Axie Infinity price could drop 5% as attention shifts to AXS killer, BEAM

- Axie Infinity price uptrend appears to be running out of steam amid a shifted focus to counterpart gaming token BEAM.

- AXS is up 17% in the month against BEAM’s 150% surge over the same duration, pointing to a shifted focus among gaming enthusiasts.

- AXS could drop 5% to $7.05, losing all the ground covered after the 12% crash recorded on December 11.

- The bullish outlook will be invalidated once the price closes above the $8.06 resistance level, marking a new higher high.

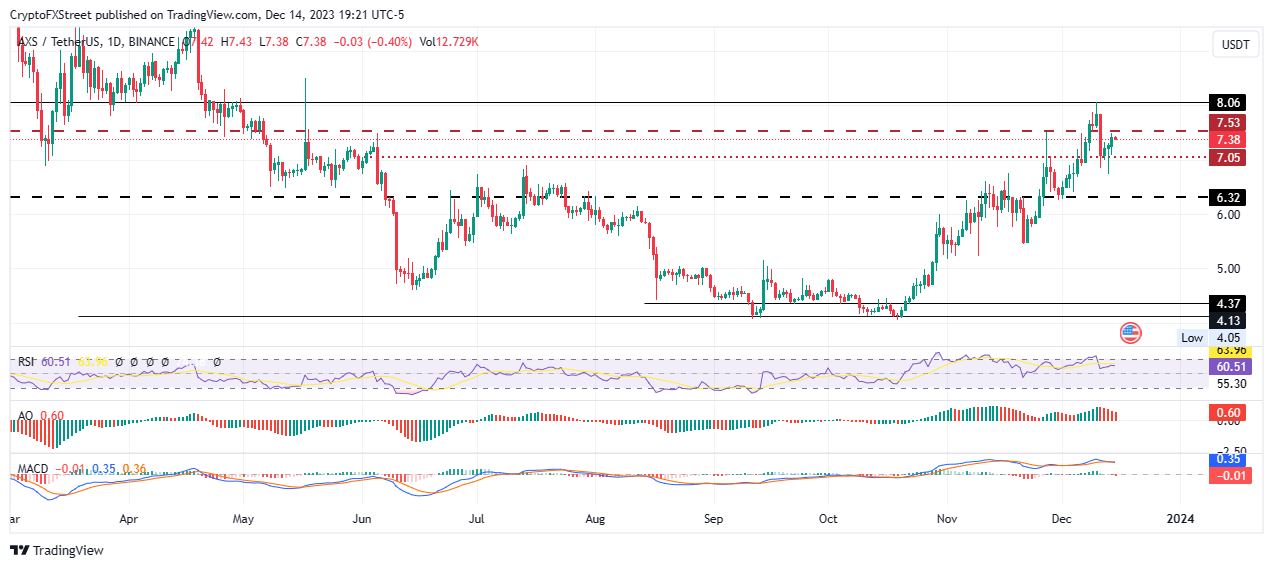

Axie Infinity (AXS) price is trading with a bullish bias, but the uptrend appears to be running out of steam, indicated by the subdued Relative Strength Index (RSI). Meanwhile, on the other side of the fence, BEAM token, AXS’s peer in the gaming sector, seems to be gaining traction, pointing to shifted focus as gaming enthusiasts chase the more actionable market.

Also Read: Three gaming crypto tokens to have in your watchlist as GTA 6 trailer looms: AXS, MANA and ENJ

Axie Infinity records abysmal gains on Beam’s account

Axie Infinity (AXS) price is up 17% since the onset of December 15 in a rather dry or gentle slope. Over the same duration, Beam (BEAM) coin price has soared 151% with a steep climb. Despite being a late entrant, BEAM market capitalization is $1.103 billion against AXS’s $975 million, with the former being a clear usurper.

AXS/USDT 1-day chart, BEAM/USDT 1-day chart

Beam’s remarkable traction in what is arguably the most fervent sector of cryptocurrency adoption, gaming, comes on the back of its robust technology infrastructure and community participation. Its hallmark revolves around the Beam SDK, which enables easy integration of components such as NFTs and token economies by game creators into their games.

Axie Infinity price could drop 5%

Axie Infinity price could fall 5% to test the $7.05 support as the RSI is already subdued, flattening to show waning momentum. Meanwhile, the histogram bars of the Awesome Oscillator (A) are red-soaked and edging towards the zero line, suggesting the bears are gaining ground. The Moving Average Convergence Divergence (MACD) indicator is also crossing below the signal line (orange band) accentuating the bearish thesis.

If the $7.05 support fails to hold, Axie Infinity price could extend the fall, potentially going as low as the $6.32 support. Such a move would denote a 15% drop below current levels.

AXS/USDT 1-day chart

Conversely, if bullish momentum grows, Axie Infinity price could push north, breaching the immediate hurdle at $7.53. In a highly bullish case, the gains could extend to the $8.06 barricade, above which the bearish thesis would be invalidating, giving the gaming token a fair chance at targeting the 9.82 range high.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.