Avalanche’s AVAX price at inflection point, could trigger a 15% move in either direction

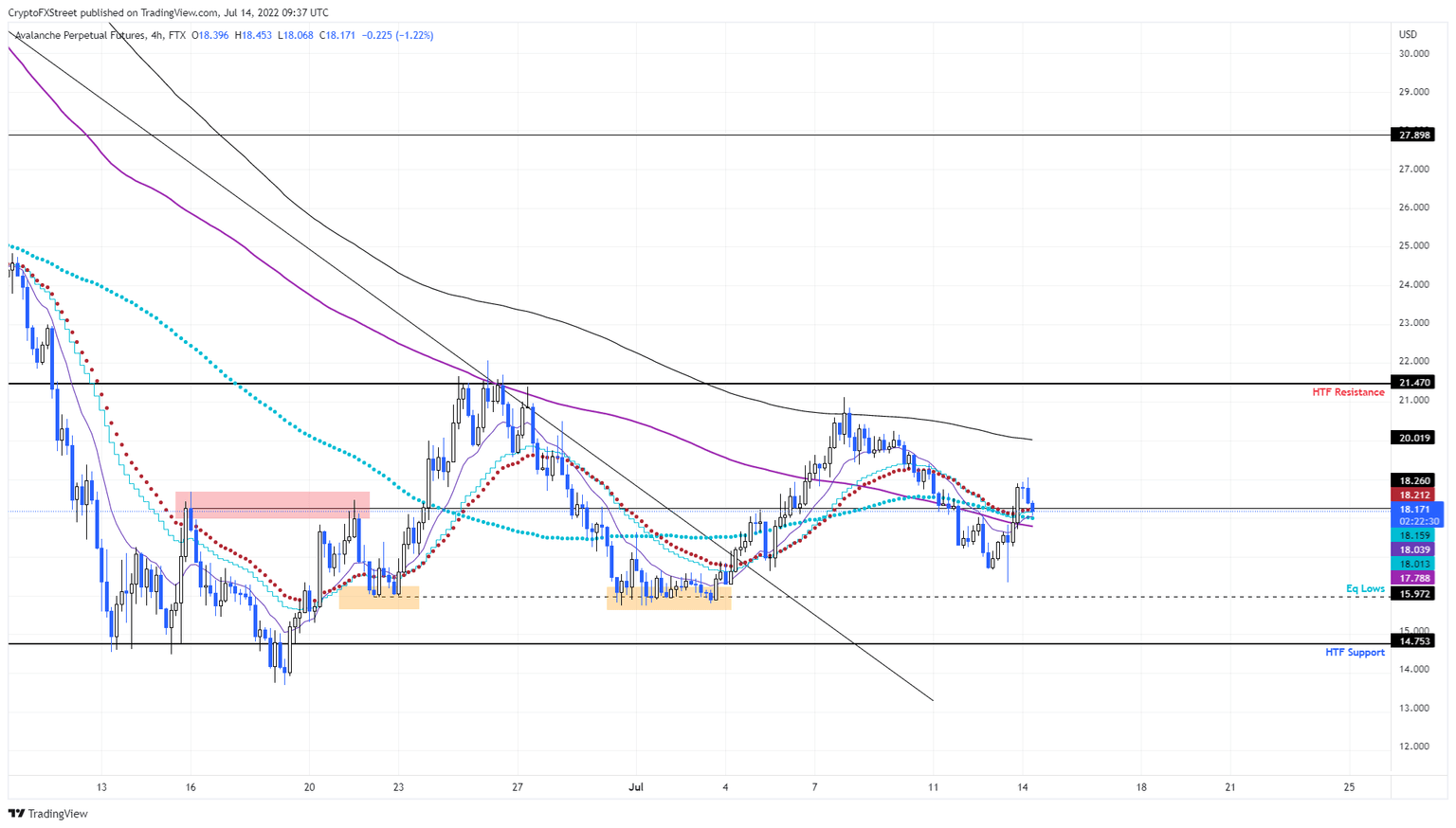

- AVAX price is bouncing off a plethora of moving averages serving as support around the $18.1 level.

- Based on price action, a move to $21.47 seems likely as long as the mentioned support level holds.

- On the other hand, if the moving averages cluster breaks down, Avalanche investors can expect an 18% downswing to $14.75.

AVAX price is at a stable level, but that could change soon on a potential run-up to crucial levels. However, this outlook is contingent on the fact that the cluster of support indicators around $18.1 holds. A failure there, on the other hand, could result in a steep correction.

AVAX price is at a junction

AVAX price has flipped the $18.26 hurdle into a support floor, and with it, the cluster of 50 and 200 Exponential Moving Averages (EMAs). This bunch of indicators is especially important to where Avalanche moves next.

Assuming AVAX price bounces off this level, investors can expect a 10% bounce to retest the 200 four-hour MA at $20.01. If buyers continue to step in and flip the aforementioned level, Avalanche will retest the $21.47 hurdle.

In total, this move would constitute a 17% gain.

AVAX/USDT 4-hour chart

While this bounce seems plausible and likely to occur, it is dependent on two things – the Bitcoin price recovering and continuing to bounce and the cluster of moving averages at $18.26 holding.

However, if AVAX price fails to do so and flips the $18.26 support floor into a hurdle, investors can expect Avalanche bears to take over and knockdown Avalanche price. This development could see AVAX price crash 12% to $15.97, allowing market makers to collect the liquidity resting below this level.

In some cases, AVAX price could reach for a revisit of the $14.75 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.