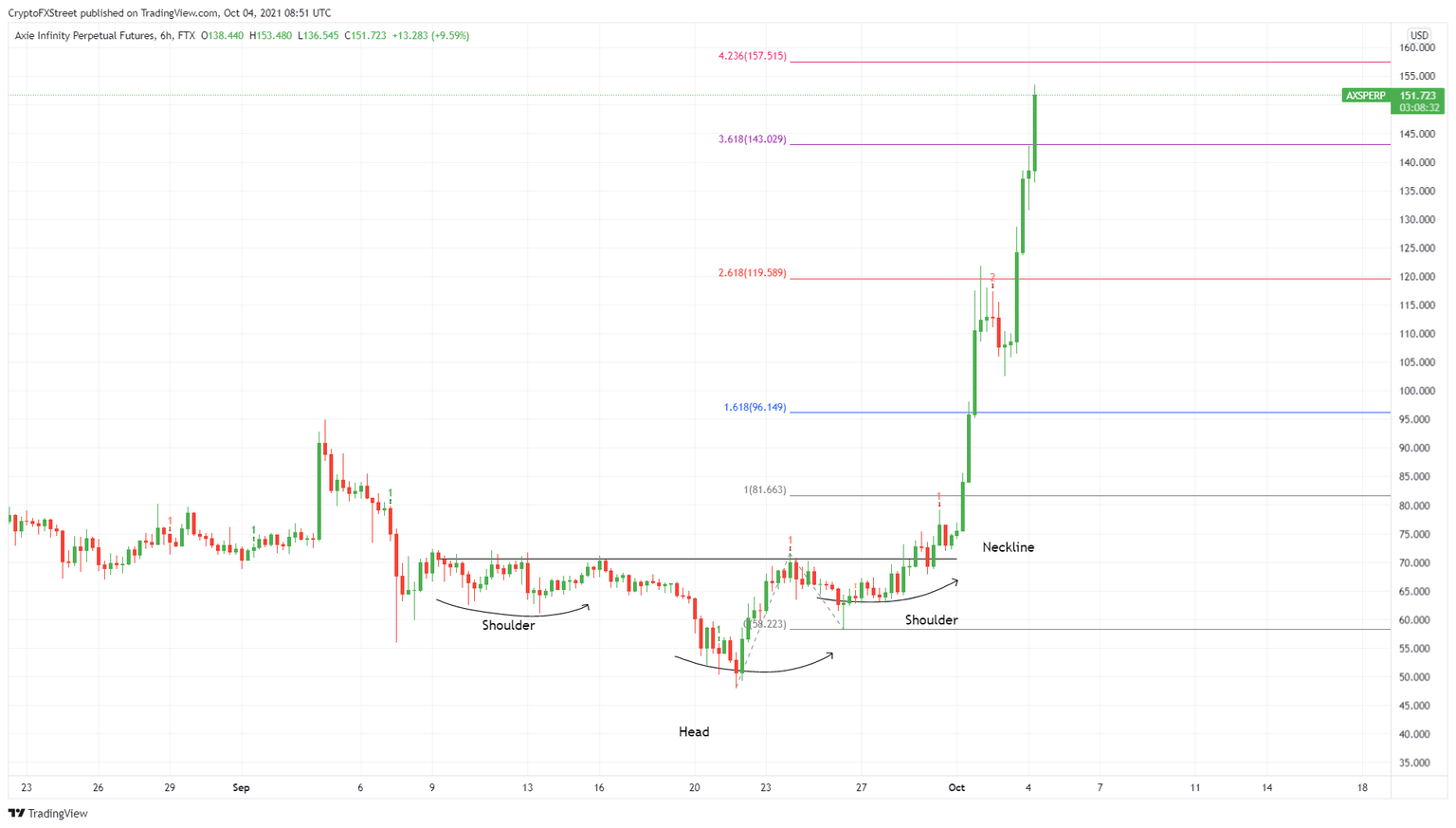

Axie Infinity price was forming a head-and-shoulders pattern in late September. A successful breach out of this technical formation predicted AXS could head to $90 and, in some cases, $100, but the bull rally pushed the altcoin to $153.

This run-up constitutes a 117% ascent from the neckline and 107% advance from the October 1 lows. Axie Infinity price is currently hovering above the 361.8% trend-based Fibonacci extension level at $143. It could set up a new all-time high at $157.52 after retesting the 423.6% trend-based Fibonacci extension level.

While the ascent is impressive, the altcoin is due for a correction. The $143 support floor will be the first barrier that AXS will retest. A breach of this barrier is likely if investors continue to book profits. In such a case, Axie Infinity price might revisit the 121.88 demand level or the 261.8% trend-based Fibonacci extension level at $119.59.

This correction would represent a 22% pullback.

AXS/USDT 6-hour chart

Regardless of the bullish momentum around Axie Infinity price, things will turn south if the holders rush to the exit. A decisive close below $106 will create a lower low and invalidate the bullish thesis.

In this situation, AXS might retest the 161.8% trend-based Fibonacci extension level at $96.15.

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.