Axie Infinity Prediction: AXS reclaiming the Christmas high of $11.15 will remain hopium unless this happens

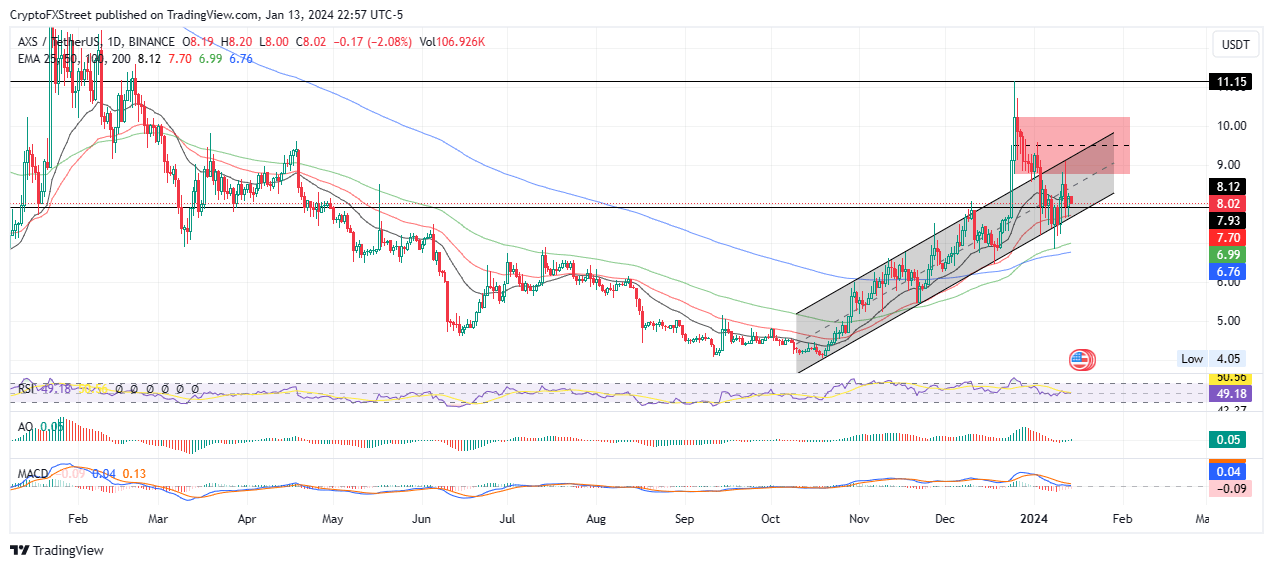

- Axie Infinity recorded a high of $11.15 on December 25, levels last tested on February 21, 2023.

- To reclaim this level, AXS must break and close above the midline of the supply zone at $9.51, confirming trend continuation.

- Santiment indicates that traders are taking more short positions for AXS than longs this weekend.

Axie Infinity (AXS) price is trading with a bullish bias despite the recent crash. It comes after recording an intra-day high of $11.15 on December 25, with the bulls pushing to reclaim this level. Meanwhile, markets are anticipating a bounce after the recent slump, save for AXS and Bitcoin Cash (BCH), which Santiment analysts say are recording higher ratio of shorts than longs this weekend.

Axie Infinity and Bitcoin Cash see more short bets than longs this weekend

Axie Infinity (AXS) and Bitcoin Cash (BCH) have recorded more short bets than longs this weekend, data from behavior analytics tool Santiment shows. It comes as the market expects the two altcoins to drop further, unlike the broader market which is expected to recover.

#AxieInfinity and #BitcoinCash are among the very slim group of #crypto assets that are seeing a higher ratio of shorts than longs this weekend. Traders appear to be confident of a market bounce upcoming, and $BCH & $AXS are two exceptions. Short liquidations

— Santiment (@santimentfeed) January 14, 2024

(Cont) pic.twitter.com/nqx94rbSCZ

Meanwhile, Axie Infinity price looks poised for an extended move south, with the Relative Strength Index (RSI) nose-diving to show falling momentum. Enhanced selling pressure could see AXS price drop, losing the immediate support at $ 7.93. Further south, the gaming token could lose the support presented by the confluence between the 50-day Exponential Moving Average (EMA) at 7.70 and the lower boundary of the channel.

In the dire case, Axie Infinity price could extend the fall to the 100-day EMA at $6.99, or if push comes to shove, look for support around the 200-day EMA at $6.76.

AXS/USDT 1-day chart

On the other hand, if bulls play their hand right, Axie Infinity price could reclaim the Christmas high of $11.15, standing almost 40% above current levels. For this to happen, however, they must increase their buying pressure, foraying into the supply zone between $8.73 and $10.26.

The first sign of this move would be a decisive candlestick close above the midline of supply zone at $9.49. This would set the pace for a continuation, with AXS likely to flip the supply zone into a bullish breaker as it targets the $11.15 range high. In a highly bullish case, the cryptocurrency could clear this top and create a higher high above this level.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.